All ESG/SRI articles – Page 2

-

White papers

White papersOcean pledges create waves of opportunity

At a UN ocean conference in June, dozens of countries promised to ratify the High Seas Treaty to bring it into force. The aim is to protect marine life by curbing overfishing, and ensure that the ocean is managed sustainably. What are the implications for companies and investors? By Ming Yang, Shoa Hirosato and Xinyu Pei.

-

White papers

White papersPrivate equity with purpose: The case for impact investing

Capital markets are continually being buffeted by far-reaching forces that are shaping societies, economies, and the environment. Technological innovation, climate change, demographic shifts, rising inequalities, and evolving regulatory requirements all pose challenges but also create opportunities for forward-thinking investors as economies adapt to disruption.

-

White papers

White papers2024-2025 Private equity impact report: Accelerating solutions for a world in transition

The world faces intertwined crises of escalating emissions, resource strain and growing inequality that amplifies vulnerability to climate change. Despite recent global market and regulatory shifts, a focus remains on backing growth-oriented, lower-middle market companies driving an inclusive transition to a low-carbon economy, with confidence in long-term fundamentals where impact initiatives align directly with performance rather than creating trade-offs. Our latest impact report highlights new investments across energy efficiency, resource optimization and circular economy solutions, enhanced ESG measurement and emissions tracking, industry partnerships, and portfolio case studies demonstrating growth and impact in action.

-

White papers

White papersThe Nuance in Net Zero

Effective measurement of progress toward net-zero alignment has never been more important to investors and companies that have adopted net-zero ambitions.

-

White papers

White papersBlended Finance: scaling capital for sustainable impact

With development financing needs outpacing available resources, attracting private capital into social and environmental projects in risky markets (e.g., emerging markets) is vital. We believe that Blended Finance (BF) offers a strategic solution. Specifically, this investment approach involves the public sector leveraging private money to finance projects focused on achieving sustainable development goals (SDGs) and addressing climate change.

-

White papers

White papersAutomating Insight Extraction from Oil And Gas Sector Climate Disclosures with AI

Environmental, social, and governance (ESG) reporting has become a cornerstone of corporate transparency and accountability, especially within high emission sectors such as oil and gas. However, the traditional methods of extracting meaningful insights from ESG data are time-consuming and are in general processed manually.

-

White papers

White papersESG Thema #21 - From access to empowerment: how financial inclusion fuels resilience

Financial inclusion spans savings, credit, payment services, insurance, and investments. Many low-income households and small businesses, particularly in developing countries, remain excluded or underbanked, relying mainly on cash transactions that expose them to risks and hinder their saving and investing activities. Credit access is often limited or costly, pushing many to informal lenders or expensive formal options. Digital finance—financial services delivered via mobile and internet platforms—is central to expanding access.

-

White papers

White papersWhat do we know about retail responsible investors?

The Amundi Investment Institute, in partnership with Crédit Agricole du Languedoc, the University of Montpellier, and Montpellier Business School (MBS), has forged a unique collaboration dedicated to advancing our understanding of individual investors’ financial preferences and needs. This partnership combines academic rigor with practical insights from the financial industry, creating a rich foundation for exploring the evolving landscape of retail investment behavior.

-

White papers

White papersEuropean infrastructure - Striking the right balance

Despite macroeconomic turmoil in some markets, infrastructure decarbonisation and digitalisation remain viable and appealing thematic investment options in Europe. Karen Azoulay, Head of Infrastructure Debt and Paul-Francois Prouvost, Private Assets Investor Relations, review the opportunities in European Infrastructure.

-

White papers

White papersEurope: A global leader in sustainable investment opportunities

For years Europe has been the indomitable epicentre in the battle against climate change. Thanks to its solid, long-term commitments, today it is an international hive of innovation and investment opportunity – and one which could hugely benefit given that globally annual clean energy investment needs to more than triple by 2030 to $4trn to reach net zero by 2050.

-

White papers

White papersMobilising finance for sustainable transition

The lack of financing for sustainability transition across companies in emerging markets (EMs) has created a critical gap. With EM corporates facing limited access to dedicated funding pools, it is vital to channel capital into companies that are actively implementing ambitious and measurable sustainability initiatives. By supporting businesses on their journey towards sustainable practices, investors may catalyse positive environmental and social change while generating long-term financial returns.

-

White papers

White papersWhy Emerging Markets Are Holding Firm on Sustainability

As U.S. interest in environmental, social and governance investing cools, companies in emerging markets countries are ramping up their efforts—propelled by investor demands and the pursuit of lasting competitiveness.

-

White papers

White papersGlobal SMID Equity Engagement Report: A focus on responsible AI

This report outlines why – in light of the rapid developments in AI and the early-stage adoption across industry – we have chosen to purposefully scale up our AI-related engagement efforts with a range of companies, particularly in the software space.

-

White papers

White papersOur new AI assessment of engagement sentiment

The Global Equity ESG team outline how they are using AI to elevate their engagement discourse to uncover a more nuanced view of company trajectories.

-

White papers

White papersBeyond politics: Unlocking the value of diversity and inclusion

While recent political pushback has seen diversity, equity and inclusion (DEI) slip down the agenda, we believe there are still significant opportunities for investors in this area. Thembeka Stemela-Dagbo, Sustainable and Impact Equities Fund Manager, explores the key reasons for investors to promote DEI, and the potential risks of failing to do so.

-

Video

VideoThe AI toolbox

Damien Zhang and the MDT team look at artificial intelligence as a toolbox, not a black box. From large language models to machine learning, the team pick and choose the right tools to sharpen their investment process.

-

White papers

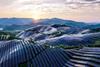

White papersChasing the sun: China leads global race to build solar power

China has significantly increased its solar power capacity in recent years and it now leads the pack globally, surpassing all other countries combined. As different regions adopt varied approaches to renewable energy, the global energy transition is complex and operates at multiple speeds.

-

White papers

White papersInvesting for change: China’s world-leading electric vehicle industry

As many countries attempt to phase out fossil fuels, electric vehicles (EVs) have become ubiquitous – and China is leading the way. Sitting at the intersection of technology, sustainability, and global growth, the Chinese EV sector is an emblem of China’s global ambitions.

-

Video

VideoNew name, same philosophy: (Re)introducing: Global SMID Equity Engagement

The Fund may have changed its name – but nothing fundamental has changed. In this video, we explain why the philosophy, objectives and process behind Global SMID Equity Engagement all remain the same.

-

White papers

White papersGiving due importance to mental wellbeing

Many people are affected – directly and indirectly – by the issue of mental health, and this has been particularly apparent over the last few years amid the pandemic and the cost-of-living crisis. Against this backdrop, the Global SMID Equity Engagement* team engaged with about 60% of the portfolio during 2024 on this topic.