Real Estate Updates

-

Asset Manager News

Asset Manager NewsInfravia confirms its ambitions in Real Estate with the full integration of OREIMA

InfraVia has completed the full integration of OREIMA, the real estate investment specialist acquired in 2023. OREIMA’s teams will now operate fully under the InfraVia brand.

-

Asset Manager News

Asset Manager NewsHarbert Management Corporation in partnership with DeA Capital Real Estate acquires French business parks portfolio

Harbert Management Corporation (“HMC”), an independent US-based alternative asset manager focused on real assets, and DeA Capital Real Estate, a leading player in real estate investment management in Europe, through a joint venture have acquired an initial c.73,000 sq.m. portfolio of business parks in France.

-

Asset Manager News

Asset Manager NewsDEA capital real estate and Invesco enter into partnership with the Banque des territoires’ “agile programme” to expand the supply of student housing in France

Invesco Real Estate, the global real estate investment arm of Invesco Ltd. (NYSE: IVZ), and DeA Capital Real Estate, a leading European asset manager, announce the entry of Banque des Territoires into the capital of their investment platform to boost the student housing market in France.

-

Asset Manager News

Asset Manager NewsOutlook Achmea Real Estate: Dutch real estate is a strategic choice

Dutch real estate is an attractive option for institutional investors seeking predictable returns, social impact and an effective inflation hedge. However, to attract the foreign capital necessary for solving major social issues, a more attractive investment climate in the Netherlands is required.

-

Asset Manager News

Asset Manager NewsPrague to welcome IHG’s InterContinental brand in historic old town

Set to open in 2029, this latest signing in the Czech Republic joins IHG’s growing European luxury and lifestyle offering. The new InterContinental Prague hotel will be hosted in a historic building part of the portfolio managed by Generali Real Estate.

-

Asset Manager News

Asset Manager NewsAchmea’s healthcare real estate fund most sustainable in the world

Amsterdam, 30 October 2025 – The Achmea Dutch Health Care Property Fund (ADHCPF), managed by Achmea Real Estate, has once again been named the most sustainable healthcare real estate fund in the world. The fund ranked first in its peer group in the Global Real Estate Sustainability Benchmark (GRESB), a leading sustainability benchmarking tool.

-

Asset Manager News

Asset Manager NewsCapital House Disposition

Barings recently sold Capital House, a landmark office building in close proximity to Bank junction, the City of London and the Bank of England. The asset was sold off-market, achieving a price above book value and a tighter yield compared to market level prime city yields.

-

Asset Manager News

Asset Manager NewsGenerali Real Estate and Gruppo Percassi announce the acquisition of OrioCenter, the largest shopping centre in Italy and one of the largest in Europe

The shopping centre, sold by Commerz Real, has been acquired by Generali Real Estate and Gruppo Percassi through a real estate fund in which they hold equal stakes

-

Asset Manager News

Asset Manager NewsL&G NTR Clean Power Fund acquires 105MW Irish solar project

The acquisition increases the Fund’s total capacity in Ireland to more than 430MW and marks its tenth acquisition

-

Asset Manager News

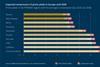

Asset Manager NewsGARBE PYRAMID MAP: Prime Yields of European Logistics Real Estate Show Stable Trend

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030.

-

Asset Manager News

Asset Manager NewsNTR completes on an initial €65 Million Financing Deal with Rabobank and Siemens Financial Services

Funding will enable the construction phase of Irish ready-to-build solar and BESS co-location portfolio for the L&G NTR Clean Power (Europe) III Fund

-

Asset Manager News

Asset Manager NewsOBRAMAT will cover circa. 30% of its annual electricity consumption with solar energy thanks to its agreement with NTR

OBRAMAT will cover circa. 30% of its annual electricity consumption with solar energy thanks to its agreement with NTR

-

Asset Manager News

Asset Manager NewsLeroy Merlin Spain signs an agreement with NTR to cover nearly 30% of its annual electricity consumption with solar energy

LEROY MERLIN Spain, a leading home improvement company, and NTR, an experienced sustainable infrastructure investor and asset manager, have sealed an agreement to further drive LEROY MERLIN’s sustainability strategy and advance the decarbonization of its operations

-

Asset Manager News

Asset Manager NewsGARBE PYRAMID-MAP: Rental Trend on European Logistics Real Estate Market Remains Stable – Modest Growth Forecast through 2030

Europe’s logistics real estate market is moving through a stabilisation and consolidation phase. More specifically, an average rental growth of 70 cents per square metre is projected for the period starting with the second quarter of 2025 and ending with the second quarter of 2030. This would imply an annual growth rate of 1.9 percent (CAGR or Compound Annual Growth Rate).

-

Asset Manager News

Asset Manager NewsGenerali Deutschland purchases Momenturm from Art-Invest Real Estate and establishes new corporate headquarters in Munich’s Werksviertel district

Art-Invest Real Estate is selling the Momenturm project to Generali Deutschland, and Generali Real Estate S.p.A. acted on behalf of Generali Deutschland during the acquisition.

-

Asset Manager News

Asset Manager NewsWaterways Ireland and IPUT Real Estate unveil major public realm upgrade along Dublin’s Grand Canal

Investment enhances public space, accessibility, and biodiversity between Leeson and Baggot Street bridges.

-

Asset Manager News

Asset Manager NewsGARBE Industrial Launches New Spin-off, GARBE Regeneration

GARBE Industrial, one of the leading developers, providers and managers of logistics, light industrial and commercial real estate in Germany and Europe, is expanding its business portfolio: Going live on 1 August 2025, GARBE Regeneration is a new company that specialises in the early detection of land development potential and in the reactivation of unused sites for alternative utilisation. The new company will be headed by Maik Zeranski and Rick Mädel.

-

Asset Manager News

Asset Manager NewsHazelview Celebrates Major Affordable Housing Milestone for Bloor & Dufferin Development

Toronto (ON), July 22, 2024 — Hazelview Celebrates Major Affordable Housing Milestone for Bloor & Dufferin Development.

-

Asset Manager News

Asset Manager Newsa.s.r. and PFZW reposition Amvest’s real estate activities

PFZW and a.s.r. have today agreed to divide the real estate activities of Amvest. As from 1 January 2026, PFZW will acquire a.s.r.’s shares in the management and development organisation, becoming the sole shareholder of Amvest Vastgoed B.V. The current development portfolio of Amvest will be split between PFZW and a.s.r. Management of a.s.r.’s separate account, comprising 7,500 residential units, will be transferred to a.s.r. real estate. No changes will be made to the funds managed by Amvest. By dividing the activities, both shareholders enhance their effectiveness and will be able to pursue their own strategic direction going forward. The transaction is subject to approval by the AFM and ACM.

-

Asset Manager News

Asset Manager News25 North Wall Quay | Setting the Standard

IPUT is proud to mark the official opening of 25 North Wall Quay with An Taoiseach, Micheál Martin, and our long-standing partners, A&L Goodbody.