Manager News – Page 31

-

Asset Manager News

Asset Manager NewsNuveen Real Estate raises further €50 million, and acquires Dutch portfolio, for its latest European logistics strategy

Nuveen Real Estate, one of the largest real estate investment managers globally, has raised a further €50 million for its sixth European logistics strategy.

-

Asset Manager News

Asset Manager NewsPGIM Real Estate strengthens global innovation strategy with European investment in Fifth Wall

PGIM Real Estate has strengthened its global innovation strategy with an investment into the Fifth Wall European Real Estate Technology Fund. PGIM Real Estate is the real estate investment and financing business of PGIM, the US$1.5 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU).

-

Asset Manager News

Asset Manager NewsGLP’s Global Logistics Business Announces Record Leasing and Developments in 2020

22.7 million sqm (244 million sq ft) of leases signed, driven by record levels of renewal leases and e-commerce demand

-

Asset Manager News

Asset Manager NewsPGIM Real Estate invests in UK senior housing

PGIM Real Estate, on behalf of an investment strategy, has entered into a joint venture with Elevation, a specialist healthcare real estate investment management firm. The venture will fund developer-operators of new build care homes across the UK. PGIM Real Estate is partnering with Elevation in sourcing and structuring investments with operators. Elevation will provide ongoing asset and development management services.

-

Asset Manager News

Asset Manager NewsPGIM Real Estate Secures S$900 Million Green Loan From DBS, OCBC Bank And UOB For NEX Mall

PGIM Real Estate has secured a S$900 million green loan from DBS, OCBC Bank and UOB for the refinancing of NEX, a major retail mall in Singapore. This deal marks a significant foray into sustainable finance for PGIM Real Estate in the region.

-

Asset Manager News

Asset Manager NewsFederated Hermes to launch Sustainable Global Equity Fund as first of new product suite

The international business of Federated Hermes has today announced the launch of a new Sustainable Global Equity Fund, the first of a new Sustainable suite of products being developed by the firm to meet strong demand from clients for values-based solutions.

-

Asset Manager News

Asset Manager NewsThe end of LIBOR: implications for investors

The London Inter-bank Offered Rate (LIBOR) is one of the main interest-rate benchmarks used in global financial markets. By the end of 2021, LIBOR reference rates and other interbank offered rates (IBORs) will be retired. What will replace LIBOR and other IBORs, and what does this mean for investors?

-

Asset Manager News

Asset Manager NewsLineage Logistics Raises $1.9 Billion in New Equity to Fund Investment in Global Network Capacity and Industry-Leading Technology

Lineage Logistics, LLC (“Lineage” or the “Company”), the world’s largest and most innovative temperature-controlled industrial REIT and logistics solutions provider, today announced it has raised $1.9 billion in equity from new and existing strategic partners. Participating investors include BentallGreenOak, D1 Capital Partners, Oxford Properties, CenterSquare Investment Management, MS Tactical Value and Conversant Capital, OP Trust, Cohen & Steers, among others.

-

Asset Manager News

Asset Manager NewsGLP Closes First Sustainability-Linked Loan of $658 Million, One of the Largest in APAC

GLP closed its first sustainability-linked loan (SLL) of US$658 million with participation from 10 banks. The loan is one of the largest SLLs in Asia Pacific and signifies GLP’s ongoing commitment to sustainability. GLP will use the loan proceeds to contribute to environmental objectives related to climate change mitigation and the promotion of green buildings.

-

Asset Manager News

Asset Manager NewsOrchard Street expands ESG commitment with launch of net zero carbon targets

Orchard Street Investment Management (‘Orchard Street’), the specialist commercial property investment manager, announces an expansion of its ESG efforts through a commitment to become a net zero carbon business by 2050. Orchard Street will publish a 2030 net zero carbon transition strategy in 2021 and is beginning the net zero carbon journey immediately by targeting a 25% reduction in occupier carbon intensity by 2025. Occupier carbon emissions represent over 90% of the business’ total carbon footprint.

-

-

Asset Manager News

Asset Manager NewsGenerali Real Estate acquires Kotva department store in Prague

Prague - Generali Real Estate has acquired the Kotva department store on behalf of the pan-european fund “Generali Real Estate Asset Repositioning S.A.” (GREAR) - a fund dedicated to value add strategies in all the major European countries - from the real estate company PSN.

-

Asset Manager News

Asset Manager NewsPGIM Real Estate acquires two residential buildings in Paris for its European core strategy

PGIM Real Estate has acquired a residential portfolio of two properties, located in the 16th arrondissement of Paris, on behalf of its European core strategy. PGIM Real Estate is the real estate investment and financing business of PGIM, the US$1.5 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU).

-

Asset Manager News

Asset Manager NewsOrchard Street completes first letting at West London’s greenest industrial estate

Airbox to take c. 20,000 sq ft at carbon neutral A+ rated Communication Park in Feltham, following its redevelopment

-

Asset Manager News

Asset Manager News2020: A resilient year

We delivered a resilient performance for 2020 despite an uncertain market environment. This resilience, and the quality of our portfolio, is clear in our rental recovery of over 97% resulting in a cash dividend of €102.5 million for our shareholders.

-

Asset Manager News

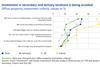

Asset Manager NewsInvestor survey: Pandemic redefines office investment landscape

European real estate investors are rethinking their office property strategies in the wake of the coronavirus pandemic. While the old mantra of location, location, location still holds true, a shift towards core, core, core is apparent in the current situation.

-

Asset Manager News

Asset Manager NewsFarming for the future? - Green News & Views - Growing a greener world with farmland

Sustainable farmland practices play a vital role in reducing greenhouse gas emissions as well as conserving energy and water. It can also help to meet global demand for food, while encouraging sustainable practices benefiting the environment over the long-term.

-

Asset Manager News

Asset Manager NewsPGIM Real Estate invests in Taronga Ventures in support of global innovation strategy

As part of its effort to expand and strengthen its global innovation strategy through key partnerships, PGIM Real Estate has acquired a strategic equity stake in Taronga Ventures, further supported by a commitment to Taronga’s RealTech Ventures Fund. PGIM Real Estate is the real estate investment and financing business of PGIM, the $1.4 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU).

-

Asset Manager News

Asset Manager NewsPGIM Real Estate raises £190m to launch UK Affordable Housing Fund

PGIM Real Estate has launched its UK Affordable Housing Fund, with an initial capital raise totaling £190 million, from the Northern LGPS and Brunel Pension Partnership. PGIM Real Estate is the real estate investment and financing business of PGIM, the US$1.4 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU).

-

Asset Manager News

Asset Manager NewsSteady growth path: Union Investment completes real estate transactions worth EUR 4.1 billion

Union Investment has continued to deliver reliable growth despite a challenging investment environment. In an exceptional year dominated by the pandemic, the Hamburg-based real estate investment manager invested around EUR 4.1 billion in the European commercial real estate markets in 2020, securing a total of 62 high-quality properties or projects for its real estate funds through a combination of single-property and portfolio deals.