A global leader in active, responsible investing

Guided by our conviction that responsible investing is the best way to create long term wealth, we provide specialised capabilities across equity, fixed income and private markets, multi asset and liquidity management strategies, and world leading stewardship.

Our goals are to help people invest and retire better, to help clients achieve better risk adjusted returns and, where possible, to contribute to positive outcomes that benefit the wider world.

All activities previously carried out by Hermes Fund Managers are now undertaken by Federated Hermes Limited (or one of its subsidiaries). We still offer the same distinct investment propositions and pioneering responsible investment and stewardship services for which we are renowned in addition to important strategies from the entire group.

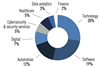

Our investment and stewardship capabilities:

- Active equities: global and regional

- Fixed income: across regions, sectors and the yield curve

- Liquidity: solutions driven by four decades of experience

- Private markets: real estate, infrastructure, private equity and debt

- Stewardship: corporate engagement, proxy voting, policy advocacy