All Europe articles – Page 12

-

Webinar

WebinarGerman Election Results: Shaping Europe’s Future?

Thank you for attending our call “German Election Results: Shaping Europe’s Future?” with Anna Rosenberg, Head of Geopolitics at Amundi Investment Institute; Thomas Kruse, CIO Amundi Germany; and esteemed guest, Günther H. Oettinger, Former European Commissioner and Member of the Supervisory Board at Amundi Germany.

-

White papers

White papersTo maximise the new cycle, investors should target modern logistics

2024 was a transitional year for European logistics, with capital markets showing early signs of recovery, while the occupational market remained relatively sluggish. With demand conditions stabilizing, we believe 2025 is an inflection year offering a potentially compelling entry point into a new cycle.

-

White papers

White papersDeA Capital Real Estate: Demographics are destiny

DeA Capital Real Estate works with selected third-party institutional investors across Europe, with a total AuM of E13.5bn. Emanuele Caniggia and Emanuele Dubini, CEO and CIO respectively of DeA Capital Real Estate, explain why their international platform is driven by demographics and macroeconomics.

-

White papers

White papersThe golden years for European senior housing

Europe’s most frequently discussed demographic shift is its fast-ageing population. The European population is forecast to continue getting older, shifting the demographic framework in Europe to an unprecedented extent. In turn, the senior housing sector is expected to experience a significant surge in demand over the next decade, driven by the unprecedented acceleration of the 75+ population whilst the rest of the population is already in decline.

-

White papers

White papersTurning Europe’s real estate complexity into an investment opportunity

The volatility of the past few years has created a new investment dynamic and operating environment. With shorter real estate investment cycles and valuations in some markets seemingly bottoming out, well-positioned investors should benefit from a different, flexible approach as a means to find pockets of growth. Annette Kröger, CEO Europe, PIMCO Prime Real Estate, reflects on why the current investment window needs a change of mindset.

-

White papers

White papersPractical Thought About Southern Europe PBSA

Taking inspiration from the late Charlie Munger’s problem solving frameworks, we will apply some of his mental models to a relatively simple question: Where should long-term investors look to allocate capital in European real estate today? The short answer would be to look to provide capital to the sectors in most need (those with the greatest demand/supply imbalance), at the most attractive price point, which would subsequently reward investors with the most stable and growing cashflows over a long period of time. Through this lens, the PBSA market in Southern Europe looks to be a leading contender.

-

White papers

White papersThe European appeal

The European equity market has been in the spotlight so far this year, outperforming major global markets, driven by strong performances in the financial sector and more recently in the tech and industrial sectors.

-

White papers

White papersForming coalition will be easiest of next German Chancellor’s many challenges

The centre-right Christian Democratic Union (CDU) and its sister party, the Christian Socialist Union (CSU), won the German election with 28.6% of the popular vote. CDU leader Friedrich Merz is therefore set to be the next Chancellor and will lead coalition talks to form a government at a time when Europe’s biggest economy faces economic, trade and geopolitical challenges.

-

White papers

White papersThe new world of private credit investing

The new European Long-Term Investment Funds Regulation (ELTIF 2.0) has created opportunities to invest in private assets through open-ended funds. Stephane Blanchoz discusses this innovative regulation and the additional investment opportunities it brings.

-

White papers

White papersEuropean Real Estate: Can the U.K. Continue to Lead the Recovery

The U.K. led the rest of the world’s property markets in 2024—but now faces higher U.S.-style interest rates, and a much cooler Eurozone-style growth climate.

-

Asset Manager News

Asset Manager NewsGARBE PYRAMID-MAP: Slowing Growth of Prime Rents on European Logistics Real Estate Markets

The cycle of soaring rent rates in Europe’s top logistics markets has ended. During the second half of 2024, the average prime rent increased by just 6 cents, rising from 7.30 euros to 7.36 euros per square metre. It is the equivalent of 0.9 percent and thus trails the inflation rate in the eurozone, which was 2.4 percent at the last count. The 2024 take-up in Europe, while representing a modest year-on-year decline (-7 percent), actually exceeds the pre-pandemic figures by a narrow margin. The vacancy rate across Europe was just under six percent.

-

White papers

White papersHow can UK real estate better attract international capital?

In late January, leading figures from some of Europe’s foremost real estate lenders, sponsors, advisors and other market participants gathered at the heart of the UK’s political establishment, The House of Lords at the Palace of Westminster, to discuss the future of the UK real estate sector.

-

Asset Manager News

Asset Manager NewsSchroders Capital acquires NH Collection Milan CityLife hotel from Invesco Real Estate’s European Hotel Fund

Schroders Capital, the USD97.3 billion private markets business of Schroders, has acquired the NH Collection Milan CityLife hotel on behalf of one of its pan-European hotel funds from Invesco Real Estate, the USD 85bn global real estate investment business of Invesco Ltd. (NYSE: IVZ).

-

Asset Manager News

Asset Manager NewsL&G NTR Clean Power (Europe) Fund acquires 211MW Irish Battery and Solar projects

The acquisition brings the Fund’s total capacity in Ireland to over 326 MW and marks its ninth acquisition

-

White papers

White papersEuropean Small Caps: Three Catalysts for Change

From changing interest rate expectations to potential political resolutions, there are reasons to believe that European smaller companies may be at a turning point. European equities have begun 2025 on a strong footing, outpacing both U.S. and broader developed markets this year. While this outperformance in part reflects both the recent decline in U.S. technology companies and a partial clawback of European equity indices’ relative underperformance since 2022, immediate concerns over trade tariffs have diminished.

-

Asset Manager News

Asset Manager NewsGARBE Industrial Real Estate Expands Strategic Partnership with SFO Capital Partners

GARBE Industrial Real Estate GmbH (“GARBE Industrial”), one of the leading providers and managers of logistics, light industrial and technology assets in Germany and Europe, formed a third joint venture with SFO Capital Partners, a London-based global real estate investor and investment manager to develop and manage a 22,000 sqm Grade A logistics development in Italy.

-

White papers

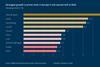

White papersReal Estate Convictions: An Asset Manager’s View of the European Real Estate Markets - Q4 2024

World growth is currently forecast at +3.3% for 2025, a slight improvement on 2024 (+3.2%). While economic activity in the United States will be determined by Donald Trump’s economic policy decisions, these will also have global repercussions. Similarly, China will probably need to step up its fiscal support to boost activity. Finally, while the outlook for the euro zone has improved, possible trade tensions with the US, lack of productivity gains and regional conflicts are all risks weighing on the economic outlook.

-

White papers

White papersEuro high-yield – There is more to come!

Over the last two years, the euro high-yield segment has performed well, with relatively low volatility. It has shown resilience to both external shocks and negative idiosyncratic events within the high-yield universe. We think this demonstrates that the segment is now more mature and of better intrinsic quality than a few years back.

-

White papers

White papersKeeping pace with evolving markets

LaSalle’s David White and Craig Oram provide insights on navigating the evolving real estate debt markets in the US and Europe.

-

White papers

White papersLong-Term Equity: A Winner for Insurers?

Lower capital charges on a broader array of long-term equity investments could encourage insurers to reshape their asset allocations.