All Office articles – Page 9

-

White papers

White papersThe case for private U.S. commercial real estate In search of investment returns

The investment landscape since the Global Financial Crisis (GFC) more than a decade ago has been significantly impacted by a sea change in central bank policies, ushering in a period of unprecedented low interest rates and increased adoption of Keynesian approaches. Post-GFC, the Fed remained very deliberate in its removal of accommodative policy to ensure stronger growth and achieve its inflationary target of roughly 2%.

-

White papers

White papersReal Estate Outlook – Europe, Edition 1 - 2021: Caution required

The European economy ends 2020 fairly battered and bruised as the second wave of the COVID-19 pandemic hit hard, both in terms of infections and the wider economy.

-

White papers

White papersReal Estate Outlook – APAC, Edition 1 2021: Stay circumspect

Most major APAC economies will bottom and reverse the growth decline by year-end. The general prognosis for 2021 is less negative but occupier performance will continue to face pressure.

-

White papers

White papersInterest Rates are Rising, Should Real Estate be Concerned?

Capital markets are increasingly penciling in a higher interest rate scenario as reflected in a sharp steepening in the Treasury yield curve over the past 30 days. The yield on the 10-year bond has increased by 40 bps over the past 30 days.

-

Research Report

Research ReportAEW Monthly Research Report - March 2021

During the Covid-19 lockdowns, the share of office employees working sometime or usually from home (WFH) more than doubled from 28% in 2018 to 67% in July 2020 across the EU 27 region. To measure the possible impact from WFH we develop a data driven market resilience ranking measures across our 25 office markets using five key variables.

-

-

White papers

White papersEurope Real Estate sector report - Spring 2021

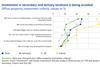

Long leases and strong covenants have shielded office landlords from the very worst impact of the COVID -19 pandemic, though there are signs of some stress creeping into the occupier market. In the short term, nearly all markets across Europe are expected to see yields stay relatively flat despite rent growth pausing or turning negative. A significant bifurcation appears to be occuring between core and secondary investments, asset quality, tenant quality, and gateway and non- gateway markets.

-

White papers

White papersReal Estate House View - Europe 2021

While e-commerce growth in Europe is thought to have averaged at around 10% in 2020, China may have experienced up to 30% growth. It is all about live streams, interaction via social media and being part of the product and its use over the phone. There is a “consumer-centric” vibrancy in China’s e-commerce market, while the west has a “tech driven”, top down approach.

-

White papers

White papersReal Estate House View - United Kingdom 2021

The future of office has been the subject of fierce debate. The pandemic has proven both the extent to which work can be done from home and the limits of this.

-

White papers

White papersWiredScore: Tenants expect quality connectivity

In today’s digital business world, nothing is ever fast enough. From running e-commerce platforms and delivering online services, communicating with clients and colleagues, to using cloud apps to manage operations, the internet underpins most core business functions.

-

White papers

White papersEmbracing change The future of the office sector post-COVID-19

In this paper, we examine how office space will continue to add value to employees and employers after the current health situation has subsided.

-

Asset Manager News

Asset Manager NewsInvestor survey: Pandemic redefines office investment landscape

European real estate investors are rethinking their office property strategies in the wake of the coronavirus pandemic. While the old mantra of location, location, location still holds true, a shift towards core, core, core is apparent in the current situation.

-

White papers

White papersAre Offices Where the Most Compelling Post-COVID Opportunities Reside?

Early autumn optimism—which followed the easing of lockdown restrictions—faded fast with governments again forced to introduce tighter lockdown restrictions through Q4, to try and combat soaring infection rates and prevent health services from becoming overwhelmed.

-

Asset Manager News

Asset Manager NewsSteady growth path: Union Investment completes real estate transactions worth EUR 4.1 billion

Union Investment has continued to deliver reliable growth despite a challenging investment environment. In an exceptional year dominated by the pandemic, the Hamburg-based real estate investment manager invested around EUR 4.1 billion in the European commercial real estate markets in 2020, securing a total of 62 high-quality properties or projects for its real estate funds through a combination of single-property and portfolio deals.

-

Asset Manager News

Asset Manager NewsPGIM Real Estate acquires stake in leading UK commercial property company

PGIM Real Estate has acquired a 25 per cent stake in Langtree, on behalf of an investment strategy, in a multi-million pound deal. Langtree is a leading UK regional property development and management business.

-

White papers

White papersVirtual reality: How COVID-19 is reshaping the world of work

While the coronavirus pandemic has devastated livelihoods, it also presents an opportunity for companies and policymakers to reinvent the world of work. The future is full of possibilities – but no easy answers.

-

White papers

White papersEuropean real estate: Searching for opportunity in a new era

It’s difficult to think of a scenario more impactful to real estate markets than COVID-19. The pandemic has been a direct hit on European real estate, and much uncertainty remains regarding the ultimate long-term effect.

-

White papers

White papersCOVID, remote working and building back better: The stories that defined real assets in 2020

We select some of our key pieces of content on real asset markets in a dramatic year.

-

Asset Manager News

Asset Manager NewsGenerali Real Estate acquires prime office complex in Issy Les Moulineaux, Paris

Generali Real Estate has completed the acquisition of the prime office building “Bords de Seine 2” on behalf of “Generali Europe Income Holding (GEIH)” and “GF Pierre”, two pan- European funds managed by Generali Real Estate SGR. The seller is BNP Paribas REIM for the fund BNP Paribas Diversipierre.

-

White papers

White papersReal estate 2021 outlook

No one can deny how challenging 2020 has been. As coronavirus spread around the globe, life for many was put on hold. Unprecedented government-imposed measures curtailed social and economic activity to protect people’s health and save lives.

Looking to 2021, the pandemic continues, but people continue to adapt, adjusting to the new normal as treatments for the disease improve and vaccine hopes are high.