GARBE was founded in Hamburg in 1965, and has evolved into one of Europe’s leading real estate companies in the years since. The corporate strategy, “sheds, beds & infrastructure”, follows an active 360-degree approach across the three holding companies: GARBE Industrial Real Estate, GARBE Reside, and GARBE Infrastructure. This approach allows the company to cover the entire value chain of a property as developer, operator, and investor across asset classes.

GARBEs expertise spans project development, fund and investment management as well as asset and property management. The company has been providing these management services in the field of logistics and corporate real estate for 60 years for a variety of different, predominantly regulated investment vehicles and mandates such as separate accounts, commingled funds and joint ventures primarily for institutional investors with German and European investments.

The company is committed to its guiding principle of balancing ecology with economy, this is called sustainonomics (https://www.garbe.de/en/sustainonomics/). The focus is on sector-specific expertise, decentralised operations, and a pan-European approach. GARBE aims to deliver maximum value to its tenants and investors through active asset management. Today, the company employs around 600 experts in 21 branch offices across 14 countries to develop and manage more than EUR 15 billion worth of assets under management.

GARBE Industrial belongs, together with GARBE Insite (Light Industrial), GRR GARBE Retail (grocery retailing) and NDC GARBE (data center) to GARBE Industrial Real Estate. The goal is to build a fully integrated platform that spans the entire industrial value chain — from production to the end customer. GARBE Industrial drives the “sheds” component of the “sheds, beds & infrastructure” strategy, leveraging its leading market position in industrial and logistics real estate.

GARBE Industrial GmbH & Co. KG: Sector forecasts

INDUSTRY: Germany

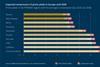

Logistics properties remain among the most sought-after asset classes in Germany. Compared to last year, the overall market conditions have changed only little: geopolitical risks (including Ukraine and the Middle East), fragile supply chains, and weak economic momentum continue to weigh on sentiment among occupiers and investors alike. At the same time, the latest Q3 figures show a noticeable recovery in leasing activity, fueling hopes for recovery for the sector. According to CBRE, total take-up reached 3.94 million sqm in the first three quarters of 2025, while BNP Paribas Real Estate reported 4.3 million sqm (both figures +≈10% y/y), driven by a strong Q3 with roughly 1.6 million sqm for the quarter, following a muted start to the year. Especially the core logistics hubs performed particularly well (+27% y/y), led by Berlin, Frankfurt/Rhine-Main, and Hamburg.

Despite the still subdued macroeconomic environment, the logistics real estate market remains fundamentally robust. Vacancy rates in prime markets are still low, while rental dynamics have stabilised or even turned slightly upward. According to BNPPRE, prime rents increased by around 2.4% year-on-year across major locations. On the demand side, logistics service providers accounted for roughly 41% of take-up, with e-commerce activity also picking up again.

On the investment side, the picture remains mixed. The transaction volume for the first nine months amounted to roughly €4.0–4.2 billion. Encouragingly, Q3 was also the strongest quarter of the year, reflecting an increase in deal activity and broader market participation. However, total volumes remain below long-term averages, mainly due to the continued scarcity of large-scale portfolio transactions above €100 million. A stable sideways movement is emerging in prime yields.

Europe

Across Europe, the logistics real estate market continues to mirror the situation in Germany to a large extent. However, underlying dynamics and market maturity differ considerably between regions. As a result, a pan-European investment strategy focusing on selective markets with continued rental upside and favourable entry conditions remains attractive. In addition, de-risking strategies regarding the supply chains are gradually reshaping the industrial landscape, with certain production segments being relocated to Europe to strengthen the supply-chain resilience. Many occupiers are diversifying production and storage locations to mitigate geopolitical and logistical risks. Central and Eastern European countries stand to benefit most from this structural shift, as their competitive cost base, improving infrastructure, and strategic connectivity between Western Europe and Asia make them ideal for these purposes. Consequently, regional governments are increasingly aligning infrastructure and industrial development programmes with these evolving supply-chain strategies.

The e-commerce sector, already a key driver of demand, is expanding further, fuelled by the entry of new market participants such as Temu and TikTok Shop. While online retail penetration remains lower in parts of Southern and Eastern Europe, these regions are expected to catch up rapidly, supported by improving digital infrastructure and strong consumer growth. At the same time, core Western European hubs will retain their relevance due to their proximity to major consumption markets and highly developed logistics ecosystems.Investment principles & strategy.

Investment principles & strategy

Leading platform in Germany:

GARBE Industrial is one of the leading investment and asset managers in the logistics and industrial sector. With over 300 employees across 17 locations in Europe, the company manages more than 230 properties with 7.0 million square meters of lettable space and a large number of project developments. Its assets under management (AUM) total up to €11 billion, reflecting a first-class track record.

Fully integrated 360-degree management approach:

GARBE Industrial offers market leading expertise across all value added areas in the fields of project development, investment management, asset management, including property, fund and portfolio management, with extensive market knowledge and a broad network, the company maintains strong, longstanding relationships with key stakeholders, including regional and international tenants, brokerage houses, asset and portfolio owners, banks/financiers, as well as authorities.

Excellent access to investment opportunities and reliable execution:

Through a local boots-on-the-ground approach and deep market networks, experienced employees and teams ensure excellent access to investment opportunities by maintaining strong relationships with longstanding local, supraregional and international partners—including tenants, brokers, asset owners and banks. These connections form an important pillar of the continuous deal flow, preferably off-market.

Comprehensive experience in regulated fund, portfolio, investment and asset management for industrial and corporate real estate:

GARBE Industrial has been managing real estate assets in regulated real estate special AIFs for institutional and professional investors for around 20 years.

Sustainability and ESG have been an integral part of the organisation, decision-making, and processes for more than a decade. The impact of the business activities on the environment and society is a key element of the corporate culture, connecting actions to environmental and social responsibilities.

GARBE Industrial has an efficient organisation and can implement decisions and solutions for investors flexibly.

Strategic corporate development

As a proven specialist and market-leading platform for logistics and industrial real estate in Germany and Europe, GARBE Industrial will continue to focus on these segments throughout Europe and further expand its growth strategy and activities in Europe. Within this framework, the company continuously develops attractive real estate projects and rental space offers for tenants, as well as actively managed investment strategies and fund solutions for their investors. With the local boots-on-the-ground approach across Europe and by leveraging the well-resourced, dedicated responsible investing teams, GARBE Industrial aims to increase the number of ESG, sustainable and impact strategies to meet the increasing demand from the clients.

Performance verification

GARBE Industrial has achieved excellent results for its investors in the past, depending on the investment strategy chosen in each case. The team is happy to provide further information about the performance and how the company achieved it in a personal conversation.

COMPLIANCE STATEMENT

GARBE Industrial GmbH&Co. KG has compiled the contents of this information with care. Despite all due care, the data and content may have changed in the meantime. Therefore, GARBE Industrial GmbH & Co. KG does not assume any liability or guarantee for the timeliness, accuracy and completeness of the information provided. Excluded from this is the liability for own gross negligence or intent. As far as the information contains forward-looking statements, these are based on current estimates and assumptions made by GARBE Industrial GmbH & CO. KG and are subject to a number of risks and uncertainties that could cause a forward-looking estimate or statement to be subject to certain uncertainties and to change.