All Clean Energy articles

-

Webinar

WebinarWebinar: Unlocking value in battery storage

As the global energy transition accelerates, Battery Energy Storage Systems (BESS) are emerging as a cornerstone of grid stability, renewable integration, and energy market flexibility. Watch our webinar which explores the macro landscape shaping the BESS sector and the strategies driving revenue and investment returns in this fast-evolving market.

-

White papers

White papersIndia’s Clean Energy Moment

Will India’s policy push create the de risked clean energy opportunities of the decade?

-

White papers

White papersPlugging water network leaks with smart technologies

Ageing and leaky water systems are in urgent need of an upgrade, presenting opportunities for innovative solution providers and utilities alike.1

-

White papers

White papersOrbital AI Data Centers Prepare for Launch

Welcome to the new space race, brought to you by AI.

-

Podcast

PodcastElectrification and AI turbocharge clean energy outlook

Clean energy started 2026 strongly as the investment theme rides the bullish sentiment around power demand, expanding electrification and the build-out of the digital ecosystem. The growing appetite for clean energy has also shone the spotlight on companies that own and operate essential and critical infrastructure such as AI datacentres.

-

White papers

White papersNTR Achieves Top Scores in the 2025 UN PRI Assessment

NTR is pleased to announce that the 2025 UN Principles for Responsible Investment (PRI) assessment results have been released, with the company achieving a score of 100% across all evaluated categories.

-

White papers

White papersInvestors reveal their top ESG investment themes and more

At a time of macroeconomic and geopolitical uncertainty, our fifth annual ESG Global Study finds that most investors remain committed to considering ESG issues in the investment process.

-

White papers

White papersCOP30: Bringing Private Capital and AI Into the Climate Fight

Private capital is expected to play a critical role in mobilizing $1.3 trillion of finance needed to fight climate change. AI, if properly aligned with climate goals, could be powerful in building vital resilience.

-

White papers

White papersUnderstanding the modern electrical grid

The electricity grid is at the heart of the clean energy transition and is undergoing one of the most significant transformations in its history. Understanding the modern electrical grid is no easy task, but it is a necessary one, as the grid plays a critical role in economic growth, energy security and decarbonisation. Read our white paper which examines how the grid works, the impact of renewables, the evolution of grid technology and how investors can participate in its modernisation.

-

White papers

White papersUnderstanding the modern electrical grid

The electricity grid is at the heart of the clean energy transition and is undergoing one of the most significant transformations in its history. Understanding the modern electrical grid is no easy task, but it is a necessary one, as the grid plays a critical role in economic growth, energy security and decarbonisation. Read our white paper which examines how the grid works, the impact of renewables, the evolution of grid technology and how investors can participate in its modernisation.

-

White papers

White papersEurope: A global leader in sustainable investment opportunities

For years Europe has been the indomitable epicentre in the battle against climate change. Thanks to its solid, long-term commitments, today it is an international hive of innovation and investment opportunity – and one which could hugely benefit given that globally annual clean energy investment needs to more than triple by 2030 to $4trn to reach net zero by 2050.

-

White papers

White papersParis Climate Agreement: Why the investment case remains strong

There has been increasing negative sentiment against climate change mitigation and broader sustainable investing in 2025, most notably from the second Trump administration in the US. However, we believe the case remains strong for investors aiming to align with the goals of the Paris Agreement.

-

White papers

White papersInfrastructure Investor - European Fund Management Roundtable

Read Infrastructure Investor’s recent European Fund Management Roundtable featuring Joost Bergsma, Global Head of Clean Energy for Nuveen Infrastructure, where he discusses the key dynamics facing the European energy markets, and why he believes the region is becoming an increasingly attractive destination for institutional investors seeking stability in clean energy investment.

-

White papers

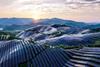

White papersChasing the sun: China leads global race to build solar power

China has significantly increased its solar power capacity in recent years and it now leads the pack globally, surpassing all other countries combined. As different regions adopt varied approaches to renewable energy, the global energy transition is complex and operates at multiple speeds.

-

White papers

White papersO’Connor Global Multi-Strategy Alpha Monthly Letter: An energy transition inflection point

As we pass the halfway mark of 2025, the energy transition landscape has undergone significant transformation. US policy shifts under President Trump – including the One Big Beautiful Bill Act (OBBB), executive orders supporting nuclear and clean energy, and broader deregulation – have reshaped global energy dynamics.

-

Asset Manager News

Asset Manager NewsSosteneo successfully completes final close of Fund I and launches Fund II

Milan – Sosteneo, a specialist investment manager focused on clean energy infrastructure and part of Generali Investments, today announced the final close of its first flagship fund (Sosteneo Clean Energy Infrastructure Fund or “Fund I”), with more than two-thirds of the portfolio now operational.

-

Asset Manager News

Asset Manager NewsSosteneo successfully completes final close of Fund I and launches Fund II

Milan – Sosteneo, a specialist investment manager focused on clean energy infrastructure and part of Generali Investments, today announced the final close of its first flagship fund (Sosteneo Clean Energy Infrastructure Fund or “Fund I”), with more than two-thirds of the portfolio now operational. Fund I raised over €620 million in capital commitments, alongside €80 million in co-investment capital.

-

Asset Manager News

Asset Manager NewsNuveen Raises $1.3 Billion From Global Institutional Investors For Energy & Power Infrastructure Credit Strategy

Nuveen, a global investment manager, has completed its first close with $1.3 billion of initial capital commitments for its Energy & Power Infrastructure Credit strategy, a $2.5 billion target private credit strategy providing private infrastructure credit solutions to companies in support of the growing demand for energy and power arising from digitalization, electrification and the reindustrialization of North America, Europe and other OECD countries.

-

White papers

White papersConstructing the Future: Building Resilient Portfolios With Infrastructure

Private infrastructure stands out in an uncertain world.

-

White papers

White papersESG Annual Report 2025

Welcome to our seventh annual Environment, Social and Governance (ESG) Report, covering the 12-month period to March 2025.