All Research & Forecasting articles – Page 4

-

-

White papers

White papersRedevco publishes its 17th Responsible Investment Report

We are proud to present our 17th Responsible Investment Report, which is a testament to our mission of transformative real estate that builds value for investors and enriches communities. This report, Connecting Performance to Impact, details the progress towards our sustainability targets in 2024 across four impact pillars: built environment, natural environment, social value and responsible governance.

-

White papers

White papersWhy Australian office: Perception, reality and the great opportunity

Over the past four years, the performance of the office market was dominated by the uncertainty cast by the pandemic-induced lockdowns and the largest interest rate cycle in decades. The consequential unknowns over workplace strategies, the economy, and adjustment to higher rates contributed to the largest valuation repricing since the GFC.

-

White papers

White papersSeizing the “Debt-First” Office Moment Timing: Extended, Opportunities Unlocked

As we progress into 2025, Hines Research believes market conditions continue to support the thesis for debt investment in the U.S. office sector.

-

White papers

White papers2025 Half Year Results

We use our expertise to access, deploy, manage and invest equity to create value and generate superior returns for our investor customers

-

White papers

White papersEurope Real Estate Sector Report

Europe’s real estate market is showing early signs of recovery, with industrial and residential sectors leading the way, while office spaces continue to face challenges. Investors should focus on high-quality assets in resilient submarkets to navigate the evolving landscape.

-

Research Report

Research ReportReal Estate House Views H1 2025

Explore our collection of in-depth outlooks on real estate investing globally.

-

White papers

White papers2025 Europe Self Storage Sector Update

The self storage sector in the Europe continues to see strong fundamentals, with strong rental growth and stable occupancy despite a marked increase in supply reflecting demand for the sector

-

White papers

White papersU.S. Real Estate Sector Report

The U.S. office real estate market shows early signs of recovery, with selective opportunities emerging despite ongoing challenges.

-

White papers

White papersHarrison Street 2025 Europe Outlook

Europe’s Inflation Story: Significant Progress Has Been Made but Risks Remain

-

White papers

White papersHow a core-plus strategy may enhance your portfolio

Principal Real Estate has been investing in commercial real estate (CRE) for more than 60 years and in core-plus real estate for over 20 years. Having experienced numerous market cycles in that time, we believe CRE values have largely adjusted for the current cycle, setting the stage for an attractive entry point for private equity investors.

-

White papers

White papersWhat does tariff uncertainty mean for real estate?

Private real estate entered 2025 with prospects looking up, having materially rebalanced over the course of a two-year downturn for the asset class.

-

White papers

White papersSchroders Capital Investment Outlook: Real Estate H1 2025

There is increasing evidence of positive market movements in relation to activity and transaction pricing – and our value framework suggests that, despite a challenged economic outlook, we are in the early stages of a steady real estate recovery.

-

White papers

White papersFour-quadrant report - March 2025

This report offers a clear view of U.S. commercial real estate through the four-quadrant framework. It highlights how economic, political, and market trends are impacting public and private equity and debt, with a summary of current conditions and key investment themes.

-

White papers

White papersAPAC Research Perspective - Q1 2025

The unknowns continue to build in 2025, casting a shadow over broad decision making and growth prospects in the Asia Pacific region.

-

White papers

White papersSearching for Gold: Strategies for Navigating Debt Opportunities in Uncertain Times

Modern private credit emerged in the wake of the Global Financial Crisis (GFC) and the resulting capital constraints, regulatory and otherwise, of traditional bank financing.

-

Research Report

Research ReportPrivate Insights #7 - Europe Logistics: Resilient Performance with a Promising Outlook

“The European logistics market has performed resiliently despite political and economic uncertainty, with structural trends and a recovering economy supporting the growing demand for modern warehouse space. With rate cuts, easing inflation and an improvement in price clarity, the market has also seen greater capital inflows. Mapletree endeavours to strengthen our foothold in this region to bring value to our investors.” - Ralph van der Beek, Chief Executive Officer, Commercial and Logistics, Europe

-

White papers

White papersIn Focus - Energy transition infrastructure: Three key areas of opportunity

In our previous white paper, we made the case for a concentrated focus on the energy transition for private infrastructure allocations. Among other things we highlighted the uncorrelated returns and differentiated risk premia these assets can deliver to portfolios – and the potential for this to drive outperformance as the global journey to net zero progresses.

-

Research Report

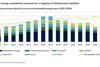

Research ReportInfrastructure Quarterly

The Infrastructure Quarterly explores the performance of the private and listed infrastructure markets, along with sector insights such as renewables and digital infrastructure, to identify actionable insights for your portfolio decisions.

-

White papers

White papersOpportunities in UK commercial real estate: Navigating a rebounding market

As we’ve previously discussed, the UK commercial real estate market is showing promising signs of recovery, making it an attractive option for investors. According to our newest forecast, various segments within the market are expected to deliver robust returns driven primarily by local supply and demand dynamics rather than yield compression.