All Emerging Market articles – Page 45

-

White papers

White papersCoronavirus concerns spark market sell off

Public and market fears have converged with countries outside China anxious that they may be approaching the same point as China was at the end of December - the preliminary stages of a devastating epidemic.

-

White papers

White papersExports’ dependence to China and Asia of more than 70 countries

The Coronavirus is expected to have a significant impact at least on China Q1 GDP figure. This will affect many countries firstly through exports to China (including tourism). As shown in charts below and as expected, China’s share in total of exports is high for most of Asian countries particularly for South Korea, Hong Kong and Mongolia. Including Japan, share of exports to Asia for Asian countries is above 50% except for China, India, Sri Lanka and Kazakhstan.

-

White papers

White papersGlobal high yield outlook: Be confident, but not complacent

Last year was a strong year for global bond markets, which were supported by the accommodative stance of the main central banks and strong investor demand. US, European and EM high yield (HY) bonds all returned more than 14% swapped into US dollars. The performance was led by the higher-quality segments of the market, such as BB-rated bonds, as well as the strong performance of CCC bonds in Europe. This was due to the search for yield across credit products, helped by positive risk sentiment.

-

White papers

White papersGlobal Emerging Markets: ESG Materiality, Q4 2019

Welcome to the Global Emerging Markets’ ESG Materiality commentary – a quarterly publication that demonstrates our engagement activity with portfolio companies and showcases holdings that are creating positive impact aligned to the Sustainable Development Goals. In addition, we explore an environmental, social and governance (ESG) theme and its implications for the asset class.

-

White papers

White papersImpact Report, Q4 2019

How do we ensure a sustainable food supply for future generations? In our Q4 2019 report, we explore one of the biggest quandaries of our generation – finding solutions to build a sustainable food system that can feed a growing global population and safeguard the planet.

-

White papers

White papersWhat can we expect from CEE4’s recent data?

We do not have yet the details regarding GDP components but looking at hard data gives us some insights. In Czech, for instance, we assume that the main driver of growth in Q4 has been private consumption as retail sales, industrial production and services remained positive while the manufacturing sector shrank. Similarly, in Poland, while industrial production and retail sales were strong on the last quarter of 2019, construction sector collapsed.

-

White papers

White papersRevisiting China’s Equity Markets as Coronavirus Spreads

Growing fears about the coronavirus have hit Chinese stocks. While markets will remain unstable until China gets the outbreak under control, equity investors should revisit lessons from previous epidemics and consider the potential longer-term effects of the current crisis.

-

White papers

White papersGlobal Emerging Markets: 2020 country allocation review

Monetary easing and a pause in trade tensions helped global growth turn a corner at the start of this year. While the structural growth story for emerging markets remains intact, a potent mix of challenges remain – including the coronavirus, which should depress activity for the first half of this year. Here, we consider our 2020 country allocations for global emerging markets.

-

White papers

White papersBrexit Still Weighs On GBP, But The Situation On Rates And Equity Could Normalise

Now that the United Kingdom is officially out of the EU, a new phase has opened up, during which UK officials will have to negotiate a trade deal with the EU to avoid a ‘Brexit cliff edge’ at the end of 2020. The available time span is short, but an agreement is possible on either a trade deal, another extension or some mixture of the two.

-

White papers

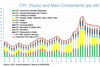

White papersTurkey: Inflation And Monetary Policy

January’s inflation report and last inflation figures: The Governor of the CBRT debriefed last week on the first inflation report of the year January inflation figure released at 12.15% yoy, higher than in December (11.84%). The rise in housing, electricity and energy were the main drivers pf this increase. ...

-

White papers

White papersBlog: Sustainable investing in Europe: Why putting a label on it really matters

The labels that independently certify sustainable investment strategies in Europe are by no means new – in fact, they have multiplied and been expanded in recent years. Cynics may view such labels as bureaucratic meddling that adds unwanted hassle and cost. Far from it.

-

White papers

White papersTop Risk Map - February 2020

At the start of the 2020s, markets continued to be dominated by geopolitical issues, with short-lived Iran tensions at the forefront initially, followed by the news regarding a phase one trade deal between the US and China. Now, growth expectations are becoming the main driver of the market. That’s why the recent volatility due to the news about the spreading of the corona virus in China is higher than in the case of US-Iran tensions, as the epidemic could harm China (and global growth) if not contained soon (not our base case at the moment).

-

White papers

White papersFocus On Fundamentals: Virus Volatility Provides Entry Points For EM Equities

The coronavirus has been the strongest driver behind the recent volatility in financial markets, providing the trigger for a break in the rally in risk assets, which had been running uninterrupted since October.We should be aware that the trough for markets could be well in advance of the peak of the epidemic, as markets tend to overreact at the beginning of a crisis and then stabilise and rebound, despite the continuation of the negative news flow.

-

White papers

White papersEM Local Debt’s Time to Shine?

Emerging markets (EM) local currency denominated debt may be poised to outperform.

-

White papers

White papersStrategic Relative Value – Q1 2020

Persistent central bank liquidity and easing geopolitical tensions should support a continued rally in risk assets this year. However, the significant disconnect between elevated valuations and only modest economic growth means risk assets are vulnerable to a deterioration in sentiment so investors should also maintain some defensive positioning.

-

White papers

White papersWhat Can German Equity Investors Expect in the Months Ahead?

While the phase one U.S.-China trade deal may provide a near-term boost for German equities, there are a number of risks on the horizon that could introduce volatility in the months ahead—making stock selection as important as ever.

-

White papers

White papersGoing Viral: The Coronavirus or a Central Bank Holding Pattern?

Wuhan goes on lockdown while the U.S. shifts trade truce considerations to Europe. Meanwhile, Central banks remain optimistic for strengthening global growth, and we’re vigilant for potential insurance cuts from the BoE next week.

-

White papers

White papersSpectrum Asset Management Outlook for 2020

Some macro risks—such as Brexit—appear to be de-escalating, but uncertainties continue; trade war negotiations are likely to overhang sentiment into the United States election.

-

White papers

White papersCore Matters - Germany’s fading shine

The investment case for Germany is dwindling. Following the GFC, Germany’s annual growth outperformed the rest of the euro area in from 2010 to 2017 by 1.2 pp on average. That said, in 2018 German growth underperformed and is expected to do so also in 2019 and 2020.

-

White papers

White papersEurope At An Economic Policy Crossroads

On an international scale, Europe is struggling to establish itself, in particular against the two giants, the United States and China. The European Union (EU) must therefore be strengthened at all levels: political/ diplomatic, security/defence, financial architecture, development of high technologies, financing of the energy transition, etc.