All Logistics articles

-

White papers

White papersDeconstructing IOS

Since the early 1990s, Realterm has been a pioneer investor in transportation logistics real estate, a subset of the industrial & logistics real estate sector that prominently includes many types of industrial outdoor storage (IOS) facilities.

-

People News

People NewsRedevco accelerates growth in logistics sector with acquisition of Roebuck

Amsterdam, September 16, 2025 – Redevco, one of Europe’s largest privately-owned real estate managers, today announces the acquisition of Roebuck, a specialist logistics investment and asset manager with approximately €1 billion in assets under management across the UK and continental Europe.

-

White papers

White papersModern Logistics In Europe: A Timely Opportunity For Institutional Capital

As the new European real estate cycle takes shape, we continue to see logistics as one of the more attractive investment propositions, underpinned by three pillars:

-

White papers

White papersLogistics real estate in Europe on a growth trajectory

Demand for modern logistics properties in Europe remains high, and matters such as location quality, energy efficiency, automation and flexible use are continuously gaining in importance. Germany in particular plays a key role in this framework – as Europe’s largest logistics market and as a hub for international supply chains. Swiss Life Asset Managers, with a Europe-wide logistics strategy, is amongst those actively shaping this change.

-

Asset Manager News

Asset Manager NewsAccess Portfolio Acquisition

Barings has acquired a multi-let urban logistics and industrial portfolio comprising four assets. Located in high-demand urban submarkets where quality supply is scarce, the portfolio was purchased in June 2025 as part of a non-core investment strategy.

-

People News

People NewsRedevco Closes Second Loan Investment Providing a €67m Facility to Support 2 German Logistics Developments

London, 20 October 2025 – Redevco, one of Europe’s largest privately owned real estate managers, has completed its second loan investment, underscoring the growing momentum for its real estate debt business just six months after closing its debut deal. The €67 million loan will fund the acquisition and development of two Class A Mid-Box Logistics projects in Frankfurt and Karlsruhe, with a combined area of 63,000 sqm, by the Invesco Real Estate and Propel Industrial joint venture.

-

White papers

White papersGRESB 2024 Results

We are extremely proud to have retained our GRESB 5-star ratings for the third consecutive year across both our standing investments and development projects.

-

Asset Manager News

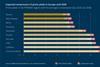

Asset Manager NewsGARBE PYRAMID MAP: Prime Yields of European Logistics Real Estate Show Stable Trend

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030.

-

Asset Manager News

Asset Manager NewsGARBE PYRAMID-MAP: Rental Trend on European Logistics Real Estate Market Remains Stable – Modest Growth Forecast through 2030

Europe’s logistics real estate market is moving through a stabilisation and consolidation phase. More specifically, an average rental growth of 70 cents per square metre is projected for the period starting with the second quarter of 2025 and ending with the second quarter of 2030. This would imply an annual growth rate of 1.9 percent (CAGR or Compound Annual Growth Rate).

-

Asset Manager News

Asset Manager NewsPortfolio acquisition of 24 properties strengthens Slättö’s light industrial platform

Slättö, through its logistics and industrial platform Evolv, has acquired a portfolio of 24 properties primarily located in Linköping, Norrköping, Nyköping and Örebro. The portfolio consists of high-quality truck and car workshop facilities situated in regional cities with strong infrastructure access and established tenants.

-

People News

People NewsRedevco appoints Séverine Maumy as Head of Asset & Transaction Management

Redevco, one of Europe’s largest privately-owned real estate managers, has appointed Séverine Maumy as Head of Asset & Transaction Management effective August 25, 2025. This appointment marks another milestone in Redevco’s growth strategy, strengthening the platform’s capabilities across the full real estate lifecycle. It coincides with a phase of strategic expansion in the retail parks and logistics space, alongside the advancement of Redevco’s proprietary development pipeline.

-

Asset Manager News

Asset Manager NewsHelsinki light industrial assets added to Slättö’s portfolio

Slättö continues to execute on its successful light-industrial roll-up strategy across Sweden and Finland. In its latest transactions in Finland, Slättö, through its logistics and industrial platform Evolv, has acquired seven light industrial properties in four separate transactions. The newly acquired Finnish properties are flexible multipurpose assets in strong locations along the main highways in the Helsinki Metropolitan Area (HMA).

-

White papers

White papersUK real estate market outlook Q3 2025

Returns have been gradually climbing since the start of the year, as capital growth has returned. Find out more about our UK real estate views.

-

Asset Manager News

Asset Manager NewsDea Capital Real Estate And Corebridge Real Estate Investors Sell Two Spanish Industrial Properties For EUR 25 Million

Madrid/Jersey City, NJ, 17 July 2025 – A joint venture between DeA Capital Real Estate (“DeA Capital RE”) and Corebridge Real Estate Investors (“CREI”) today announced the sale of two Class A industrial facilities in Madrid, Spain to a UK-based, single-family office advised by Delin Property for approximately EUR 25 Million. The two properties, totaling over 18,000 sqm of high-quality rentable space,are located in well-established submarkets within Madrid’s innermost industrial rings. At the time of the sale, both assets were 100% leased to five tenants, reflecting the strength and resilience of demand in the region’s logistics sector.

-

Asset Manager News

Asset Manager NewsDea Capital Real Estate Launches Strategic Land Sales Program With 14-Hectare Logistics Deal Near Warsaw

Warsaw, 8 July 2025 – DeA Capital Real Estate has officially launched its long-term Polish land sales strategy with the successful sale of a 14-hectare logistics site in Nadarzyn, just outside Warsaw. The transaction, concluded with leading warehouse developer 7R, marks the first exit from a larger, multi-sector land portfolio that DeA Capital Real Estate has been assembling and preparing across Poland over the past five years.

-

White papers

White papersProducing in Europe for Europe: why reindustrialisation is the next big real estate play

We explore Europe’s focus on resilience, highlighting prospects in securing supply chains and spurring innovation.

-

Asset Manager News

Asset Manager NewsDeA Capital Real Estate expands in the Middle East

DeA Capital Real Estate continues its international expansion with a focus on logistics, living, hospitality, and infrastructure. With over €12 billion in AUM and operations in five European countries, the firm recently completed a successful roadshow in Kuwait, Bahrain, and the UAE.

-

White papers

White papersBroad-based Logistics Demand Offers Resilience Against Tariffs

Despite the most recent reductions and pauses, tariffs triggered a spike in trade policy uncertainty. This is expected to push up supply chain pressures. European logistics occupiers are likely to further deepen their operational focus from just-in-time to just-in-case to ensure continuity. This might trigger a higher demand for logistics space.

-

Asset Manager News

Asset Manager NewsNuveen provides A$205 million senior loan supporting multi-storey logistics facility

Global asset manager Nuveen has provided an A$205 million senior loan to Hale, Warburg Pincus and Oxford Properties Group to support the development of a multi-storey logistics facility at Rosehill, Sydney.

-

White papers

White papersSustainability In European Logistics Real Estate

Sustainability has become an increasingly significant consideration in European real estate investing and asset management. This shift results from investors’ sustainability targets and growing pressures from occupiers, set against a backdrop of tightening European regulations aimed at decarbonising the built environment. These factors are accelerating key trends across all property types, including logistics.