Corporate Overview

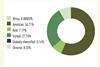

Charter Hall (ASX:CHC) is Australia’s leading fully integrated diversified property investment and funds management group. We use our expertise to access, deploy, manage and invest equity to create value and generate superior returns for our investor customers. We’ve curated a diverse portfolio of high-quality properties across our core sectors – Office, Industrial & Logistics, Retail and Social Infrastructure.

Operating with prudence, we have carefully curated an A$87.0 billion portfolio, comprising A$69.4 billion of property funds under management with over 1,500 high-quality, long-leased properties to more than 4,400 tenants.

Partnership and financial discipline are at the heart of our approach. Underpinning our focus on mutual success, our balance sheet capital is primarily invested alongside our investors, with more than A$2.7 billion co-invested in our funds and partnerships.

We take a long-term view, combining insight and inventiveness to unlock hidden value for our customers and communities. Our A$17.0 billion pipeline of develop-to-core projects delivers sustainable, technologically enabled, future-proofed assets that attract key customers and high-quality, long-term leases, ultimately delivering superior returns for our funds and partnerships. The impacts of what we do are far-reaching. From helping businesses succeed by supporting their evolving workplace needs, to providing investors with superior returns, we support our customers, people and communities to grow.

Strategic corporate development

Charter Hall actively seeks out opportunities to strategically grow its business across Australia, with a strong emphasis on diversification through new funds, capital partners, tenant customers, asset acquisitions and our develop-to-core pipeline across all property sectors.

Through diversification of capital sources, we have built resilience into our business model, supported by a high-quality team focused on delivering outstanding results. Our strategic focus remains on investment funds and partnerships characterised by long WALE, high occupancy, and annual rent reviews, which deliver real income growth to our investors. Our development pipeline enables us to add value to existing assets while developing new high-quality, sustainable assets within our funds and partnerships.

Sector forecasts

INDUSTRIAL & LOGISTICS: Australia’s prime I&L market continues to benefit from an improving economic environment and heightened global volatility. Investor demand remains robust. Occupier strategies have tilted back towards supply chain resilience post tariffs, with demand supported by improving household balance sheets, positive wage growth, and increased consumption of nondiscretionary and convenience retail goods. Structural drivers remain with strong population growth, historically high levels of infrastructure development, growing e-commerce, and increased automation across logistics networks. The supply/demand imbalance remains a defining feature of the market. Elevated construction costs and limited availability of serviced, zoned industrial land are further restricting new development. Vacancy remains some of the lowest levels globally, at 2.8% nationally. Rents are forecast to continue to be driven by persistently low vacancy and the diminishing supply pipeline, with national face rents expected to grow at a more sustainable average rate of ~4.0% per annum over the next five years.

OFFICE: Momentum in office demand continued, with occupied stock growing by 285,000 sqm over the past year (31% above the 10-year average). Tenant demand remains concentrated in modern, high-quality buildings, with lower vacancy and stronger rental growth in these assets. Restrictive construction conditions continue to limit new developments. Building completions peaked in Dec-2022, and the pace of new additions is expected to decline further in coming years. The balance between improving tenant demand and limited supply has contributed to rental growth. Prime net effective CBD rents increased by 5.8% y/y, the highest since September 2018. Forward-looking indicators highlight ongoing value recovery, with capital values up +1.2% q/q. Transaction volumes reached $7.0 billion over the year to Sep- 25, recovering from the lows of March 2024. The outlook is for further gradual improvement as supply remains limited and tenant demand strengthens, especially for modern, well-located assets.

RESIDENTIAL/ LIVING SECTOR: High construction and financing costs, labour shortages, and a restrictive planning system are contributing to an undersupply of new housing. Current forecasts anticipate the National Housing Accord target of 1.2 million new homes will be missed by one third or more. The apartment sector will be increasingly critical to support a ramp up in housing supply. However, the recovery of higher-density housing will take longer due to the lag between approvals and completions.

