All REIM articles – Page 5

-

Asset Manager News

Asset Manager NewsL&G NTR Clean Power Fund acquires 105MW Irish solar project

The acquisition increases the Fund’s total capacity in Ireland to more than 430MW and marks its tenth acquisition

-

White papers

White papersEuropean Commercial Real Estate Market Overview

Europe’s commercial real estate market is entering an early recovery phase, supported by easing inflation, potential monetary policy shifts, and growing investor interest in resilient sectors such as logistics and residential.

-

White papers

White papersU.S. Commercial Real Estate Market Overview

The U.S. CRE market shows early signs of stabilization, with improving fundamentals and more balanced supply–demand dynamics after a period of repricing and tighter financing conditions.

-

White papers

White papersRetail parks and urbanisation: investing in the future of cities

Urbanisation is one of the defining forces of our time. As cities grow denser and more complex, pressure on infrastructure intensifies – particularly in retail. Consumers increasingly demand speed, convenience, and flexibility in their shopping experience, and urban environments must adapt to meet these expectations.

-

White papers

White papersLaSalle’s European Cities Growth Index 2025

This year marks the 25th edition of the European Cities Growth Index, where we rank Europe’s cities on expected real estate demand growth, incorporating new factors on defence, climate, and energy in this edition.

-

White papers

White papersKey considerations for investors in European real estate debt

There are a number of considerations institutional investors should bear in mind when selecting investments and structuring European real estate loan positions, including market dynamics, sponsor quality, asset fundamentals and investment structuring. Many of these can impact the risk and return dynamics and must be factored into thoughtful portfolio construction.

-

White papers

White papersModern warehouses driving the next phase of industrial growth

Modern logistics and warehouse assets are leading global industrial growth, with demand supported by e-commerce, supply-chain resilience, and limited new development creating room for rent recovery.

-

White papers

White papersThe case for industrial development in the next cycle

With fundamentals normalizing and construction pipelines easing, selective industrial development is poised to outperform in the next cycle, particularly for high-quality, well-located assets.

-

White papers

White papersCRE in an easing cycle: Why long rates matter more than the Fed

As central banks approach an easing cycle, long-term yields—not short-term Fed actions—are becoming the key driver of real estate pricing and investment performance globally.

-

White papers

White papersData center development opportunities in secondary markets

Secondary U.S. markets are emerging as key growth hubs for data centers, driven by strong digital infrastructure demand, power availability, and cost advantages over primary markets.

-

White papers

White papersStructural shifts: Can Asia Pacific living leverage its home advantage?

Asia Pacific is charting a course toward substantial growth in its living sectors. Evolving demographics, urban migration and policy initiatives are driving rental market booms in Japan and expanding investible opportunities in Australia and South Korea. So, how are these structural shifts influencing investment strategies against a backdrop of global economic uncertainty?

-

Asset Manager News

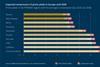

Asset Manager NewsGARBE PYRAMID MAP: Prime Yields of European Logistics Real Estate Show Stable Trend

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030.

-

White papers

White papersAn introduction to real estate debt

Over the last several years, we have seen an increase in the number of institutional investors around the world interested in adding real estate debt to their portfolios. In some instances, this is to replace an allocation to traditional fixed income, while in others it is both an enhancement and a way to further diversify their current level of real estate holdings.

-

White papers

White papersInside LaSalle’s real estate credit strategy

Stability, opportunity, and $700 million in new commitments

-

White papers

White papersPrivate Markets 700: The global investor barometer - An era of expanding possibilities

Private markets are entering an era of expanding possibilities. Our latest Private Markets 700 research - drawing on the views of more than 700 institutional investors worldwide - reveals that investors are asking for more from their private markets portfolios, tasking them with delivering on a wider set of objectives than ever before.

-

Asset Manager News

Asset Manager NewsNTR completes on an initial €65 Million Financing Deal with Rabobank and Siemens Financial Services

Funding will enable the construction phase of Irish ready-to-build solar and BESS co-location portfolio for the L&G NTR Clean Power (Europe) III Fund

-

Asset Manager News

Asset Manager NewsOBRAMAT will cover circa. 30% of its annual electricity consumption with solar energy thanks to its agreement with NTR

OBRAMAT will cover circa. 30% of its annual electricity consumption with solar energy thanks to its agreement with NTR

-

White papers

White papersExploring European real estate debt

As market conditions shift, real estate debt has become a key asset class for investors seeking stability, strong risk-adjusted returns and diversification.

-

Asset Manager News

Asset Manager NewsLeroy Merlin Spain signs an agreement with NTR to cover nearly 30% of its annual electricity consumption with solar energy

LEROY MERLIN Spain, a leading home improvement company, and NTR, an experienced sustainable infrastructure investor and asset manager, have sealed an agreement to further drive LEROY MERLIN’s sustainability strategy and advance the decarbonization of its operations

-

White papers

White papersReal Estate Outlook – Switzerland, Edition 2H25: Swiss real estate once again the safe haven

The global environment in 2025 is characterized by heightened uncertainty. Geopolitical tensions, notably the Russia-Ukraine war, the ongoing conflict in Gaza, and the return of Donald Trump as US President in November 2024, have all contributed to increased economic and trade policy uncertainty.