All Inflation articles – Page 58

-

White papers

White papersThe inflation genie – Understanding the drivers for the medium term

The COVID-19 pandemic has revived a familiar conversation about the inflation genie escaping the bottle. The speculation is similar to the one that surfaced in the immediate aftermath of the Global Financial Crisis and at various points since then: That we are likely to experience a burst of inflation in the coming years.

-

White papers

White papersCoronavirus & Inflation in Advanced Economies: Slower for Longer

If consumers manage to recover quickly and healthily, thanks in part to so much public money being put in their hands, supply may fall short and inflation could come back.

-

White papers

White papersQuarterly Economic Outlook: we’ve never had it so loose

The US and UK are already running highly negative interest rates, when QE is considered, according to a report by the International business of Federated Hermes. It says that true, QE-adjusted policy rates are now as low as -10% in the US, and -6% in the UK or around -12% and -8% in real (inflation-adjusted) terms.

-

White papers

White papersThe day after #6 - Inflation: persistent headwinds but a possible inflationary cocktail

Since the beginning of the coronavirus pandemic, all eyes have been on the unfolding health catastrophe and the consequences of confinement: economies halted, exploding rates of unemployment (in particular in the United States), and rising debt levels. In this extraordinary context, inflation is often overlooked. This is a dangerous mistake, in our view. For investors, now more than ever, it is crucial to keep a very close eye on this metric—in particular, since we may be at the beginning of a complete regime shift.

-

White papers

White papersSweden’s Experiment with Negative Rates

At the end of 2019, Sweden’s Riksbank initiated a policy change at a time when the much larger European Central Bank (ECB) announced its determination to persist with its negative interest rate policy.

-

White papers

White papersWhat We Already Know About The Recovery

And why bonds and stocks may not be pricing in such different outcomes.

-

White papers

White papersGlobal Supply & Demand Curves Shift to the Left

U.S. inflation came in soft for April amid low oil prices and weak global demand. The employment report saw leisure and hospitality with the highest job losses, and Saudi Arabia announced plans to cut oil production again, easing concerns over storage capacity limits worldwide.

-

White papers

White papersTo Trade or Not to Trade? That is the Question…

Despite rising tensions between the U.S. and China, the U.S. has signaled they won’t tear up the trade deal, yet. Inflation may be impacted by weaker demand and lower oil prices. The ECB weighs what to do next after Germany ruled its QE program violated its constitution.

-

White papers

White papersAdventures on the Planet of the Apes: Navigating the Low-Rate Environment

Artificially low rates are causing multiple distortions and pockets of heightened risks—and while the current environment may be unprecedented, it need not be incomprehensible. Investors who understand the dynamics driving low rates may be positioned to take advantage of promising opportunities.

-

White papers

White papersMarket weekly – Fixed income: Deflation, not inflation, is the main risk now

After a rollercoaster ride in April, senior investment strategist Daniel Morris and Dominick DeAlto, chief investment officer fixed income, discuss what will matter next for developed bond markets.

-

White papers

White papersThe outlook for eurozone inflation-linked bonds

A V-shape economic recovery in the eurozone looks unlikely, while member states continue their marathon search for a compromise on how to fund the reconstruction. The poor outlook for the economy and inflation, and the ECB’s asset purchases, should keep eurozone government bond yields low and cap the risk premiums on ‘peripheral’ bonds.

-

White papers

White papersContraction > recovery > late cycle: a cycle round trip in three years

The pandemic outbreak altered the cycle of financial regimes we had in mind at the end of 2019, with consequences extending over the medium term: after a sharp contraction in 2020, 2021 will see a “recovery” in the growth and profit cycle with a rebound in risky assets while in 2022, we expect a normalization towards a late cycle.

-

White papers

White papers10 (mostly new) predictions for 2020: A light at the end of a very long tunnel

We launched our original set of 2020 predictions a few months ago with the theme, “Uncertainties diminish, but markets struggle.” The coronavirus pandemic and resulting economic and market upheaval have since changed everything. In early March, consensus expectations for 2020 global GDP growth were +3%. Now they are -3%.1 A 6% swing would be unusual over a three-year time period. We just saw one in a month.

-

White papers

White papersSouth Africa Inflation

South African inflation came out higher in January: 4.5% yoy compared to 4% in December but is in the middle of the inflation target (3-6%) of the South African Central Bank (SARB). This acceleration in inflation is mainly explained by a sharp rise in transport prices linked to base effects of fuel prices (+ 13.7% in January against 2.4% the previous month).

-

White papers

White papersTurkey: Inflation And Monetary Policy

January’s inflation report and last inflation figures: The Governor of the CBRT debriefed last week on the first inflation report of the year January inflation figure released at 12.15% yoy, higher than in December (11.84%). The rise in housing, electricity and energy were the main drivers pf this increase. ...

-

White papers

White papersInvestment Phazer Update: downward trend is confirmed

While in the short term we do expect some temporary relief coming from positive economic surprises and supportive news on the trade front (should coronavirus impact be limited), on a medium-term horizon our economic scenario confirms the fragility of the profit cycle.

-

White papers

White papersFocal Point US outlook: a soft landing supported by the Fed

We expect the US economy to cool this year. Growth will likely ease from 2.2% to 1.6% because of the full effect of tariffs becoming effective during the first half of the year. The lagged impact of the 2019 rate cuts and that of the additional reduction we expect for Q2 will engineer a soft landing of the economy, despite still substantial headwinds. The Fed will take big steps to adapt its monetary policy strategy to a low-inflation, low-interest rates world. The broad view of this strategy should be clearer by summer, but the dovish bias it will most likely produce will be welcomed by markets.

-

White papers

White papersBlog: China themes for 2020 – growth and policy (2/2)

What to expect economically from superpower China in 2020? In the final part of this two-part series, senior economist Chi Lo discusses the outlook for inflation, growth and central bank policy.

-

White papers

White papersCore Matters: Where has inflation gone?

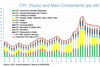

Over the past decades global inflation has been trending down. It averaged 8% yoy in the 1980s but stands at just 2.7% yoy in the current decade. Inflation is much lower in developed economies. Since 2011 it has hovered around 1.8% and 1.3% yoy in the US and euro area respectively, but only at about 0.3% yoy in Japan (excluding the sales tax hike in 2014).

-

White papers

White papersDecember Macro Dashboard

The announced Phase One trade deal between the U.S. and China, as well as the Conservatives increasing their majority in the U.K. election, has tempered two of the biggest political risks hanging over the global economy. At least temporarily, sentiment is turning optimistic.