RETAIL: Retail is benefitting from a cyclical upswing, evidenced by increased investor demand, transactional activity and sector-leading returns. The macroeconomic backdrop has become increasingly supportive to retail demand whilst the rise in construction costs continues to have a profound impact on new development. Construction activity across the retail market remains at historical lows, with restrictive supply contributing to an acceleration in rents. Convenience-based retail assets, characterised by a greater exposure to nondiscretionary retailing have outperformed larger, discretionary-focused shopping centres, particularly over the last decade. Strong population growth and constrained supply is anticipated to drive ongoing higher rental and capital value growth for convenience retail assets.

OTHER: Assets, such as childcare centres, senior housing, student accommodation, government premises and medical/health facilities, are becoming an increasingly attractive sector for investors. Essential by nature, these sectors continue to benefit from strong demand fundamentals.

Investment principles & strategy

Charter Hall is a fully integrated property investment management platform with expertise across investment management, property and asset management, transaction, leasing and development.

We are a leading owner and manager of long WALE assets that are predominantly leased to corporate and government tenants on long-term leases. Our focus on quality, well-located assets, with strong sustainability credentials and long-term leases, together with our ability to unlock hidden value, creates a balance between stability, returns and growth.

Our development pipeline enables us to add value to existing assets while creating new product within our funds to limit the need for buying assets in a competitive on-market environment.

Our extensive market presence enables us to provide cross-sector solutions to tenant customers. More than 71% of our tenant customers lease multiple tenancies from us, reflecting the value they find in our offerings

Our leading market share in transactions, combined with our dedicated teams in each major metropolitan market, provides invaluable insight into local property markets. Over the past five years, we have undertaken A$39.2bn in gross transactions, driven by the collaborative efforts of our investment management, transaction, property services and support teams, who together curate our portfolios for the benefit of our funds and partnerships.

A key competitive advantage is our unparalleled access to off-market deals, completing approximately 50% of all transactions in the last 5 years off-market. We also leverage our skills and relationships to partner with major corporate and government entities on sale and leaseback transactions. We have undertaken more than A$11bn in sale and leaseback transactions in the past 10 years, securing our position as the leader in the long WALE triple net lease sector.

Performance verification

As at 30 June 2025, CPOF outperformed the MSCI Core Office Index over the 10-year period. Over 10-year timeframe, CPOF has returned 6.1% p.a. in comparison to the MSCI Core Office Index 5.7% p.a.

As at 30 June 2025, CPIF continues to outperform the 10-year MSCI Core Index benchmark returns by 5.2%, post all fees (CPIF MSCI 10-Year Return 10.1% vs MSCI Core Index of 4.9%).

Charter Hall’s new flagship retail fund, Charter Hall Convenience Retail Fund (CCRF) has achieved inclusion into the MSCI Index from September 2025. Based on historic returns representing the combined Retail Partnership No.1 and No. 2 (RP1 & RP2) which form part of the CCRF portfolio, CCRF has returned 9.4% over 10 years and outperformed the MSCI benchmark by 6.7% as of 30 September 2025.

Compliance statement:

This information has been prepared by Charter Hall Funds Management Limited (ACN 082 991 786) (together, with its related bodies corporate, the Charter Hall Group). This information has been prepared without reference to your particular investment objectives, financial situation or needs and does not purport to contain all the information that a prospective investor may require in evaluating a possible investment. Prospective investors should conduct their own independent review, investigations and analysis of the information contained in or referred to in this publication and the further due diligence information provided. It is not an offer of securities or advice. Any forecast or other forward-looking statement contained in this information may involve significant elements of subjective judgement and assumptions as to future events which may or may not be correct. There are usually differences between forecast and actual results because events and actual circumstances frequently do not occur as forecast and these differences may be material. Charter Hall Group is not responsible for providing updated information to any prospective investors.

Note: Figures as of 30 June 2025 unless otherwise stated.