All White papers articles – Page 32

-

White papers

White papersThe Power of Embracing Competing Ideas

This year’s recommendation for vacation reading is a fascinating exploration of the sources of rising political polarization in the U.S. and how it can be addressed.

-

White papers

White papersThe Coming Slowdown in Growth and Liquidity: What It Means For Investors in 2H 2025

We believe twin slowdowns in economic growth and global liquidity could weigh on various risk assets in the second half of 2025.

-

White papers

White papersA spirited return to Asia and China: A multi-asset strategy could help manage risks and deliver more precise outcomes

While investors have seen highs and lows in trade tariff negotiations in the past few months, after selloffs from the initial shock, markets in China and more broadly Asia got back on track and have quietly delivered strong performance this year so far.

-

White papers

White papersFed moving towards rate cuts

“The US Fed is carefully treading the policy path forward, given the mixed macro data. As signalled at the recently concluded Jackson Hole symposium, the central bank is likely to start cutting rates in September, in line with our expectations.”

-

White papers

White papersSingle-sector real estate funds outperform in Europe

Single-sector European real estate funds outperformed diversified peers in 2Q25, with income driving returns and Europe forecast to outpace the U.S. in 2025.

-

White papers

White papersKey catalysts for a sustained rebound in small caps

Small-cap stocks are showing signs of revival thanks to valuation gaps, potential Fed easing and improving macro indicators—though a durable rally will hinge on earnings growth and policy support.

-

White papers

White papersBack to school: campus capital backed by muni bonds

Higher education institutions face unprecedented challenges from demographic shifts, federal scrutiny and infrastructure needs. Municipal bonds provide essential financing that enables these institutions to build state-of-the-art facilities, maintain competitive campuses and secure operational liquidity.

-

White papers

White papersRate cuts in focus: Diverging data and the politics of monetary policy

Markets are seeing mixed signals — weak payrolls and rising input-costs from tariffs suggest inflation could pick up, even while employment growth slows.

-

White papers

White papersMo’ Money, Mo’ Problems

With the debt ceiling no longer an issue, the Treasury is set to increase issuance to raise the cash balance in the general account. Treasury intends to use more bills instead of coupon financing. This shift in strategy may pressure the Federal Reserve to adjust its portfolio, which currently holds a much lower proportion of bills than the overall Treasury market. July saw a record $27.7 billion in tariff revenue, yet tariffs remain a minor part of federal government receipts.

-

White papers

White papersJapan senior living – Capitalizing on structural trends

Japan has emerged as one of the top three commercial real estate markets in the world, as a result of structural economic reforms, monetary expansion and flexible fiscal policy.

-

White papers

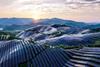

White papersChasing the sun: China leads global race to build solar power

China has significantly increased its solar power capacity in recent years and it now leads the pack globally, surpassing all other countries combined. As different regions adopt varied approaches to renewable energy, the global energy transition is complex and operates at multiple speeds.

-

White papers

White papersO’Connor Global Multi-Strategy Alpha Monthly Letter: An energy transition inflection point

As we pass the halfway mark of 2025, the energy transition landscape has undergone significant transformation. US policy shifts under President Trump – including the One Big Beautiful Bill Act (OBBB), executive orders supporting nuclear and clean energy, and broader deregulation – have reshaped global energy dynamics.

-

White papers

White papersCredit at a Crossroads: Finding Value in Europe’s Landscape

In today’s market environment, we believe European leveraged loans and high yield bonds present a compelling investment case.

-

White papers

White papersChina Bonds: Diversification potential beyond the Dollar

Strategic Allocation in a Shifting Global Paradigm: UBS (Lux) Bond SICAV – China Fixed Income (RMB)

-

White papers

White papersShow me the value: Investing in carbon removal, part two

In this article, we explore the different types of carbon credits, the development of the markets on which they are bought and sold, and how institutions can use them to achieve their investment and sustainability goals.

-

White papers

White papersA partnership to deliver breadth and depth on India equity

Why we are collaborating with HDFC Asset Management Company on an India strategy

-

White papers

White papersPlatform wars: How competition could reshape China’s gig worker economy

China’s vast army of gig workers is the backbone of the country’s digital economy, powering consumption and logistics infrastructure. Despite offering flexibility and opportunity, the gig economy also presents challenges such as weak labour protection and income insecurity.

-

White papers

White papersInvesting for change: China’s world-leading electric vehicle industry

As many countries attempt to phase out fossil fuels, electric vehicles (EVs) have become ubiquitous – and China is leading the way. Sitting at the intersection of technology, sustainability, and global growth, the Chinese EV sector is an emblem of China’s global ambitions.

-

White papers

White papersStrategy Outlook – Unified Global Alternatives - Hedge Funds Third Quarter 2025

Trump’s “Liberation Day” tariffs set global equity markets off to a volatile start in Q2 but they ultimately finished the quarter strongly positive as deals were negotiated and uncertainty eased. UGA HF Broad Based Diversified and Broad Based Neutral strategies generated positive performance during the quarter, with gains predominantly driven by Equity Hedged and Trading strategies, while Credit / Income and Relative Value strategies contributed smaller profits.

-

White papers

White papersEquities: All Eyes on the Fed

Political pressure, changing personnel and a complex mix of macroeconomic data in recent weeks have renewed the focus on the Federal Reserve and its policy direction. Compared to the bond markets, equity markets seem to be taking these developments in stride.