Content (6)

-

White papers

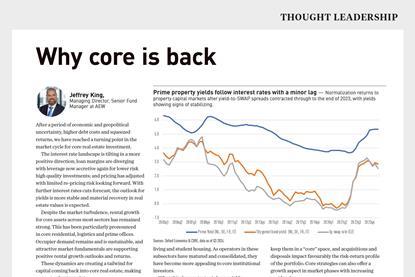

Why core is back

After a period of economic and geopolitical uncertainty, higher debt costs and squeezed returns, we have reached a turning point in the market cycle for core real estate investment. The interest rate landscape is tilting in a more positive direction; loan margins are diverging with leverage now accretive again for lower risk high quality investments; and pricing has adjusted with limited re-pricing risk looking forward. With further interest rates cuts forecast, the outlook for yields is more stable and material recovery in real estate values is expected.

-

Webinar

Global Debt Funding Gap Webcast: “Everything is Relative”

Our recent webcast “Everything is Relative” brings together AEW’s research heads from around the world to explore the global debt funding gap. The team look to explore the scale of the debt funding gap globally, and how this compares across regions. They also examine when the refinancing problems could ease.

-

White papers

European office markets starting to re-balance

This report provides an update on European office markets, which have been impacted by the concerns over the long term impact from working from home (WFH) or hybrid work practices, which is reflected in the discounts to NAV for European office REITs.

-

White papers

Real estate: why diversification is more than a buzzword

The pandemic has shown the value of a broad asset range and flexible allocation

-

White papers

Property Appreciation, Inflation and What to Expect

In a speech at the Jackson Hole summit on August 27th, Federal Reserve Chairman Powell announced new and significant changes to U.S. monetary policy, specifically with respect to the Fed’s dual mandates of full employment and price stability.

-

White papers

2020 Global Strategy Perspective

As we start the third decade of the 21st century, it is an opportune time to take stock of real estate markets around the world. Despite the aftershocks of the global financial crisis, most investors have taken advantage of real estate opportunities outside their home markets. At AEW we have been working with international investors for nearly 40 years. In this report, we share our perspective on global investment markets, considering both global trends and occupier market trends.