White papers - all assets – Page 213

-

White papers

White papersElectric vehicles – approaching the tipping point

The pace of adoption of electric vehicles (EVs) has been phenomenal. The penetration rate is already significantly ahead of many forecasts, with EVs’ share of passenger vehicles exceeding 14% in October, driven by year-on-year sales growth of 74% in a market that was otherwise down. And the rate of adoption shows little sign of slowing.

-

White papers

White papersThe year ahead for loans: Favourable dynamics, but can it continue?

For European loans, 2021 was a standout year in many ways. Record new-loan issuance was met with equally robust demand from traditional loan investors and asset allocators, looking for relatively high and stable yield, while the drive towards sustainability has been both prominent and purposeful. In this piece we present our outlook for the key drivers in the European loan market in 2022.

-

White papers

White papersCentral Banks Walk a Tightrope

Risks loom large as data-dependent central banks search for the right path ahead, but our bet is they will proceed with caution.

-

White papers

White papersKeynote Interview: Efficiency targets drive sustainability

Working to make its facilities more efficient for customers has led GLP into the world of renewable energy and technology, and putting sustainability at the center of its business, says Meredith Balenske

-

White papers

White papersFixed Income Perspectives - January 2022

Global economic growth looks likely to continue in 2022, albeit at a more modest pace. The COVID-19 pandemic does, however, add uncertainty to the outlook, as evidenced by the recent emergence of the Omicron variant.

-

White papers

White papersSolving for a Year of Inflections

The Solving for 2022 delegates voted on what they think will be this year’s best-performing investment category—and here’s why we think they are right.

-

White papers

White papersWormhole intelligence shows investors pulled in different directions by market gravity over 2021-22

This just in: The Interstellar Express reports that a vast cache of data has been recovered from Quantum Gravity Well (QGW) 3.14159 that could shed new light on an ancient, defunct civilisation.

-

White papers

White papersTo address climate change, we need to address social inequality

Two of the largest challenges society faces today – climate change and social inequality – can benefit from a joint approach, particularly as investors may have to navigate enhanced regulation in both areas, says Alex Bernhardt, global head of sustainability research.

-

White papers

White papersInvesting in 2022: Four key market drivers

The pandemic and rising inflation were prevailing drivers of markets in 2021. But the economic squeeze which dominated 2020 finally started to loosen its grip, as the world started to get back to something resembling ‘normality’ in the second half of last year.

-

White papers

White papersAsset Allocation Committee Outlook 1Q 2022

As we enter the new year, most of the global economy appears fundamentally in good shape, as demand continues to recover from the pandemic and supply chains are gradually restored.

-

White papers

White papersBolstering Asset Allocation Defenses Against COVID-19

The surge of the coronavirus omicron variant has implications not only for broader asset-class allocations but also for macro exposures within asset classes. We believe that modestly capping exposure to certain COVID-19-sensitive assets can enhance risk management.

-

White papers

White papersChina’s Complicated Year in the Global Spotlight

For the global economy, the consequences of China’s current economic trajectory are much more difficult to tease out.

-

White papers

White papersWinners of the Italian Recovery Plan (With or Without Draghi)

Which sectors stand to benefit the most from Italy’s Recovery and Resilience Plan, and what impact, if any, will the country’s next president have on efforts to implement the plan?

-

White papers

White papers1Q: 2022 Strategic Investment Outlook: Four Strategic Allocation Issues for Asset Owners in 2022

Four strategic issues—from evolving inflation drivers to a reassessment of real-return prospects and liquidity risks for equities—could have far-reaching implications for strategic asset allocations in the coming year. The action points offered in this note include both changes to portfolio structure and potential alterations in approach.

-

White papers

White papersChina’s Economy in the Year of the Tiger

For China, the year ahead holds special political and economic significance. From the Winter Olympics in February to the Chinese Communist Party’s 20th national congress, slated for the fourth quarter, “the world,” as President Xi Jinping has noted, “is turning its eyes to China.”

-

White papers

White papersLong-term demand drivers in the logistics sector

More sought-after than ever, real estate investors continue to have a bullish outlook on the logistics sector.

-

White papers

White papersSpectrum 2022 Outlook

We expect a slower pace of growth in 2022 due to monetary tightening and reduced fiscal policy support.

-

White papers

White papersShifts & Narratives #13 - Money and psychology of inflation: an investor view

Inflation was the big surprise in 2021. At the beginning of the year, the average US inflation forecast by economists for the end of 2021 was around 2%, while the latest reading in December came in at 7.0% YoY, the highest level since 1982.

-

White papers

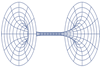

White papersMoney and its velocity matter: the great comeback of the quantity equation of money in an era of regime shift

The velocity of money (V) depends on P = the general price level, T = the total amount of goods and services produced and M = the total amount of money in circulation, and can be expressed by the formula V = PT/M.

-

White papers

White papersChina outlook – Some unconventional thoughts

While there appears to be a large degree of market consensus on China’s GDP growth in 2022, there is less clarity on the three to five-year outlook. A raft of issues could slow growth momentum in 2022.