All Fixed Income articles – Page 74

-

White papers

White papersFinancing economic growth with private debt

Listed assets no longer suffice to build an investment portfolio. Private debt is becoming central to allocations.

-

White papers

White papersCross Asset Investment Strategy - February 2022

Recent sharp increase in nominal and real yields has been reflected in strong movements in equity markets, causing a rotation out of growth into value stocks. We think the uncertainty (Covid, geopolitics) would continue as markets assess the path of inflation, economic growth and monetary policy.

-

White papers

White papersRussia-Ukraine tensions: geopolitical risk adds volatility to risk assets

Geopolitical dimension of the crisis: tensions stand at their highest point in years, after Moscow deployed 100,000 troops to its border with the Ukraine’s Donbas region. The geopolitical risk between Russia and the West remains deadlocked since Russia’s 2014 annexation of Ukraine’s Crimea peninsula and the consequent Western sanctions to Russia.

-

Podcast

PodcastEM Debt in 2022: China, COVID & Central Banks

What lies ahead for EM debt markets in 2022? Risks include higher rates and inflation as well as uncertainties surrounding China and the path of the pandemic. But with defaults still low and spreads wide by historical standards, opportunities look likely to arise.

-

White papers

White papersJeromicron: Markets Face a One-Two Punch

Preliminary Markit PMIs in the U.S. show Omicron weighed on consumer demand, labor supply, and supply chain disruptions in January. The composite PMI fell from 57 to 50.8—its lowest level in 18 months; declines were seen in services and manufacturing.

-

White papers

White papersThe year ahead for loans: Favourable dynamics, but can it continue?

For European loans, 2021 was a standout year in many ways. Record new-loan issuance was met with equally robust demand from traditional loan investors and asset allocators, looking for relatively high and stable yield, while the drive towards sustainability has been both prominent and purposeful. In this piece we present our outlook for the key drivers in the European loan market in 2022.

-

White papers

White papersFixed Income Perspectives - January 2022

Global economic growth looks likely to continue in 2022, albeit at a more modest pace. The COVID-19 pandemic does, however, add uncertainty to the outlook, as evidenced by the recent emergence of the Omicron variant.

-

White papers

White papersSolving for a Year of Inflections

The Solving for 2022 delegates voted on what they think will be this year’s best-performing investment category—and here’s why we think they are right.

-

White papers

White papersWormhole intelligence shows investors pulled in different directions by market gravity over 2021-22

This just in: The Interstellar Express reports that a vast cache of data has been recovered from Quantum Gravity Well (QGW) 3.14159 that could shed new light on an ancient, defunct civilisation.

-

Video

Video*Diversified private credit – It is about financing growth*

Investing in diversified private credit means gaining access to the stable cash flows and contained volatility of a broad range of unlisted asset classes including infrastructure and commercial real estate debt, mid-market loans and loans to small and medium-sized businesses.

-

White papers

White papersInvesting in 2022: Four key market drivers

The pandemic and rising inflation were prevailing drivers of markets in 2021. But the economic squeeze which dominated 2020 finally started to loosen its grip, as the world started to get back to something resembling ‘normality’ in the second half of last year.

-

Video

VideoFixed Income Update: 21 January 2022

In line with the recent announcements with regards to Andrew Jackson, Head of Fixed Income and Multi-Asset, leaving the firm, Eoin Murray, Head of Investment, is joined by the senior members of the Fixed Income team to introduce the succession plan.

-

White papers

White papersWinners of the Italian Recovery Plan (With or Without Draghi)

Which sectors stand to benefit the most from Italy’s Recovery and Resilience Plan, and what impact, if any, will the country’s next president have on efforts to implement the plan?

-

White papers

White papersSpectrum 2022 Outlook

We expect a slower pace of growth in 2022 due to monetary tightening and reduced fiscal policy support.

-

White papers

White papersShifts & Narratives #13 - Money and psychology of inflation: an investor view

Inflation was the big surprise in 2021. At the beginning of the year, the average US inflation forecast by economists for the end of 2021 was around 2%, while the latest reading in December came in at 7.0% YoY, the highest level since 1982.

-

White papers

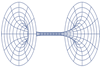

White papersMoney and its velocity matter: the great comeback of the quantity equation of money in an era of regime shift

The velocity of money (V) depends on P = the general price level, T = the total amount of goods and services produced and M = the total amount of money in circulation, and can be expressed by the formula V = PT/M.

-

White papers

White papersFour insurance portfolio allocation themes for 2022 and beyond

In today’s investment landscape, how can insurers effectively construct investment portfolios to achieve their targets and balance a range of unique requirements? This paper looks at four allocation themes we believe are most relevant to insurance portfolios.

-

White papers

White papersInflation, central banks and rising rates – Q&A with Andrew Cormack

It feels as though US policy makers have spent the entire post-global financial crisis period trying to generate inflation. Now that it’s here, it seems like the wrong kind of inflation. How do you see inflation playing out in the US?

-

White papers

White papersPensions Investment Outlook: Challenges and Opportunities

There are several uncertainties in the economic and market outlook that are important for pension funds.

-

White papers

White papersNo immediate storm ahead, but insurers should use the lull to build portfolio resilience

Lingering COVID-19-related supply-side disruptions, alongside a significant rebound in consumer demand, are producing supply bottlenecks and an inflation rate not seen for decades.