All Real Estate articles – Page 15

-

White papers

White papersPBSA a resilient play but only for those who can deliver

Few sectors in UK real estate have demonstrated the resilience, adaptability, and sustained investor confidence of Purpose-Built Student Accommodation (PBSA) as of late. Despite economic headwinds—rising construction costs and a higher cost of capital, —the sector’s fundamentals remain compelling. Transaction volumes reached approximately £3.5bn in 2024, a 13% year-on-year increase (Savills), reinforcing investor interest.

-

White papers

White papersBeyond DeepSeek: AI disruption and the implications for real estate

In the first instalment of our Artificial Intelligence & Real Estate Series, we introduced a framework to analyze the impact of the rising adoption of AI technologies on the commercial real estate environment. We also warned that as the AI revolution remains in its infancy, investors should brace for unanticipated breakthrough advancements that are difficult to predict and precisely time. Indeed, over the past month, a pivotal leap took place, intensifying the competition for AI industry leadership and market dominance.

-

Asset Manager News

Asset Manager NewsFirst ever Irish presence at MIPIM Conference

First ever Irish presence at world famous MIPIM Conference in France will seek to attract foreign investment in Irish property and development market. Over €18 billion in private investment required each year to support housing and real estate development in Ireland. Irish presence is in association with the Ireland Strategic Investment Fund (ISIF) and supported by Ardstone, Bank of Ireland, IPUT Real Estate and Kennedy Wilson.

-

White papers

White papersThe strategic advantages of investing in the seniors housing industry

The U.S. Seniors Housing sector is at the forefront of an unprecedented growth trajectory, driven by powerful demographic trends, evolving healthcare needs, and a shifting economic landscape. As the U.S. population ages, the demand for quality senior care will grow exponentially, creating a resilient, needs-based asset class that offers compelling opportunities for institutional investors. Unlike traditional real estate sectors that are often cyclical in nature, we believe that Seniors Housing demonstrates secular trends and stability due to its essential nature and the non-discretionary demand for its services.

-

White papers

White papersShaping the Future of Spanish Housing

Spain faces a housing production deficit of over 1 million homes, a gap that has been growing since 2014. By 2030, this shortfall is expected to exceed 1.7 million homes, representing more than 15 years of annual production. This structural imbalance presents a compelling opportunity for institutional and private investors looking to enter the Spanish residential market.

-

White papers

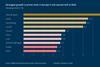

White papersWhy core is back

After a period of economic and geopolitical uncertainty, higher debt costs and squeezed returns, we have reached a turning point in the market cycle for core real estate investment. The interest rate landscape is tilting in a more positive direction; loan margins are diverging with leverage now accretive again for lower risk high quality investments; and pricing has adjusted with limited re-pricing risk looking forward. With further interest rates cuts forecast, the outlook for yields is more stable and material recovery in real estate values is expected.

-

White papers

White papersTo maximise the new cycle, investors should target modern logistics

2024 was a transitional year for European logistics, with capital markets showing early signs of recovery, while the occupational market remained relatively sluggish. With demand conditions stabilizing, we believe 2025 is an inflection year offering a potentially compelling entry point into a new cycle.

-

White papers

White papersDeA Capital Real Estate: Demographics are destiny

DeA Capital Real Estate works with selected third-party institutional investors across Europe, with a total AuM of E13.5bn. Emanuele Caniggia and Emanuele Dubini, CEO and CIO respectively of DeA Capital Real Estate, explain why their international platform is driven by demographics and macroeconomics.

-

White papers

White papersThe golden years for European senior housing

Europe’s most frequently discussed demographic shift is its fast-ageing population. The European population is forecast to continue getting older, shifting the demographic framework in Europe to an unprecedented extent. In turn, the senior housing sector is expected to experience a significant surge in demand over the next decade, driven by the unprecedented acceleration of the 75+ population whilst the rest of the population is already in decline.

-

White papers

White papersTurning Europe’s real estate complexity into an investment opportunity

The volatility of the past few years has created a new investment dynamic and operating environment. With shorter real estate investment cycles and valuations in some markets seemingly bottoming out, well-positioned investors should benefit from a different, flexible approach as a means to find pockets of growth. Annette Kröger, CEO Europe, PIMCO Prime Real Estate, reflects on why the current investment window needs a change of mindset.

-

White papers

White papersPractical Thought About Southern Europe PBSA

Taking inspiration from the late Charlie Munger’s problem solving frameworks, we will apply some of his mental models to a relatively simple question: Where should long-term investors look to allocate capital in European real estate today? The short answer would be to look to provide capital to the sectors in most need (those with the greatest demand/supply imbalance), at the most attractive price point, which would subsequently reward investors with the most stable and growing cashflows over a long period of time. Through this lens, the PBSA market in Southern Europe looks to be a leading contender.

-

-

White papers

White papersGlobal Real Estate Outlook 2025

The world is in a state of flux with divergent political, fiscal and monetary policies affecting economies and markets in different ways. Global trends must be weighed alongside sector and asset allocation considerations to enable active real estate managers to make intelligent decisions that will generate value for investors through this phase of the cycle.

-

-

White papers

White papersMove over Milan: property investors set their sights on spruced-up Rome

ROME, Feb 21 (Reuters) - Having made property investments in Milan, Italian architect Giuseppe Pezzano is now looking for a place in Rome to set up a second home and studio, as the Italian capital’s underdeveloped real estate sector draws fresh attention.

-

Research Report

Research Report2025 Market Outlook

Global economic growth will vary by region due to U.S. tariffs, protectionism, and immigration policies post-election, with persistent stagflation marked by low growth and high inflation.

-

White papers

White papersEuropean Real Estate: Can the U.K. Continue to Lead the Recovery

The U.K. led the rest of the world’s property markets in 2024—but now faces higher U.S.-style interest rates, and a much cooler Eurozone-style growth climate.

-

Asset Manager News

Asset Manager NewsInvestment Update: Real estate investors redefine their course

The recovery in the real estate market continues cautiously, writes Peter Koppers of Achmea Real Estate in the new Investment Update. INREV research shows that investors are again allocating new capital to real estate, with a strong focus on core strategies and sectors with stable fundamentals. Residential real estate remains the absolute favorite, particularly affordable rental housing and senior housing, a domain where impact, sustainability, and returns go hand in hand.

-

Asset Manager News

Asset Manager NewsGARBE PYRAMID-MAP: Slowing Growth of Prime Rents on European Logistics Real Estate Markets

The cycle of soaring rent rates in Europe’s top logistics markets has ended. During the second half of 2024, the average prime rent increased by just 6 cents, rising from 7.30 euros to 7.36 euros per square metre. It is the equivalent of 0.9 percent and thus trails the inflation rate in the eurozone, which was 2.4 percent at the last count. The 2024 take-up in Europe, while representing a modest year-on-year decline (-7 percent), actually exceeds the pre-pandemic figures by a narrow margin. The vacancy rate across Europe was just under six percent.

-

White papers

White papersHow can UK real estate better attract international capital?

In late January, leading figures from some of Europe’s foremost real estate lenders, sponsors, advisors and other market participants gathered at the heart of the UK’s political establishment, The House of Lords at the Palace of Westminster, to discuss the future of the UK real estate sector.