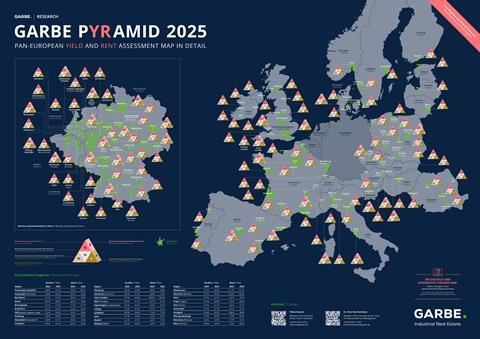

The European logistics real estate investment market appears to be recovering: For the first time since the second quarter of 2022, the average prime net initial yield rates are in decline. Growing investor interest has been reported specifically from the Benelux countries, Spain and some eastern European markets such as Poland and Romania.

Here, the drop in prime net initial yields is most readily apparent. That said, the European average fell only by a moderate four basis points from 5.65 to 5.61 percent.

Tobias Kassner, Head of Market Intelligence and Sustainability at GARBE, said: “Our data suggest an incipient trend reversal on Europe’s logistics investment market. Nonetheless, investors will continue to act cautiously because of the geopolitical and economic uncertainties.” He added that demand for assets in good locations let on long-term leases would remain just as strong in future as it is now. “In addition, ESG criteria and the easy availability of electricity still have the highest priority when making investment decisions,” Kassner elaborated.

You can now read the full whitepaper at the link below