Emerging Markets (EM) have faced a challenging environment over the past five years, due to a series of global shocks that have triggered elevated market volatility and led the MSCI EM equity benchmark to experience its most protracted drawdown in history. In this environment, global asset allocators effectively deprioritised EM, risking suboptimal allocations.

There eare five reasons why asset owners should consider reengaging with EM equity:

-

EM is too big to ignore

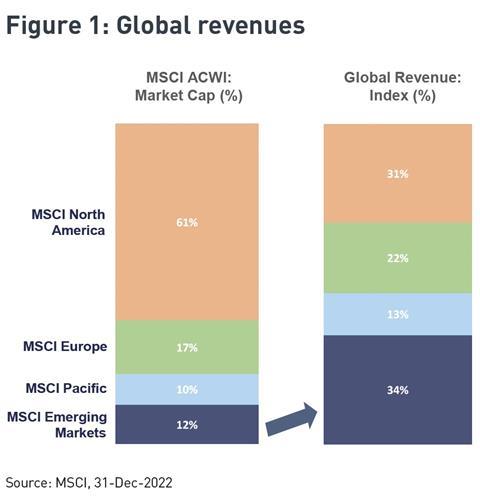

Global allocations are often framed by third partydefined weightings such as the MSCI All Country World Index.1 This market cap-based index requires investors to have a 12% EM exposure for a neutral position. Pension fund surveys suggests the sector holds a material underweight, highlighting investors’ light positioning. However, this misses a more significant point. Market cap-based approaches grossly underestimate EM’s importance. EM represents 60% of global gross domestic product GDP (based on purchasing power parity), underpinned by 88% of the world’s population. More relevantly for equity investors, as Figure 1 shows, 34% of global revenue is derived from EM, while North America is massively overrepresented in relation to the share of global revenues:

You can now read the full sponsored commentary at the link below

Supporting documents

Click link to download and view these filesFive reasons to buy emerging market equities

PDF, Size 0.15 mb