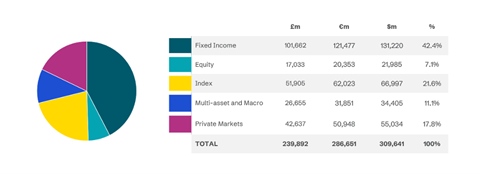

We manage over £239bn across a range of asset classes. Please see below a breakdown of our assets under management:

Source: Aviva Investors, as at 31 March 2025. The figures shown above are for the group of companies trading as Aviva Investors, the fund management arm of the Aviva Group.

Our investment range and key business focus

Aviva Investors is a global asset manager with a broad range of expertise across asset classes. Our investment desks share a common investment goal which is to deliver the specific and meaningful outcomes that matter most to today’s investor. We focus on what we do best, and on capabilities and propositions that build on our heritage in managing long-term savings. Our investment services include:

Fixed Income: Aviva Investors is a trusted institutional global fixed income investor offering a diverse range of products across the fixed income spectrum. Our Fixed Income offering includes global high yield, global investment grade, emerging market debt (‘EMD’), liability driven credit and liquidity.

Global and UK equity strategies: At Aviva Investors, we believe equity markets are inefficient and value can be added against indices or as part of investment return solutions. The future is not equal to the past hence passive or algorithmic led solutions such as ETFs may fail investors when the micro or macro outlook changes. Reflecting our belief in inefficient markets, our objective is to provide clients with a differentiated, dynamic and forward-looking equity proposition based on portfolios which are highly diversified, stock driven have high active shares and controlled factor risk.

Multi-asset & Macro: The Multi-asset & Macro team manages a range of Multi-strategy outcome-oriented funds including AIMS, segregated and pooled Multi-asset vehicles, global rates and global convertible bonds. The team undertakes analysis of the risk and return drivers across different asset classes over a variety of time horizons to determine an appropriate investment strategy for clients’ portfolios as well as manage volatility and downside risk.

Private Markets: We offer investment solutions targeting secure long income, highly diversified portfolios targeting income and growth, as well as specialist funds targeting tactical, higher growth outcomes. We invest in specific sectors, in single countries, regionally or globally, and invest across the real estate spectrum, both directly and indirectly, and in equity and real estate debt. We offer management services targeting benchmark relative, cash relative or absolute returns.

We also provide investors with access to alternative income asset classes, through a multi-strategy solution as well as single asset class strategies. These include investments in areas such as infrastructure (both debt and equity), real estate financing, structured finance and corporate private placements.

Recent highlights

- In Q4 2024, Aviva Investors launched the Carbon Removal Fund aiming to provide institutional investors including corporates, pension funds, insurers and local government pension schemes with access to carbon removal solutions which can deliver investment returns, whilst also supporting their long-term net zero ambitions. The Fund invests directly in nature-based and engineered carbon removal solutions that can provide high integrity carbon removal credits as part of a blended portfolio.

Vision and beliefs

We help our clients enhance and restore the world’s natural capital. We do this by investing in nature-based solutions to support climate goals, protect ecosystems, and promote human wellbeing and biodiversity. Returns are generated from timber, carbon, land appreciation and other associated nature-based revenues.

Residual carbon is inevitable in virtually all operational businesses. Nature-based carbon removal solutions are key enablers to reach net zero ambitions. They can be used in partnership with operational decarbonisation by corporates, public institutions and pension funds.

Investments in natural capital can drive sustainable economic growth by creating green jobs and income for those often living in rural areas. Moreover, investing in nature-based solutions supports diverse species and enhances ecosystem resilience by protecting and restoring ecosystems.

Natural capital assets can offer sustainable, long-term returns. These come via diversified income streams - such as from land value appreciation and the sale of ecosystem services such as carbon and timber. They also offer low correlation to traditional asset classes, reducing overall portfolio volatility.

Investment process and research

Our team’s technical expertise combines deep understanding of real assets investments, net zero pathways, carbon markets and nature-based solutions. We follow deep due diligence processes to deploy capital into high-integrity natural capital projects and nature-based solutions. We focus on targeted locations and project types, gaining deep knowledge of local markets and building strong relationships with development partners to create diversified portfolios of assets.

We also engage actively, both domestically and internationally, through our macro stewardship teams to ensure policy conditions support the prioritisation and scale-up of nature restoration and recovery.

Compliance statement

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited (“Aviva Investors”) as at 31 March 2025. Unless stated otherwise any views, opinions and future returns expressed are those of Aviva Investors and based on Aviva Investors internal forecasts. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Past performance is not a guide to future returns.

Some of the information within this document is based upon Aviva Investors estimates. It is not to be relied on by anyone else for the purpose of making investment decisions.

In Europe this document is issued by Aviva Investors Luxembourg S.A. Registered Office: 2 rue du Fort Bourbon, 1st Floor, 1249 Luxembourg. Supervised by Commission de Surveillance du Secteur Financier. An Aviva company. In the UK Issued by Aviva Investors Global Services Limited. Registered in England and Wales No. 1151805. Registered Office: St Helens, 1 Undershaft, London EC3P 3DQ. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119178.