Nuveen Real Estate is one of the largest investment managers in the world with $141 billion of assets under management.

Managing a suite of funds and mandates, across both public and private investments, and spanning both debt and equity across diverse geographies and investment styles, we provide access to every aspect of real estate investing.

With over 90 years of real estate investing experience and more than 765 employees* located across 30+ cities throughout the United States, Europe and Asia Pacific, the platform offers global reach with deep sector expertise, providing investors access to high quality investments across the private real estate investment landscape.

For further information, please visit us at nuveen.com/realestate

*Includes 355 real estate investment professionals, supported by a further 411 Nuveen employees. Source: Nuveen, 30 June 2025.

Sector forecasts

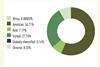

INDUSTRIAL: The strategy is to invest in well-located modern logistics assets supported by healthy levels of demand on the back of structural change, increasing defense spending and fiscal easing in Europe (as well as supplychain reconfiguration resulting from new trade tariffs) which presents opportunities for continued rental growth alongside capital appreciation following a normalization of trading conditions.

OFFICE: The recent flurry of return to the office mandates witnessed across Europe has dispelled the myth that offices are less needed in the future world of work. That has been encouraging investor confidence and is leading renewed investment activity likely to come through in the second half of 2025 and into 2026. In most markets, vacancies have peaked in this cycle and while rents have never stopped growing, only the best buildings are benefiting from growth. A reduction in new deliveries will support continued rental growth while leading cities will start to see inward yield shift already in 2025.

RESIDENTIAL: The residential market benefits from chronic undersupply of stock in all major European cities. Given high construction and financing costs the supply demand mismatch will continue in the coming years. Vacancy rates will remain very low and rental growth is likely to stay strong. However, some markets have come close to affordability thresholds, which may mean that growth rates will slow down compared to the high inflation years. Residential already commands quite low yields, which means inward yield compression is likely to be limited despite the strong occupier story.

RETAIL: The retail sector is making a comeback in 2025 after e-commerce and Covid-driven market consolidation has worked through the system. Good shopping centres, repositioned assets and convenience-oriented retail parks have all started to report higher occupancy and tentative rental growth. Investors have shown more interest in retail mainly for its high income returns. Income strategies work best for assets that are relatively light on capex, which tends to be retail parks and outlet malls.

OTHER: Student housing is expected to remain buoyant, underpinned by sustained investor appetite and shifting enrollment patterns that provide short- to medium-term fuel for demand, particularly across Continental European markets. The UK rebound should hold, while continental Europe is well-placed to capture future gains from evolving global mobility trends. In self-storage, we anticipate a continued divergence between Continental Europe and the UK. Supported by a more favorable mortgage rate environment and recovering housing activity, demand across Europe should strengthen, while UK operators remain under pressure by rising operating costs.

Investment principles & strategy

A client-focused culture is at the core of who we are and what we believe our clients expect from us. We take a stable, risk-aware investment approach to our business, which places our clients and investment teams at the heart of our process. Our fund management teams work closely with our clients to deliver investment performance that meets their objectives. The teams operate within a defined investment process with established risk controls, accompanied by investment committee oversight. Our tomorrow’s world investment philosophy incorporates strategic insights on megatrends throughout every stage of the investment process, looking beyond market cycles to assess how structural trends can best inform long-term real estate investments. Sustainability is embedded in everything we do for the enduring benefit of our clients and society.

Strategic corporate development

We work closely with our clients to develop long-term strategic relationships, to understand their goals and meet their requirements. To ensure we provide each investor with a tailored solution, made up of a range of products and strategies, we have developed our range of solutions to offer the resilient, enhanced and debt series as well as our global strategic capitalisations:

- Our resilient series focuses on providing investors with diversification, income and long-term capital growth. We invest in assets that provide durable capital preservation with an exposure to essential property sectors that look beyond market cycles.

- Our enhanced series aims to provide investors with enhanced levels of capital growth. We invest in assets in emerging sectors and locations where we have identified mispricing opportunities that have the potential to benefit from current megatrends.

- Our debt series is designed to provide investors with income-driven returns and downside risk mitigation. We provide loans on institutional quality assets across the risk spectrum to help navigate short-term market cycles.

Our global strategic capitalization offering is our newest addition, where investment strategies are designed to meet evolving client priorities, providing customized solutions based on specific client needs.

Performance verification

Nuveen Real Estate’s Performance Team has over 35 years of applied real estate performance and risk management experience. Applying strong auditable control risks, and adopting applicable real estate industry standards, the team operates independently of fund and account teams.

COMPLIANCE STATEMENT

All information is as at 30 June 2025. These materials are for use only by the intended party and may be circulated to only the person whom they may lawfully be distributed. Any entity responsible for forwarding this material to other parties takes responsibility for ensuring compliance with local laws and in particular any applicable financial promotion rules. The information presented in these materials is believed to be materially correct as at the date hereof, but no representation or warranty (express or implied) is made as to the accuracy or completeness of any of this information. Data was taken from sources deemed reliable but cannot guarantee its accuracy. The statements contained herein reflect opinions as of the date written and are subject to change without further notice. Nothing set out in these materials is or shall be relied upon as a promise or representation as to the past or future. This information does not constitute investment research as defined under MiFID. Nuveen, LLC provides investment solutions through its investment specialists.