Latest Manager Research – Page 140

-

White papers

White papersTaking action! Join us on our journey through sustainable investing in private markets

”There is an extreme shortage of sustainable assets and the supply-demand differential will only grow in the future.”

-

White papers

White papersMacroeconomic and financial market forecasts - March 2024

Macroeconomic forecasts as of 7 March 2024

-

White papers

White papersMacroeconomics, Geopolitics, and Strategy - March 2024

”European PMI data diverge not only in terms of sectors, but also in terms of countries and sub-components.”

-

White papers

White papers6 questions concerning the weakness behind US resiliency

Do you see recent US data pointing to stubborn inflation? In January we had some upside surprises, encompassing import prices, producer prices, both headline and core CPI, and the PCE deflator. We think prices were in part boosted by seasonal factors which are not fully accounted for in the usual seasonal adjustment, something that also happened last year.

-

White papers

White papersCross Asset Investment Strategy - March 2024

“While we expect the Fed, Bank of England and ECB to start rate cuts around June, we will keep an eye on the pace of disinflation for any surprises.”

-

White papers

White papersThe Economic Cost of the Carbon Tax

The choice of the optimal environmental policy is an important question in the current climate change context. While the carbon tax was the preferred policy of economists in the 1970s and 1980s, governments have implemented both quantity-based policies, such as emissions trading schemes, and price-based policies, such as fossil fuel taxes and renewable energy subsidies.

-

White papers

White papersSuper Tuesday points to a super-charged battle

“A Trump-Biden rematch looks likely in November. As we move closer to the elections, market uncertainty will rise given the candidates’ divergent approach to foreign policy and geopolitics.”

-

White papers

White papersGerman residential - Attractive entry point and strong fundamentals

Due to its size and liquidity, the German residential market plays a special role for investors, also because the residential real estate market in Germany ₋ in contrast to many other countries ₋ has been an institutionalized and professionalized asset class for some time.

-

-

White papers

White papersThe Credit Opportunity in M&A

In an environment of tight spreads and low volatility, we believe the reemergence of mergers and acquisitions can be a source of idiosyncratic alpha in credit markets.

-

White papers

White papersREITs: back on track

A look at how investors might navigate the current environment with the help of listed real estate trusts.

-

White papers

White papersThe Long Good Buy: Successfully Redeploying In Today’s Market

The heart of the buy-hold-sell decision is recognizing there are two real estate market cycles that interact with each other.

-

White papers

White papersAdapting to higher interest rates while optimizing prudential capital

As we enter 2024, the financial terrain remains shaped by high interest rates likely to persist at least through the first half of the year.

-

White papers

White papersQ4 2023 Seniors Housing Research Perspective

It’s difficult not to be excited about the prospects for seniors housing in 2024. While capital market dynamics continue to weigh on assets and portfolios that were constructed at peak valuations with variable rate debt when borrowing costs reflected a different rate environment, the strength of the underlying fundamentals driving top-line revenue growth are difficult to ignore

-

White papers

White papersRedevco aims to grow its residential development pipeline to 10,000+ units to enter top ranks of European residential managers

One of the biggest challenges facing European societies is the severe shortage of modern, affordable, and sustainable housing supply in our cities in the face of soaring demand.

-

White papers

White papersComing of age: student accommodation across Europe

The European student accommodation sector is experiencing solid expansion. This surge is driven by rising enrolments and an influx of international students seeking quality accommodation in the UK. Simultaneously, demand in continental Europe is spurred by rising domestic attendance and growing internationalisation, amidst sustained growth in English Language Programmes.

-

White papers

White papersSelf-storage: creating its own market

With retail and more recently offices falling out of favour with many investors, all eyes are on alternative property types. Among the most popular is self-storage, though as with any opportunity, a key consideration should be to separate the hype from the substance – or at least cyclical from structural drivers.

-

White papers

White papersTime for Core European Alternatives

2024 is an attractive entry point for European alternative real estate sectors. The current market dislocation that has arisen from changing capital market conditions has led to significant repricing in the past year, providing an opportunity to acquire core, well-performing alternative assets at an attractive basis discount.

-

White papers

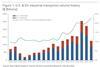

White papersThe case for U.S. & EU industrial real estate

The industrial sector has become a global favorite amongst institutional investors as large structural shifts already underway accelerated during the pandemic.

-

White papers

White papersIdentifying opportunity and creating value in a turbulent European real estate market

The European real estate market continues to recalibrate in the face of elevated interest rates, declining valuations, and economic uncertainty. Apollo is navigating this with a thematic focus, grounded in data-driven analysis and a flexible approach to tactical deployment. Here, we discuss how we’re currently engaging with the opportunities and challenges posed by the current market environment.