Real Estate Updates – Page 3

-

Asset Manager News

Asset Manager NewsIPUT Real Estate announces a €230 million commitment for its sustainable Logistics Sub Fund at Nexus Logistics Park

IPUT Real Estate (“IPUT’), Dublin’s leading property investment company, has launched a new logistics sub-fund, the “IPUT Nexus Logistics Fund” raising €115 million in new capital to develop the first 1.5 million sq. ft. of Nexus Logistics Park (“Nexus”). The IPUT Nexus Logistics Fund will operate as a sub-fund within IPUT Real Estate and is classified as an SFDR Article 9 fund, ranking it among the most sustainable real estate funds in Europe.

-

Asset Manager News

Asset Manager NewsFirst ever Irish presence at MIPIM Conference

First ever Irish presence at world famous MIPIM Conference in France will seek to attract foreign investment in Irish property and development market. Over €18 billion in private investment required each year to support housing and real estate development in Ireland. Irish presence is in association with the Ireland Strategic Investment Fund (ISIF) and supported by Ardstone, Bank of Ireland, IPUT Real Estate and Kennedy Wilson.

-

Asset Manager News

Asset Manager NewsInvestment Update: Real estate investors redefine their course

The recovery in the real estate market continues cautiously, writes Peter Koppers of Achmea Real Estate in the new Investment Update. INREV research shows that investors are again allocating new capital to real estate, with a strong focus on core strategies and sectors with stable fundamentals. Residential real estate remains the absolute favorite, particularly affordable rental housing and senior housing, a domain where impact, sustainability, and returns go hand in hand.

-

Asset Manager News

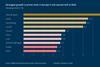

Asset Manager NewsGARBE PYRAMID-MAP: Slowing Growth of Prime Rents on European Logistics Real Estate Markets

The cycle of soaring rent rates in Europe’s top logistics markets has ended. During the second half of 2024, the average prime rent increased by just 6 cents, rising from 7.30 euros to 7.36 euros per square metre. It is the equivalent of 0.9 percent and thus trails the inflation rate in the eurozone, which was 2.4 percent at the last count. The 2024 take-up in Europe, while representing a modest year-on-year decline (-7 percent), actually exceeds the pre-pandemic figures by a narrow margin. The vacancy rate across Europe was just under six percent.

-

Asset Manager News

Asset Manager NewsSchroders Capital acquires NH Collection Milan CityLife hotel from Invesco Real Estate’s European Hotel Fund

Schroders Capital, the USD97.3 billion private markets business of Schroders, has acquired the NH Collection Milan CityLife hotel on behalf of one of its pan-European hotel funds from Invesco Real Estate, the USD 85bn global real estate investment business of Invesco Ltd. (NYSE: IVZ).

-

Asset Manager News

Asset Manager NewsL&G NTR Clean Power (Europe) Fund acquires 211MW Irish Battery and Solar projects

The acquisition brings the Fund’s total capacity in Ireland to over 326 MW and marks its ninth acquisition

-

Asset Manager News

Asset Manager NewsGARBE Industrial Real Estate Expands Strategic Partnership with SFO Capital Partners

GARBE Industrial Real Estate GmbH (“GARBE Industrial”), one of the leading providers and managers of logistics, light industrial and technology assets in Germany and Europe, formed a third joint venture with SFO Capital Partners, a London-based global real estate investor and investment manager to develop and manage a 22,000 sqm Grade A logistics development in Italy.

-

Asset Manager News

Asset Manager NewsU.S. apartment investment opportunities expected to remain robust amidst sector recovery

The U.S. apartment sector is well-positioned to capitalize on shifting sector dynamics, creating potentially long-term opportunities within the market. Below, we examine what factors are driving these changing conditions, and where investors may find value.

-

Asset Manager News

Asset Manager NewsInvesco Real Estate and Marchmont IM launch Space Industrial, a new platform investing in UK Multi Let Industrial assets

Invesco Real Estate, the USD 85bn global real estate investment business of Invesco Ltd. (NYSE: IVZ), and Marchmont Investment Management (Marchmont IM) have launched Space Industrial, a new platform which will acquire, manage and reposition Multi Let Industrial (MLI) assets in the UK.

