Corporate overview

Established in 2004, we are a leading UK focused real estate investment manager with a strong track record of delivering consistent fund performance. With over €1.3bn in Assets under Management* and €2.4bn of UK real estate acquired over the last decade, we combine deep market expertise, disciplined investment, and a boutique, client-focused approach.

We offer a full-service direct property investment management platform, managing segregated accounts for some of the world’s largest pension funds, wealth managers and private equity clients. Our team brings hands-on experience across acquisition, asset management, and transaction structuring, tailoring strategies to client requirements while maximising value and operational efficiency in every investment and offer the following services:

Funds Business

Orchard Street Investment Management structures and manages its own Orchard Street Funds, providing investors with targeted exposure to the UK real estate market. Our funds combine meticulous asset selection with robust governance and a strong focus on ESG principles, while optionally employing leverage to enhance returns in a disciplined and risk-aware manner. Backed by deep market insight, rigorous analysis, and hands-on asset management, Orchard Street ensures every investment aligns with our strategy and commitment to sustainable, long-term growth, offering investors a trusted pathway to capitalize on the dynamic UK property landscape.

Impact Manager

We have built a reputation as a leading UK real estate impact manager, specialising in delivering measurable social and environmental outcomes through direct property investment. The firm currently manages two dedicated Impact strategies for Local Government Pension Scheme (LGPS) Pools. Orchard Street’s approach integrates robust ESG governance, including third party assurance of Impact outcomes and adoption of the Financial Conduct Authority’s ‘Sustainability Impact’ label for its Social and Environmental Impact Partnership Fund. With a proven track record in responsible investment and a strategic focus on long-term value creation, Orchard Street is at the forefront of impact investing in the UK real estate sector.

Third Party Asset Management

Orchard Street Investment Management is a specialist UK real estate asset manager, dedicated to delivering value-add returns for large global private equity investors. Leveraging deep local market expertise and a hands-on, strategic approach, Orchard Street identifies, acquires, and actively manages high-potential commercial and mixed-use assets across the UK. With a focus on maximising value through targeted asset management, operational efficiencies, and market-driven insights, Orchard Street consistently transforms opportunities into measurable investment performance for its global partners.

* AUM as at June 2025 and represents the aggregate of the net asset values of client assets under management, measured under the individual client’s reporting GAAP (Generally Accepted Accounting Principles), with the addition of undrawn committed capital.

Sector forecasts

INDUSTRIAL: Multi-let industrial estates continue to benefit from strong tenant demand and limited supply, driving rental growth. The sharp rise in prime rents in London and other major conurbations is pushing demand into surrounding areas, creating a knock-on effect on rents. Whilst Orchard Street does not expect rental growth to continue at the same pace as in recent years, we believe industrial estates will remain among the strongest performing sectors. Occupier demand for Big Box logistics is improving; however, following a two year dip in new supply, development activity has resumed, which is likely to dampen rental growth prospects for average stock.

OFFICE: Post-Brexit and Covid-19 structural changes in office demand continue to impact the market, with secondary office centres experiencing particularly weak tenant interest. However, larger centres, led by London, are seeing a recovery in activity as return-to-office mandates gather momentum and corporates increase their space requirements to reflect higher occupancy rates and greater amenity provision to attract and retain talent.

RESIDENTIAL: Demand for residential property continues to outstrip supply, fuelling rental growth. Despite recent cuts to short-term interest rates, affordability for owner-occupiers remains stretched. Increasingly onerous regulation and taxation of the private rented sector are prompting many landlords to exit the market, further reducing the supply of rental accommodation. These dynamics underpin Orchard Street’s view that residential rental growth will remain strong, driving the sector’s performance.

RETAIL: Sustained real wage growth and high employment levels are supporting rising retail sales, helping retailers offset cost pressures from stubbornly high inflation and the recent increase in employer labour taxes. The sector continues to offer attractive income yields and sustainable rental growth, particularly in supply-constrained out-of-town locations.

OTHER: Alternative investments are expected to deliver a broad range of outcomes. Long-leased assets are likely to see further yield re-rating in response to higher Gilt rates. Discretionary leisure spending has proved resilient in recent years, although the hospitality sector has been hit hard by the government’s recent labour tax increases. Cinema attendance is still 25% below pre-Covid levels, suggesting further consolidate is likely before a recovery in the sector. However, the pricing of more resilient alternatives assets is currently highly attractive. By contrast, the outlook for purpose-built student accommodation remains positive, supported by strong domestic demographic trends and an expected uplift in international student numbers driven by the recent US policies.

Investment principles & strategy

Orchard Street believes that investment in relevant locations with innovative asset management plans is key to creating sustainable income - critical when approximately 75% of total return has come from income over the longer term.

The firm’s core beliefs as a real estate manager are that:

- Pro-active asset management creates outperformance;

- Multi-let assets with multiple business plans, in the best locations, generate stronger returns with a lower risk profile;

- Disciplined investment decisions create a reputation for Orchard Street as a reliable counterparty, ensuring efficient deployment of capital ;

- Rigorous risk management and responsible investing is embedded within all investment and asset management processes to enhance the long-term value of clients’ real estate portfolios; and

- Smaller highly focused and strongly aligned teams with extensive experience are key to achieving outperformance.

Performance verification

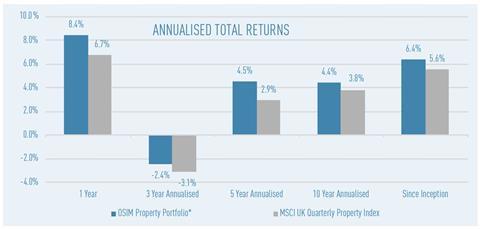

Orchard Street has consistently outperformed over three, five and 10 year periods against the MSCI UK Quarterly Property index. The performance shown below is a composite track record of Orchard Street client mandates that are benchmarked against MSCI.

Source: MSCI UK Quarterly Property Index Jun 25

* Data after January 2023 excludes two open-ended funds that became suspended or where dealings were deferred.

COMPLIANCE STATEMENT

This information is provided for use by qualified institutional investors and their advisors only. Further information is available on request or on our website. Whilst Orchard Street Investment Management LLP is not regulated, its wholly owned subsidiary, Orchard Street Investment Advisers Ltd. is authorised and regulated by the Financial Conduct Authority of the UK (FRN 461061).