Content (42)

-

White papers

Investment strategies for the new market cycle

Trends in the institutional real estate markets. The sentiment of institutional investors is improving. While recently mainly opportunistic and risk-taking players were active, the larger group of conservatively oriented and risk-averse institutional real estate investors is slowly returning to the markets.

-

White papers

Strong comeback of the European retail markets

GRAI 1/2025 confirms the positive trend in the first quarter of 2025. The EU-15 Index, compiled by Union Investment and GfK, reached a new high of 115 points, reporting further growth in seven European countries. However, trade tariffs and weakening GDP growth may have a temporary negative impact on trade.

-

White papers

Global Retail Attractiveness Index: New high in European retail markets

The positive trend in European retail markets is becoming more entrenched. In the third quarter of 2024, the Global Retail Attractiveness Index (GRAI) for Europe stood at 114 points, 1 point higher than in the previous year (Q3 2023: 113 points). In eight of the European markets covered by the Union Investment and GfK retail index, the index showed moderate to strong gains.

-

Asset Manager News

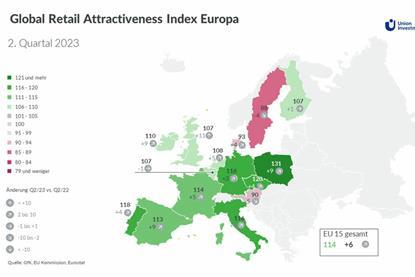

Retail Attractiveness Index: European retail markets rebound after pandemic

The positive trend in European retail markets is becoming more entrenched. The signs of recovery that emerged in the first quarter of 2023 gained in strength and breadth in Q2 2023. This upward trend then continued in the majority of countries in the first quarter of 2024.

-

Asset Manager News

Portfolio resilience: European property investors focus on modernising their portfolios

Decarbonisation, digitalisation and demographic change: the property industry is facing a wide range of transformation challenges.

-

White papers

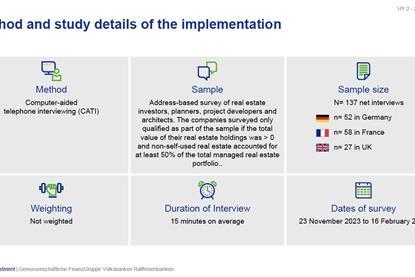

Study on the property investment climate in Europe Measurement II/ 2023

You can now read the full whitepaper at the link below

-

Asset Manager News

With good revenues and optimism: Hospitality defies the crisis

The hospitality industry is also functioning in the crisis. Expectations for business remain high, as well as for increasing revenues.

-

Asset Manager News

Retail Attractiveness Index: Recovery of European retail markets gains breadth

As early as the first quarter of 2023, Union Investment’s Global Retail Attractiveness Index (GRAI) showed tentative signs of recovery in individual European retail markets.

-

Asset Manager News

European real estate investors calculate returns of 3 to 5 percent

Union Investment has extended the lease with its current tenant teleffekt.

-

Asset Manager News

Investor survey: Double bottleneck in property markets

There are still no signs of easing in the transaction markets, with investors either short of capital or unable to find the right property.

-

White papers

No boom, but no crash either

Due to the rise in interest rates, transaction momentum in the real estate investment markets is declining. However, letting markets remain stable. The current environment offers opportunities for investors with a strong equity base.

-

White papers

Real Asset Insight May/June, Sustainable transition

Up to now, sustainability has hardly been an issue when acquiring or leasing a logistics property. That is now changing – which poses a number of challenges for the real estate sector.