All Europe articles – Page 21

-

White papers

White papersEuropean Hotel Sector: Creating value through transformation

The first step in a value-added investment strategy is finding undervalued or illiquid hotels with good micro locations in attractive markets.

-

White papers

White papersSector spotlight: Dialling up the positivity on telecoms

European telecoms have turned a corner operationally and are in the best financial health for many years. This has led us to upgrade this investment grade sector as an investment proposition, reflecting that its fundamental credit quality is expected to improve in the next few years.

-

White papers

White papersEuropean Residential: Finding A New Balance

Prime European residential markets show solid occupancy fundamentals and stabilising investment yields. This is despite the 2022-23 upward shift in interest rates and associated decline in lending. Student housing has also remained a key alternative sub-sector. The long-standing shortage of housing has further Intensified as higher mortgage rates and ...

-

Podcast

PodcastEuropean Real Estate: Light at the End of the Tunnel?

While European real estate markets have faced headwinds in recent years, there are signs that we may be at or nearing the trough of the cycle. Portfolio manager, Rory Allan provides insight into where the Barings team is finding attractive opportunities to deploy capital today.

-

White papers

White papersThe Case for U.S. & EU Industrial Real Estate

The industrial sector has become a global favorite amongst institutional investors as large structural shifts already underway, accelerated during the pandemic.

-

White papers

White papersCapitalizing on the growing European direct lending market

Private Credit, a nascent and rising asset class for wealth portfolios but one that is close to ubiquitous amongst institutional investors, can offer stable, high yielding returns and reduced volatility compared to traditional fixed income, says Michael Massarano, Partner and Deputy CIO at Arcmont Asset Management, an investment-affiliate of Nuveen.

-

Podcast

PodcastThe Investment Podcast: The long-term megatrend of European private asset-backed finance

While Europe’s private asset-backed finance markets have been growing in importance for a number of years, it’s only in recent years where we’ve seen the regulatory pressures that banks are facing come to the fore, fuelling a strong desire to shrink balance sheets and increase capital.

-

Asset Manager News

Asset Manager NewsHIH Invest Buys Solar Park in Southern Spain

Developed and sold by the company BayWa r.e. Acquired for the HIH Green Energy Invest institutional fund Electricity production pre-sold to 90 percent on ten-year power purchase agreement

-

White papers

White papersEuro government bond opportunities in a rate cutting environment

With inflation decelerating overall and markets pricing in rate cuts for 2024, the environment is ripe for European government bonds to thrive, explains Mauro Valle, Head of Fixed Income at Generali Asset Management.

-

People News

People NewsGARBE Austria Hires Franz Kastner as New Managing Director and Pushes ahead with its Expansion in Austria

GARBE Industrial Real Estate GmbH (“GARBE”), one of the leading specialists for logistics, light industrial and technology properties in Germany and other countries in Europe, is moving ahead with its expansion plans for Austria. Franz Kastner (39) was appointed as Managing Director of GARBE Industrial Real Estate Austria, a subsidiary formed in 2022.

-

White papers

White papersLiving the dream: the evolving case for European living strategies

We give our insights into European residential real estate and how it is adapting to market changes

-

Asset Manager News

Asset Manager NewsRedevco Living Targets 10,000-Plus Units for Residential Development Pipeline to Enter Top Ranks of European Residential Managers

Redevco, one of Europe’s largest private real estate companies with about €9.0 bn in AUM, has created a pan-European residential asset management platform named Redevco Living, by combining the housing projects of Dutch residential real estate specialist LIFE Europe it acquired last year, with its own residential assets.

-

White papers

White papersCross Asset Investment Strategy - March 2024

“While we expect the Fed, Bank of England and ECB to start rate cuts around June, we will keep an eye on the pace of disinflation for any surprises.”

-

White papers

White papersRedevco aims to grow its residential development pipeline to 10,000+ units to enter top ranks of European residential managers

One of the biggest challenges facing European societies is the severe shortage of modern, affordable, and sustainable housing supply in our cities in the face of soaring demand.

-

White papers

White papersComing of age: student accommodation across Europe

The European student accommodation sector is experiencing solid expansion. This surge is driven by rising enrolments and an influx of international students seeking quality accommodation in the UK. Simultaneously, demand in continental Europe is spurred by rising domestic attendance and growing internationalisation, amidst sustained growth in English Language Programmes.

-

White papers

White papersSelf-storage: creating its own market

With retail and more recently offices falling out of favour with many investors, all eyes are on alternative property types. Among the most popular is self-storage, though as with any opportunity, a key consideration should be to separate the hype from the substance – or at least cyclical from structural drivers.

-

White papers

White papersTime for Core European Alternatives

2024 is an attractive entry point for European alternative real estate sectors. The current market dislocation that has arisen from changing capital market conditions has led to significant repricing in the past year, providing an opportunity to acquire core, well-performing alternative assets at an attractive basis discount.

-

White papers

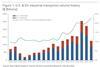

White papersThe case for U.S. & EU industrial real estate

The industrial sector has become a global favorite amongst institutional investors as large structural shifts already underway accelerated during the pandemic.

-

White papers

White papersIdentifying opportunity and creating value in a turbulent European real estate market

The European real estate market continues to recalibrate in the face of elevated interest rates, declining valuations, and economic uncertainty. Apollo is navigating this with a thematic focus, grounded in data-driven analysis and a flexible approach to tactical deployment. Here, we discuss how we’re currently engaging with the opportunities and challenges posed by the current market environment.

-

Asset Manager News

Asset Manager NewsPortfolio resilience: European property investors focus on modernising their portfolios

Decarbonisation, digitalisation and demographic change: the property industry is facing a wide range of transformation challenges.