Content (21)

-

White papers

Seizing the “Debt-First” Office Moment Timing: Extended, Opportunities Unlocked

As we progress into 2025, Hines Research believes market conditions continue to support the thesis for debt investment in the U.S. office sector.

-

Asset Manager News

Hines Announces Jones Day As First Office Tenant At South Station Tower

The Global Law Firm Will Relocate Its Boston Office to the Best-In-Class 51-Story Mixed-Use Tower Situated Over Boston’s Most Connected and Active Transit Hub

-

Asset Manager News

Space Exploration Boom Offers Real Estate Investment Opportunity

Acquisition of Titusville Logistics Center highlights opportunity in space exploration adjacent submarkets

-

Asset Manager News

Hines And Aubrey Corporation Unveil Industrial Park And Master-Planned Community In Atlanta Suburbs

Project includes over 1,200 acres zoned for manufacturing, data center, and logistics use and a 600-acre mixed-use village planned to integrate residential and retail elements

-

Asset Manager News

Hines and Ivanhoé Cambridge Near Completion of CIBC SQUARE With Topping Out of 141 Bay Street

Trophy Office Tower Hits 80% Leased with Major Tenants

-

Asset Manager News

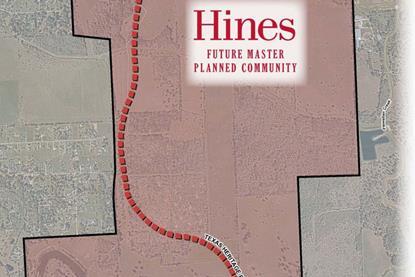

Hines Acquires Nearly 3,000 Acres In West Houston For Master-Planned Community

(HOUSTON) – Hines, the global real estate investment manager, has acquired nearly 3,000 acres near Katy, Texas, and Fulshear, Texas, to be developed into an expansive master-planned community, making it one of the firm’s largest land purchases for single-family development. The site is located at the corner of Westpark Tollway and the Texas Heritage Parkway which bisects the tract.

-

Asset Manager News

Texas Tower Secures New Leases Totaling 182,600 Square Feet

Six prominent firms join Texas Tower’s robust tenant roster, bringing building to 94% leased

-

White papers

The U.S. Office Debt Opportunity

We see a compelling thesis, with multiple complementary investment approaches, forming for investors around the office sector’s current and anticipated capital needs.

-

Asset Manager News

The Latest In-Demand View for Homeowners? A Baseball Stadium

Ballpark condos let you root, root, root for the home team from your living room, balcony or private roof deck

-

Asset Manager News

Hines Announces Over 200,000 Square Feet In New Leasing And Sales Activity At Thurmon Tanner Logistics Near Atlanta

Lease and sale showcase Hines’ momentum across southeast U.S. industrial portfolio

-

Asset Manager News

Hines Launches Network of Workspaces for Tenants to Use

Hines is making moves in the global real estate world.

-

White papers

Buying, building and managing to core

There are two main benefits to having a core-plus approach in today’s market: flexibility and keeping the portfolio young. In terms of flexibility, we can take advantage of market dislocation, as we are seeing right now. And we can benefit from the whole cycle – secular dynamics and shifting demand – in any style or sector.

![Hines [Real Estate - North America]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/web/m/f/x/hines_934187.png)

![Hines [Real Estate - North America]](https://dvn7slupl96vm.cloudfront.net/Pictures/480xany/P/Pictures/web/x/h/i/bottombanner1180x400feb20201_265490.jpg)

![Hines [Real Estate - North America]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/Pictures/web/m/f/x/hines_934187.png)