All United States articles – Page 33

-

White papers

White papersThe Grey Wave – Opportunities in U.S. Seniors Housing

U.S. Seniors Housing is attracting increased investor focus due to an aging population which will provide landlords with a demand tailwind coupled with some insulation from short term economic cycles. In just the past few years, the larger seniors housing landlords have recast the relationship with their tenants, and this has positioned those property owners to benefit from similar operational improvements already seen across many other commercial property sectors.

-

White papers

White papersU.S. single-family rentals

In the third part of our Living Sector Series, we focus our attention on single-family rentals, which is one of our highest conviction strategies within the real estate asset class today. Once synonymous with home ownership, the single-family market underwent an evolution following the Global Financial Crisis (GFC) due to shifts in economic and demographic dynamics, which changed the way individuals and households think about housing.

-

White papers

White papersNo Need to Call the Bottom – Examining Fund Vintage in the US

Rising financing costs since the Fed began to institute a series of rate hikes in March 2022 have put downward pressure on commercial real estate values. Indeed, the 11.9% annual decline in property values in the NCREIF Property Index (NPI) in 2023 was slightly worse than the annual losses suffered in 1991, 1992, and 2008 and is the second-worst year of appreciation returns since the index’s inception in 1978.

-

White papers

White papersQ1 2024 - U.S. Economic and Property Market Outlook

U.S. economic growth slowed sharply over the first three months of 2024, decelerating from more than 4% annualized growth recorded during the second half of 2023 to only 1.6% for the first quarter.

-

White papers

White papersThe Case for U.S. & EU Industrial Real Estate

The industrial sector has become a global favorite amongst institutional investors as large structural shifts already underway, accelerated during the pandemic.

-

Podcast

PodcastA World in Debt: US Treasuries

Guy: Welcome everyone to the “MIM Cuts to the Chase” podcast series. I’m your host, Guy Haselmann, and today we will discuss and unravel the US Treasury Bond market – which I often refer to as “the most important market in the world”. In light of the record-breaking U.S. Treasury issuance and looming large fiscal deficits, I think our discussion here couldn’t be timelier.

-

White papers

White papersU.S. multifamily housing: Distress can create opportunity

The U.S. multifamily housing sector faces challenges from both overdevelopment and capital market pressures, with ongoing issues anticipated through 2025. However, solid macroeconomic fundamentals and sustained demand, particularly from younger generations favoring rentals, offer potential opportunities in the medium-term for well-capitalized investors to exploit distress in the market.

-

White papers

White papersUS logistics and industrials: shifting sands in the supply chain

There is an ongoing shift in logistics away from the West Coast in the US. Read more about our views.

-

White papers

White papersThe Case for a U.S. Productivity Boom

The economy in any single year is subject to the vagaries of chance and, as such, can be “noisy”. Near-term volatility that exerts short-term stress into markets may be front of mind for most investors, but it is long-term trends that provide us with the best view of the future, especially for those with long investment horizons.

-

Asset Manager News

Asset Manager NewsHines Named to Fast Company’s World’s Most Innovative Companies List

Hines, the global real estate investment manager, has been named to Fast Company’s prestigious list of the World’s Most Innovative Companies for 2024. Ranking in the top five of the Urban Development and Real Estate category, Hines is recognized for its achievements in innovation, sustainability and environmental stewardship.

-

White papers

White papersGold has been shining bright this year

”Expectations of a Fed pivot to cut rates likely drove the recent, sharp surge in gold. Now, geopolitical risks and concerns over lack of fiscal prudence from governments could support the demand for metals.”

-

White papers

White papersA sort-of Super Tuesday

This week played host to ‘Super Tuesday’, a key date in the US presidential election calendar where key states hold their primary elections. This year’s results yielded few surprises and set up the 2024 US Presidential election to be a rematch of 2020.

-

White papers

White papersMarkets heed data, not Fed Speak

Strong reports have swayed expectations for rate cuts rather than the Fed’s constant blaring.

-

Video

VideoThe stars (and stripes) align: The overlooked appeal of US SMID

In our latest video insight, Charlotte Daughtrey, Equity Investment Specialist, makes the case for US SMID (small and mid-sized) stocks, which can sometimes get overlooked amid the hype around the so-called ‘Magnificent Seven’ stocks, but can represent a particularly exciting area of the market.

-

White papers

White papers6 questions concerning the weakness behind US resiliency

Do you see recent US data pointing to stubborn inflation? In January we had some upside surprises, encompassing import prices, producer prices, both headline and core CPI, and the PCE deflator. We think prices were in part boosted by seasonal factors which are not fully accounted for in the usual seasonal adjustment, something that also happened last year.

-

White papers

White papersSuper Tuesday points to a super-charged battle

“A Trump-Biden rematch looks likely in November. As we move closer to the elections, market uncertainty will rise given the candidates’ divergent approach to foreign policy and geopolitics.”

-

White papers

White papersThe Long Good Buy: Successfully Redeploying In Today’s Market

The heart of the buy-hold-sell decision is recognizing there are two real estate market cycles that interact with each other.

-

White papers

White papersSelf-storage: creating its own market

With retail and more recently offices falling out of favour with many investors, all eyes are on alternative property types. Among the most popular is self-storage, though as with any opportunity, a key consideration should be to separate the hype from the substance – or at least cyclical from structural drivers.

-

White papers

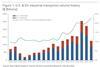

White papersThe case for U.S. & EU industrial real estate

The industrial sector has become a global favorite amongst institutional investors as large structural shifts already underway accelerated during the pandemic.

-

White papers

White papersU.S. Economic and Property Market Outlook - Q4 2023

The U.S. economy continues to surprise to the upside, posting annualized fourth-quarter real GDP growth of 3.3% (3.1% year over year) on top of the nearly 5% annualized growth in the third quarter.