All REIM articles – Page 14

-

White papers

White papersH1 2025 Real Estate investment outlook: Three takeaways for private investors

Amid evidence of a recovery progressing across global real estate, we explore the key opportunities for private wealth investors in 2025 and beyond.

-

People News

People NewsTom Herrschaft to Become New Head of Real Estate Management at GARBE Industrial Real Estate

GARBE Industrial Real Estate GmbH (“GARBE”), one of the leading developers, providers and managers of logistics and light industrial assets in Germany and elsewhere in Europe, is strengthening its executive team by appointing Tom Herrschaft as the new Head of Real Estate Management.

-

White papers

White papersSix reasons to consider real estate debt in 2025

Real estate debt has always been a valuable component of any portfolio; however, it is emerging as a viable solution to a wide array of investor concerns today. It’s a strategy that offers a range of benefits with attractive risk-adjusted returns across market cycles.

-

Asset Manager News

Asset Manager NewsTristan Fund and Edmond de Rothschild REIM acquire XXL logistics development in the multimodal platform Delta 3

EPISO 6, a fund managed by Tristan Capital Partners and joint venture partner Edmond de Rothschild REIM, have acquired a c.136,000 sqm logistics development in Delta 3 - Dourges (Lille area).

-

White papers

White papersSchroders Capital Investment Outlook: Real Estate H1 2025

There is increasing evidence of positive market movements in relation to activity and transaction pricing – and our value framework suggests that, despite a challenged economic outlook, we are in the early stages of a steady real estate recovery.

-

Asset Manager News

Asset Manager NewsRedevco Closes Landmark £47.5m Loan Investment for New Real Estate Debt Platform

Redevco, one of Europe’s largest privately owned real estate managers, has successfully closed its first loan investment from its recently launched Real Estate Debt platform, a landmark moment in the company’s expansion into real estate lending.

-

Asset Manager News

Asset Manager NewsInvesco Real Estate acquires 412-bed central Berlin hotel for bespoke EUR1bn AUM institutional client from CA Immo

Invesco Real Estate, the USD85 billion global real estate investment business of Invesco Ltd. (NYSE: IVZ), has acquired the InterCity Hotel in central Berlin, a 412-room upper midscale hotel, on behalf of a German separate account client, administered by the Luxemburg fund services platform of Universal Investment Group. The hotel was sold by CA Immo.

-

White papers

White papersWorking backwards: Dealing with unprecedented policy uncertainty

A reader waking up from a quarter-long slumber on April 1, 2025 would be forgiven for confusing the headlines for an April Fools’ Day prank.

-

White papers

White papersIf you want peace: How European real estate investors can respond to new geopolitical realities

In December 2024, we wrote, that “if regional procurement increases, European defense contractors will likely need to expand their manufacturing capabilities, which may include a larger real estate footprint.”

-

People News

People NewsChad W. Phillips appointed as Global Head of Nuveen Real Estate

Nuveen, the investment manager of TIAA, announced today that Chad W. Phillips will serve as Global Head of Nuveen Real Estate, effective immediately, as the firm activates long-standing succession plans following Chris McGibbon’s decision to retire after nearly 25 years of service.

-

White papers

White papersFour-quadrant report - March 2025

This report offers a clear view of U.S. commercial real estate through the four-quadrant framework. It highlights how economic, political, and market trends are impacting public and private equity and debt, with a summary of current conditions and key investment themes.

-

People News

People NewsRedevco Appoints Simon Marx as Head of Research

Redevco, one of Europe’s largest privately owned real estate managers, is pleased to announce the appointment of Simon Marx as Head of Research, effective 1 April 2025. Simon will be based in Redevco’s London office and will report directly to Veronica Gallo-Alvarez, Head of Investment Management.

-

White papers

White papersAPAC Research Perspective - Q1 2025

The unknowns continue to build in 2025, casting a shadow over broad decision making and growth prospects in the Asia Pacific region.

-

White papers

White papersSearching for Gold: Strategies for Navigating Debt Opportunities in Uncertain Times

Modern private credit emerged in the wake of the Global Financial Crisis (GFC) and the resulting capital constraints, regulatory and otherwise, of traditional bank financing.

-

White papers

White papersEuropean Residential Returns to Focus on Current Income and Rental Growth

Despite lower mortgage rates and a recovery in lending volumes over the last year, affordability for homeowners is projected to remain challenging as 2025-29 house prices are forecast to increase by 3.5% p.a. in both the Eurozone and the UK.

-

Asset Manager News

Asset Manager NewsInvesco Real Estate & Propel ONE to develop logistics facility near Frankfurt am Main

Invesco Real Estate, the global real estate investment business of Invesco Ltd. (NYSE: IVZ), has further increased its commitment to the European logistics sector with the acquisition of a plot in Langenselbold, close to Frankfurt am Main in Germany for the speculative development of a small-size logistics warehouse.

-

Research Report

Research ReportPrivate Insights #7 - Europe Logistics: Resilient Performance with a Promising Outlook

“The European logistics market has performed resiliently despite political and economic uncertainty, with structural trends and a recovering economy supporting the growing demand for modern warehouse space. With rate cuts, easing inflation and an improvement in price clarity, the market has also seen greater capital inflows. Mapletree endeavours to strengthen our foothold in this region to bring value to our investors.” - Ralph van der Beek, Chief Executive Officer, Commercial and Logistics, Europe

-

White papers

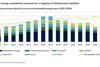

White papersIn Focus - Energy transition infrastructure: Three key areas of opportunity

In our previous white paper, we made the case for a concentrated focus on the energy transition for private infrastructure allocations. Among other things we highlighted the uncorrelated returns and differentiated risk premia these assets can deliver to portfolios – and the potential for this to drive outperformance as the global journey to net zero progresses.

-

People News

People NewsGARBE Industrial Real Estate Enlarges Management Team

GARBE Industrial Real Estate GmbH (“GARBE”), one of the leading providers and managers of logistics and light industrial assets in Germany and Europe, is reinforcing its investment and portfolio management as part of its growth strategy. Dr. Peter Bartholomäus will assume the position of Chief Investment Officer (CIO). Nicolai Soltau will succeed him in his current role as Head of Portfolio Management as of April 2025. Both will report directly to Jan Philipp Daun, Managing Director of GARBE Industrial Real Estate.

-