White papers - all assets – Page 27

-

White papers

White papersHow far does the Fed’s influence extend?

Not all points of the yield curve respond equally to Federal Reserve rate cuts.

-

White papers

White papers360° Fixed Income Report: How not to be a deer caught in the ‘headlines’

Read our latest 360° fixed income report to learn more about our credit team’s outlook for macro, fundamental and technical forces.

-

White papers

White papersWhy a government shutdown is unlikely to alter the stock market’s course

Historical data suggest U.S. government shutdowns generally have only short-lived market effects—so investors should focus on broader economic fundamentals rather than headline-risk.

-

White papers

White papersOil and gas: The case for higher returns

Oil and gas companies have historically delivered modest returns despite a favorable environment – averaging just 10% over 30 years. Now, rising political volatility, climate litigation, and competition from clean technologies have increased the risks for the sector. Yet, companies are targeting the same returns. Investors must demand more.

-

White papers

White papersInfrastructure CLOs: 101

Infrastructure CLOs are reshaping how institutional investors access essential, income-generating assets—offering a scalable, risk-adjusted entry point into the infrastructure debt market.

-

White papers

White papersSecondaries Spotlight: Up, Up & Away

With deal volumes projected to hit $230 B in 2025, the secondaries market is booming. Growing investor demand, new capital sources and scalable structures are creating compelling opportunities—though sustained growth will hinge on continued capital access.

-

White papers

White papersDigital Infrastructure Equity: Why Scale Isn’t Everything

Small-scale digital infrastructure, especially edge data centers and bulk fiber platforms, is emerging as an increasingly attractive and undervalued opportunity. These assets can offer critical infrastructure characteristics, inflation protection potential and value retention, with speed, flexibility and resilience needed in a rapidly evolving digital world.

-

White papers

White papersNatural Capital and Economic Growth

This paper examines the complex relationship between natural capital and long-term economic growth. Specifically, we review resource-based growth theories and various modeling approaches. In most frameworks, natural capital is considered an additional production factor that supplements traditional inputs. However, we highlight a common conceptual confusion between economic wealth (a stock) and economic growth (a flow).

-

White papers

White papers5 leadership lessons from top CEOs

Culture eats strategy for breakfast, according to management guru Peter Drucker.

-

White papers

White papersSmooth sailing? Don’t get caught in the cross currents

The full impact of tariffs is not yet clear, but investors’ resilience to crises looks to be challenged. In this CIO Note, Fabiana Fedeli, CIO Equities, Multi Asset and Sustainability, emphasises the importance of focusing on the ‘micro’ when the macro backdrop is uncertain. In a market where return dispersion is growing, Fabiana suggests granular stock selection is key to identifying the winners and taking advantage of idiosyncratic opportunities.

-

White papers

White papersUnified Global Alternatives – Hedge Fund Bulletin: Monthly Hedge Fund Update – July 2025

Risk assets produced mostly positive performance in July as investors focus shifted towards constructive earnings, strong inflows from both retail and professional communities, as well as a softening in early month factor rotation pressures. The Dow Jones Industrials, S&P500 and the NASDAQ had positive performance. In Equity / Hedged, US Equity Hedged strategies produced mostly positive returns.

-

White papers

White papersThe Power of Embracing Competing Ideas

This year’s recommendation for vacation reading is a fascinating exploration of the sources of rising political polarization in the U.S. and how it can be addressed.

-

White papers

White papersThe Coming Slowdown in Growth and Liquidity: What It Means For Investors in 2H 2025

We believe twin slowdowns in economic growth and global liquidity could weigh on various risk assets in the second half of 2025.

-

White papers

White papersA spirited return to Asia and China: A multi-asset strategy could help manage risks and deliver more precise outcomes

While investors have seen highs and lows in trade tariff negotiations in the past few months, after selloffs from the initial shock, markets in China and more broadly Asia got back on track and have quietly delivered strong performance this year so far.

-

White papers

White papersFed moving towards rate cuts

“The US Fed is carefully treading the policy path forward, given the mixed macro data. As signalled at the recently concluded Jackson Hole symposium, the central bank is likely to start cutting rates in September, in line with our expectations.”

-

White papers

White papersKey catalysts for a sustained rebound in small caps

Small-cap stocks are showing signs of revival thanks to valuation gaps, potential Fed easing and improving macro indicators—though a durable rally will hinge on earnings growth and policy support.

-

White papers

White papersBack to school: campus capital backed by muni bonds

Higher education institutions face unprecedented challenges from demographic shifts, federal scrutiny and infrastructure needs. Municipal bonds provide essential financing that enables these institutions to build state-of-the-art facilities, maintain competitive campuses and secure operational liquidity.

-

White papers

White papersRate cuts in focus: Diverging data and the politics of monetary policy

Markets are seeing mixed signals — weak payrolls and rising input-costs from tariffs suggest inflation could pick up, even while employment growth slows.

-

White papers

White papersMo’ Money, Mo’ Problems

With the debt ceiling no longer an issue, the Treasury is set to increase issuance to raise the cash balance in the general account. Treasury intends to use more bills instead of coupon financing. This shift in strategy may pressure the Federal Reserve to adjust its portfolio, which currently holds a much lower proportion of bills than the overall Treasury market. July saw a record $27.7 billion in tariff revenue, yet tariffs remain a minor part of federal government receipts.

-

White papers

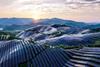

White papersChasing the sun: China leads global race to build solar power

China has significantly increased its solar power capacity in recent years and it now leads the pack globally, surpassing all other countries combined. As different regions adopt varied approaches to renewable energy, the global energy transition is complex and operates at multiple speeds.