Manager News

-

Asset Manager News

Asset Manager NewsInfravia confirms its ambitions in Real Estate with the full integration of OREIMA

InfraVia has completed the full integration of OREIMA, the real estate investment specialist acquired in 2023. OREIMA’s teams will now operate fully under the InfraVia brand.

-

Asset Manager News

Asset Manager NewsHarbert Management Corporation in partnership with DeA Capital Real Estate acquires French business parks portfolio

Harbert Management Corporation (“HMC”), an independent US-based alternative asset manager focused on real assets, and DeA Capital Real Estate, a leading player in real estate investment management in Europe, through a joint venture have acquired an initial c.73,000 sq.m. portfolio of business parks in France.

-

Asset Manager News

Asset Manager NewsDEA capital real estate and Invesco enter into partnership with the Banque des territoires’ “agile programme” to expand the supply of student housing in France

Invesco Real Estate, the global real estate investment arm of Invesco Ltd. (NYSE: IVZ), and DeA Capital Real Estate, a leading European asset manager, announce the entry of Banque des Territoires into the capital of their investment platform to boost the student housing market in France.

-

Asset Manager News

Asset Manager NewsOutlook Achmea Real Estate: Dutch real estate is a strategic choice

Dutch real estate is an attractive option for institutional investors seeking predictable returns, social impact and an effective inflation hedge. However, to attract the foreign capital necessary for solving major social issues, a more attractive investment climate in the Netherlands is required.

-

Asset Manager News

Asset Manager NewsPrague to welcome IHG’s InterContinental brand in historic old town

Set to open in 2029, this latest signing in the Czech Republic joins IHG’s growing European luxury and lifestyle offering. The new InterContinental Prague hotel will be hosted in a historic building part of the portfolio managed by Generali Real Estate.

-

Asset Manager News

Asset Manager NewsActis to acquire singapore’s leading environmental management company

LUXEMBOURG, 23 September 2025: Actis, a leading growth market investor in sustainable infrastructure, today announced its 90% acquisition (alongside Founder and CEO William Lee) of 800 Super Holdings Ltd (“800 Super”), a leading integrated environmental management company in Singapore, from the Keppel Asia Infrastructure Fund LP (KAIF) and Keppel Ltd.’s Infrastructure Division (Keppel). The investment will be made through Actis’ second Long Life Infrastructure Fund (ALLIF 2).

-

Asset Manager News

Asset Manager NewsActis launches new Latin American hyperscale data center platform, TERRANOVA, To Accelerate Latin America’s Digital Expansion

SÃO PAULO & LUXEMBOURG, 2 December 2025: TERRANOVA, a new hyperscale data center platform established by Actis, a leading growth market investor in sustainable infrastructure, and part of General Atlantic, a global investment leader, today announced its official launch in Latin America. TERRANOVA’s mission is to power the region’s next phase of digital growth, building energy-efficient and customer-focused data centers that meet the rising demand for AI and cloud infrastructure across Brazil, Mexico, and Chile.

-

Asset Manager News

Asset Manager NewsBridgewater Associates and Lumyna Investments Announce Launch of the Lumyna – Bridgewater Absolute Return Fixed Income UCITS Fund

London, [17 November 2025] – Bridgewater Associates (“Bridgewater”), a leading global investment manager, and Lumyna Investments (“Lumyna”), part of Generali Investments, are pleased to announce the launch of the Lumyna – Bridgewater Absolute Return Fixed Income UCITS Fund (“ARFI”). ARFI will be a liquid, actively managed strategy designed to deliver uncorrelated alpha across global fixed income and currency markets.

-

Asset Manager News

Asset Manager NewsAchmea’s healthcare real estate fund most sustainable in the world

Amsterdam, 30 October 2025 – The Achmea Dutch Health Care Property Fund (ADHCPF), managed by Achmea Real Estate, has once again been named the most sustainable healthcare real estate fund in the world. The fund ranked first in its peer group in the Global Real Estate Sustainability Benchmark (GRESB), a leading sustainability benchmarking tool.

