Marketing communication

Pictet Asset Management’s annual outlook provides detail on the defining themes of 2025. We share critical insights into the challenges and opportunities that financial institutions may face.

| Bright spots | Threats |

|---|---|

|

|

|

|

|

|

It’s not (quite) all about Trump

Donald Trump’s victory in the US presidential election casts a big shadow over global financial markets. But it’s by no means all bad news. That’s because unless he sticks rigidly to the most extreme elements of his agenda, the global economy’s broadly positive fundamentals should assert themselves and provide a benign environment for risky asset classes in 2025.

Equities regions and sectors: US supremacy

Resilience will be the distinguishing feature of global equity markets in 2025, with companies likely to deliver steady earnings growth, translating into single digit returns for investors.

Fixed income and currencies: UK a bright spot

After a year marked by escalating military conflicts and persistent political uncertainty, major economies show resilient growth and easing inflation, with bonds likely to offer positive inflation-adjusted returns, particularly in emerging markets.

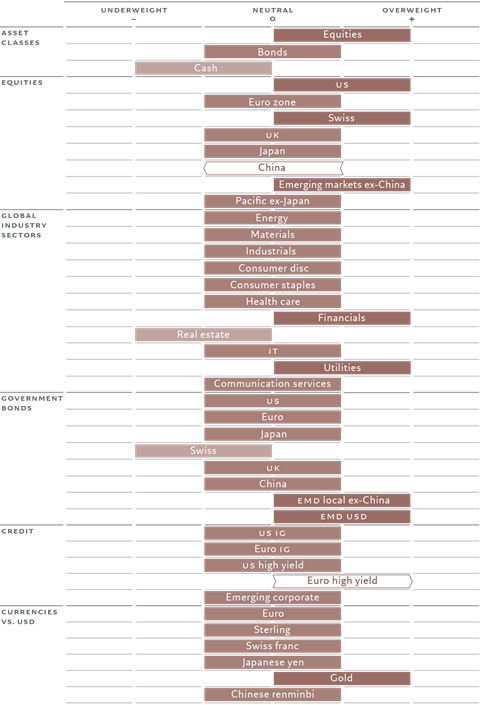

Tactical asset allocation stance

Our annual outlook has also informed our tactical asset allocation stance, which is set out below.

Read our full Annual Outlook for 2025 here.

Disclaimer

This marketing material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For UK investors, the Pictet and Pictet Total Return umbrellas are domiciled in Luxembourg and are recognised collective investment schemes under section 264 of the Financial Services and Markets Act 2000. Swiss Pictet funds are only registered for distribution in Switzerland under the Swiss Fund Act, they are categorised in the United Kingdom as unregulated collective investment schemes. The Pictet group manages hedge funds, funds of hedge funds and funds of private equity funds which are not registered for public distribution within the European Union and are categorised in the United Kingdom as unregulated collective investment schemes.