All Europe articles – Page 53

-

White papers

White papersGlobal Data Centers - European Excerpt

The COVID-19 pandemic has caused the largest economic shock in generations. Significant disruption across all segments of the economy has resulted in severe recessions globally.

-

White papers

White papersQ4 earnings season: an impressive resilience that supports our pro-cyclical views

Given the context, Q4 2020 corporate earnings proved resilient. The regions least impacted by the pandemic, such as EM (+25%) and Japan (+20%), experienced notable increases.

-

White papers

White papers22@ – innovation in Barcelona

Barcelona is in the middle of one of the most ambitious urban renewal projects in the world – and PATRIZIA is in the thick of it. With 22@, the city is seeking to transform the historic but run-down industrial district of Poblenou into a dynamic and innovative district. Greg Langley reports.

-

White papers

White papersEurope Real Estate sector report - Spring 2021

Long leases and strong covenants have shielded office landlords from the very worst impact of the COVID -19 pandemic, though there are signs of some stress creeping into the occupier market. In the short term, nearly all markets across Europe are expected to see yields stay relatively flat despite rent growth pausing or turning negative. A significant bifurcation appears to be occuring between core and secondary investments, asset quality, tenant quality, and gateway and non- gateway markets.

-

White papers

White papersReal Estate House View - Europe 2021

While e-commerce growth in Europe is thought to have averaged at around 10% in 2020, China may have experienced up to 30% growth. It is all about live streams, interaction via social media and being part of the product and its use over the phone. There is a “consumer-centric” vibrancy in China’s e-commerce market, while the west has a “tech driven”, top down approach.

-

White papers

White papersHow Manchester transformed into a city of the future

Once an industrial powerhouse, Manchester reversed its decline to become one of Europe’s top creative capitals. Watch our video to find out why we call it a city of the future.

-

White papers

White papersInvesting in post-Covid-19 European private debt markets: focus on selection

Private debt markets have grown rapidly since the Great Financial Crisis (GFC), with global assets under management (AuM) tripling, from $275bn in 2009 to over $850bn in 2019. The European market accounts for about a third of these assets.

-

-

White papers

White papersTracking ECB’s Communication: Perspectives And Implications For Financial Markets

This article assesses the communication of the European Central Bank (ECB) using Natural Language Processing (NLP) techniques. We show the evolution of discourse over time and capture the main themes of interest for the central bank that go beyond its traditional mandate of maintaining price stability, enlightening main concerns and themes of discussion among board members.

-

White papers

White papersMario Draghi: Deus Ex Machina or Knight of the Apocalypse?

The Future of Italy and Implications for Europe.

-

White papers

White papersDistressed Debt: The Opportunities Surfacing in COVID’s Wake

Barings’ Stuart Mathieson and Bryan High provide insight into today’s distressed debt market, including their expectations for defaults, an overview of the competitive landscape, and where the next opportunities may emerge across the U.S. and Europe.

-

White papers

White papersCan Draghi’s Europe Catch up With Biden’s America?

A rise in U.S. retail sales showed that fiscal stimulus is working and keeping shoppers in the driver’s seat. In Europe, smaller fiscal support and tighter restrictions have weighed on consumer spending but investment and export growth point to a stronger second half of 2021.

-

White papers

White papersThe latest evolution of distress language in CLO documentation

With greater flexibility afforded to the manager, what can debt investors reasonably expect from changes made to documentation for collateralised loan obligations (CLOs)?

-

White papers

White papersBank bonds and the uncertainty principle: why financial analysts must look outside the box

Bank bond analysts could once ply their craft among the two well-defined research fields of macro-economics and financial accounts. But, as Fiorino discovers, understanding financial institution fixed income securities now requires analysis that stretches across traditional boundaries of knowledge.

-

White papers

White papersHow Will Europe Tackle the Biggest Question of the Year?

Besides the rollout of vaccines that will save us from life inside four walls, we will know how governments want to handle the bill of the pandemic.

-

Asset Manager News

Asset Manager NewsGenerali Real Estate acquires Kotva department store in Prague

Prague - Generali Real Estate has acquired the Kotva department store on behalf of the pan-european fund “Generali Real Estate Asset Repositioning S.A.” (GREAR) - a fund dedicated to value add strategies in all the major European countries - from the real estate company PSN.

-

White papers

White papersThe Green Transition: Implications of the European Recovery Plan

Despite questions over financing the European Union’s (EU’s) new Green Deal, the green transition is now under way. The implications for bond investors are clear and urgent.

-

Asset Manager News

Asset Manager NewsOrchard Street completes first letting at West London’s greenest industrial estate

Airbox to take c. 20,000 sq ft at carbon neutral A+ rated Communication Park in Feltham, following its redevelopment

-

White papers

White papersFuture financial footprints: Europe takes next steps on sustainable legs

Almost three years since the European Commission put its sustainability plan into action – and amid a second tranche of proposed reforms for the 2020-25 period – we examine the journey to date and map out the most promising routes ahead to reach the High Level Expert Group on Sustainable Finance (HLEG) destinations.

-

Asset Manager News

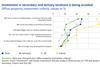

Asset Manager NewsInvestor survey: Pandemic redefines office investment landscape

European real estate investors are rethinking their office property strategies in the wake of the coronavirus pandemic. While the old mantra of location, location, location still holds true, a shift towards core, core, core is apparent in the current situation.