-

Asset Manager News

Asset Manager NewsSpace Exploration Boom Offers Real Estate Investment Opportunity

Acquisition of Titusville Logistics Center highlights opportunity in space exploration adjacent submarkets

-

Asset Manager News

Asset Manager NewsCharter Hall acquires strategic ‘shovel ready’ logistics site in Darra, Brisbane to create new $350 million industrial estate adjacent to its completed $250 million estate

Charter Hall Group (Charter Hall or the Group) is pleased to announce that its $13 billion Charter Hall Prime Industrial Fund (CPIF or the Fund) has acquired a prime Industrial development site at Harcourt Road Darra, for $80.55 million, which will be developed into a $350 million estate upon completion.

-

Asset Manager News

Asset Manager NewsGenerali Real Estate Acquires Prime Logistics Asset in Barcelona from Scannell Properties

Generali Real Estate announces the acquisition of Logistic Park Montornés, a state-of-the-art logistics asset in Montornés del Vallès (Barcelona) on behalf of the pan-European “Generali Real Estate Logistics Fund” (GRELF) managed by Generali Real Estate SGR and reserved for institutional investors, from Scannell Properties España.

-

Asset Manager News

Asset Manager NewsGARBE PYRAMID-MAP: Europe’s Logistics Real Estate Investment Markets Indicate Trend Reversal

The European logistics real estate investment market appears to be recovering: For the first time since the second quarter of 2022, the average prime net initial yield rates are in decline. Growing investor interest has been reported specifically from the Benelux countries, Spain and some eastern European markets such as Poland and Romania.

-

Asset Manager News

Asset Manager NewsGARBE Industrial and Sidra Capital Form Joint Venture for the Purpose of Sale-and-Leaseback Transactions

GARBE Industrial Real Estate GmbH (“GARBE Industrial”), one of the leading providers and managers of logistics, light industrial and technology assets in Germany and Europe, just formed a strategic joint venture with Sidra Capital, a Middle Eastern investment manager with a global portfolio. The partnership’s objective is the acquisition of light industrial and logistics real estate in Germany within the framework of sale-and-leaseback transactions.

-

Asset Manager News

Asset Manager NewsHines and Ivanhoé Cambridge Near Completion of CIBC SQUARE With Topping Out of 141 Bay Street

Trophy Office Tower Hits 80% Leased with Major Tenants

-

Asset Manager News

Asset Manager NewsL&G NTR Clean Power Fund acquires 115MW Irish solar project

The project secures further geographic diversification for the Fund and marks its eighth acquisition

-

Asset Manager News

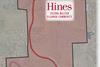

Asset Manager NewsHines Acquires Nearly 3,000 Acres In West Houston For Master-Planned Community

(HOUSTON) – Hines, the global real estate investment manager, has acquired nearly 3,000 acres near Katy, Texas, and Fulshear, Texas, to be developed into an expansive master-planned community, making it one of the firm’s largest land purchases for single-family development. The site is located at the corner of Westpark Tollway and the Texas Heritage Parkway which bisects the tract.

-

Asset Manager News

Asset Manager NewsInvesco Real Estate & Propel Industrial to redevelop 80,000 sqm German industrial brownfield site

Invesco Real Estate, the USD 85bn global real estate investment business of Invesco Ltd. (NYSE: IVZ), has acquired a cluster of warehouses in Bruchsal, Germany, on behalf of Invesco Real Estate Europe Fund III – SCSp (Europe III), the third European value-add strategy in succession for the firm.

-

Asset Manager News

Asset Manager NewsCharter Hall demonstrates depth of demand for small-scale industrial assets with $500 million in sales

Charter Hall Group (Charter Hall or the Group) is pleased to announce that it has successfully divested of approximately $500 million in small-scale industrial assets over the last 18 months, in accretive transactions that demonstrate the depth of demand for assets in the sub-$50 million price bracket.

-

Asset Manager News

Asset Manager NewsInvesco Real Estate caps record 2024 for logistics deals with forward development of Grade A site in Piedmont

Invesco Real Estate, the EUR 80bn global real estate investment business of Invesco Ltd. (NYSE: IVZ), has forward funded the development of a Grade A 25,000 sqm cold storage logistics facility in the Piedmont region of Italy on behalf of a long-standing German separate account mandate.