-

Asset Manager News

Asset Manager NewsAccess Portfolio Acquisition

Barings has acquired a multi-let urban logistics and industrial portfolio comprising four assets. Located in high-demand urban submarkets where quality supply is scarce, the portfolio was purchased in June 2025 as part of a non-core investment strategy.

-

Asset Manager News

Asset Manager NewsCapital House Disposition

Barings recently sold Capital House, a landmark office building in close proximity to Bank junction, the City of London and the Bank of England. The asset was sold off-market, achieving a price above book value and a tighter yield compared to market level prime city yields.

-

Asset Manager News

Asset Manager NewsActis continues Latin American energy momentum with new Skyline transmission line acquisition

LUXEMBOURG, 21 October 2025: Actis, a leading growth markets investor in sustainable infrastructure, has signed an agreement to acquire a 135km electricity transmission line from EDP Brasil to add to its Actis Long Life Infrastructure Fund 2 (ALLIF2) Brazilian electricity transmission platform, Skyline.

-

Asset Manager News

Asset Manager NewsMidOcean Credit Partners and Lumyna Investments Announce Launch of the Lumyna – MidOcean Absolute Return Credit UCITS Fund

London, 13 October 2025 – MidOcean Credit Partners (“MidOcean”), a leading U.S. credit manager with nearly two decades of experience that is part of the broader MidOcean Partners platform, and Lumyna Investments, part of Generali Investments, are pleased to announce the launch of the Lumyna – MidOcean Absolute Return Credit UCITS Fund (“the Fund”, “MARC”), an actively managed short-duration long/short high yield strategy designed to provide capital appreciation across market cycles.

-

Asset Manager News

Asset Manager NewsGenerali Real Estate and Gruppo Percassi announce the acquisition of OrioCenter, the largest shopping centre in Italy and one of the largest in Europe

The shopping centre, sold by Commerz Real, has been acquired by Generali Real Estate and Gruppo Percassi through a real estate fund in which they hold equal stakes

-

Asset Manager News

Asset Manager NewsGenerali Investments Completes Acquisition of Majority Stake in MGG Investment Group

NEW YORK and MILAN – Generali Investments, a leading global investment management firm and part of the Generali Group, and MGG Investment Group (“MGG”), a U.S. private direct lending investment firm with over $6.5 billion in assets under management which was launched in 2014 by Kevin Griffin and McCourt Global, today announced Generali Investments’ wholly-owned subsidiary, Conning & Company, completed its acquisition of a 77% stake in MGG and its affiliates.

-

Asset Manager News

Asset Manager NewsL&G NTR Clean Power Fund acquires 105MW Irish solar project

The acquisition increases the Fund’s total capacity in Ireland to more than 430MW and marks its tenth acquisition

-

Asset Manager News

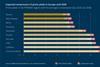

Asset Manager NewsGARBE PYRAMID MAP: Prime Yields of European Logistics Real Estate Show Stable Trend

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030.

-

Asset Manager News

Asset Manager NewsKPN Pension Fund increases commitment to ASR Dutch Science Park Fund to € 45 Million

KPN Pension Fund has increased its current commitment of € 15 million to the ASR Dutch Science Park Fund by an additional € 30 million. Advised by Aegon Asset Management, KPN Pension Fund has been a participant in the fund since September 2021. The fund invests in office and laboratory buildings located on science parks in the Netherlands. The ASR Dutch Science Park Fund positively contributes to the Dutch knowledge economy by accommodating companies engaged in research and development within science park ecosystems. In doing so, the fund supports companies working on the UN Sustainable Development Goals (UN SDGs).

-

Asset Manager News

Asset Manager NewsNTR completes on an initial €65 Million Financing Deal with Rabobank and Siemens Financial Services

Funding will enable the construction phase of Irish ready-to-build solar and BESS co-location portfolio for the L&G NTR Clean Power (Europe) III Fund

-

Asset Manager News

Asset Manager NewsFranklin Templeton forms strategic partnership with Copenhagen Infrastructure Partners, DigitalBridge, and Actis to expand infrastructure solutions for Private wealth

Franklin Templeton forms strategic partnership with Copenhagen Infrastructure Partners, DigitalBridge, and Actis to expand infrastructure solutions for Private wealth