Marketing communication

Securing single-digit annual returns from a diversified portfolio could prove an unusually complex task in the next five years, largely because of volatile inflation and more muscular state intervention.

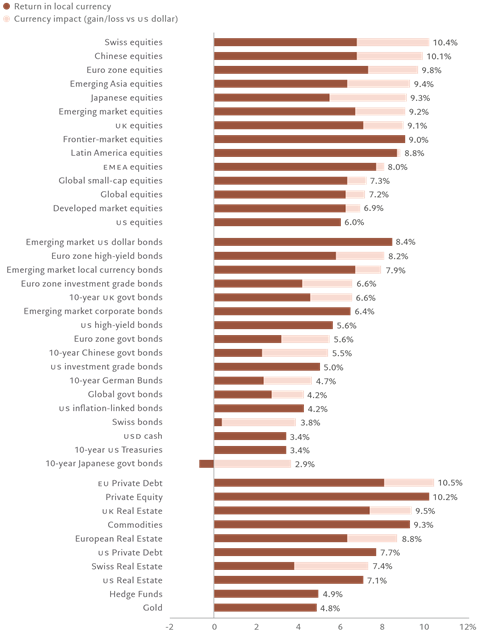

1. RETURN PROJECTIONS FOR THE NEXT FIVE YEARS

Investment strategies will need an overhaul over the next five years. And for several reasons. Economic growth for the rest of this decade will remain stubbornly below average as inflation – while in retreat – is likely to be unusually volatile. Greater state intervention in the economy, meanwhile – in industries such as cleantech, semiconductors and defence – will not only add to the public debt burden but could also increase the risk of policy mistakes and capital misallocation.

The headwinds become more powerful still when the effects of weak productivity, labour shortages and tighter financial conditions begin to manifest themselves with greater intensity. Yet for nimble investors, and those prepared to venture beyond the beaten track of developed equity markets, several potentially rewarding opportunities remain.

ASSET CLASS RETURNS, 5-YEAR FORECAST, %, ANNUALISED

Source: Pictet Asset Management, forecast period 30.04.2023-30.04.2028

| OPPORTUNITIES | THREATS |

|---|---|

|

|

2. SECULAR TRENDS

A more interventionist state

Stung by the experiences of the Covid pandemic and the Ukraine war, governments are prioritising domestic resilience and national defence.

The renewed geopolitical rivalry will reconfigure global commerce. Industries that attract the greatest amount of state subsidies – such as semiconductors, green technology, cybersecurity and defence – may well see an improvement in their fortunes.

Yet the broader picture is one of increased risks for investors. The likelihood of policy mistakes will increase as governments and regulators become involved in the management of their economies.

Inflation will fall but it will also be more volatile

We expect inflation to drift back towards levels consistent with central bank targets over the next five years. But this will come with a cost: the rate of inflation will be considerably more volatile.

Returns on traditional portfolios will be lower. As a consequence, economies will grow at below their own long-term trend while returns from traditional balanced portfolios will also be lower than the historical average.

Brace for a labour shortage

An ageing population and the shift to flexible working are exacerbating labour shortages around the world. This is already lowering productivity and curtailing the world economy’s long-term growth potential. China’s shrinking population will make matters even worse.

The adoption of automation could become a more urgent priority.

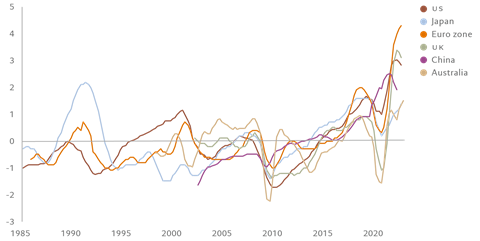

IN SHORT SUPPLY

LABOUR SHORTAGE INDICATORS IN SELECTED ECONOMIES

Source: Refinitiv Datastream, NFIB, Eurostat, Bank of Japan, ONS, China’s Ministry of Human Resources and Social Security, NAB, Pictet Asset Management. Based on standard deviations from long-term average, 4-quarter rolling average. Data covering period 01.01.1985-31.12.2022.

Avoiding a prolonged economic stagnation will mean making even greater use of automation and machine learning to boost productivity.

But a tech transition will be a long and complicated process.