All Europe articles – Page 4

-

White papers

White papersEuropean equities offer potential long-term growth and value

European stocks have enjoyed significant outperformance in 2025, with the regions indices comfortably outpacing other major markets.

-

White papers

White papersNuveen Real Estate Provides €350 Million Debt Financing for Premium Dutch Light Industrial Portfolio

Ten-Year Senior Loan Supports Urban Industrial’s Strategic Portfolio of 55 Assets Across the Netherlands’ Prime Randstad Region.

-

White papers

White papersWhy now is the time for European real estate debt

Our research shows that the current opportunity for investors in private real estate credit is very attractive, and alternative lenders are poised to further expand their market share in the coming years.

-

White papers

White papersYield Convergence Reshapes Portfolio Strategy

Yield differentials across asset classes have narrowed to historic lows, reshaping portfolio risk and opportunity. In this context, diversifying allocations and locking in higher fixed income yields offers a more compelling risk-reward for multi-asset investors.

-

White papers

White papersEurope’s real estate renaissance

European real estate markets are finally stepping out from the shadow of their American counterparts, as the global investment landscape undergoes a fundamental transformation. For investors, this presents a compelling opportunity to reconsider European real estate strategies, particularly value-add approaches with the potential for superior returns in an increasingly favourable environment.

-

White papers

White papersSolid foundations: The case is building for infrastructure equity

In this article Viktor Dietrich, Research Director for infrastructure, venture capital and natural capital, revisits the case for investing in European infrastructure equity. He suggests reasons why small-to-mid-sized opportunities should feature prominently on investors’ radar.

-

White papers

White papersHarnessing thematic indices to support European growth and portfolio resilience

How do you achieve long-term objectives in an environment of uncertainty without sacrificing agility? This is the question being asked by many pension funds and institutional asset managers facing persistent macroeconomic uncertainty, shifting policy dynamics and heightened market volatility. Thematic indices are a compelling solution - not merely as performance trackers, but as forward-looking allocation tools aligned with the ongoing structural transformations in Europe’s economic fabric.

-

White papers

White papersHow Factor Investing Is Changing: Three Structural Shifts

Factor investing has long been a cornerstone of systematic portfolio construction, particularly within the ETF ecosystem. In European UCITS ETFs, its relevance has grown significantly: factor ETF assets have reached over USD 80 billion and have now surpassed those in sector ETFs, signalling a structural change in investor behaviour. Still, they represent only about 5% of the overall UCITS market . A key driver behind this trend is the rise of equal-weighted investment strategies, which have become a simple and efficient tool for investors to navigate current market challenges, now accounting for roughly a quarter of all factor allocations.

-

Asset Manager News

Asset Manager NewsGenerali Real Estate and Gruppo Percassi announce the acquisition of OrioCenter, the largest shopping centre in Italy and one of the largest in Europe

The shopping centre, sold by Commerz Real, has been acquired by Generali Real Estate and Gruppo Percassi through a real estate fund in which they hold equal stakes

-

White papers

White papersLight industrial and logistics real estate in Europe: a cornerstone for diversified investment strategies

In the ever-changing European real estate landscape, light industrial properties have emerged as a strategically asset class. With their flexibility, multi-tenant structures and proximity to urban centres, these assets are a compelling addition to diversified investment portfolios. At Swiss Life Asset Managers, light industrial real estate is a key pillar of our investment strategy, alongside logistics, life sciences and living – the 4L strategy, underscoring its long-term relevance and performance potential.

-

White papers

White papersEuropean Commercial Real Estate Market Overview

Europe’s commercial real estate market is entering an early recovery phase, supported by easing inflation, potential monetary policy shifts, and growing investor interest in resilient sectors such as logistics and residential.

-

White papers

White papersLaSalle’s European Cities Growth Index 2025

This year marks the 25th edition of the European Cities Growth Index, where we rank Europe’s cities on expected real estate demand growth, incorporating new factors on defence, climate, and energy in this edition.

-

White papers

White papersKey considerations for investors in European real estate debt

There are a number of considerations institutional investors should bear in mind when selecting investments and structuring European real estate loan positions, including market dynamics, sponsor quality, asset fundamentals and investment structuring. Many of these can impact the risk and return dynamics and must be factored into thoughtful portfolio construction.

-

White papers

White papersEuropean High Yield: A Compelling Case in an Uncertain World

European high yield has been resilient during periods of lower growth. And, looking forward, we believe there are several key reasons why the asset class remains well-positioned, despite the unknowns on the horizon.

-

White papers

White papersECB strategy review: The investment implications

A cursory glance at the European Central Bank’s (ECB) 2025 monetary policy strategy assessment shows no major changes to its last review four years earlier – something which should, in the main, comfort investors. However, a deeper dive into the document and the surrounding macroeconomic backdrop reveals it to be - in our view at least - an ECB strategy policy overhaul, rather than a technical fine-tuning exercise.

-

White papers

White papersDivergence calls for diversification: Asia’s investors look to Europe

Over more than a decade, many Asian countries have looked beyond their own borders for long-term investment opportunities, with significant amounts of capital being directed towards the US. This year we note that Asian investors are increasingly aiming at rebalancing their portfolios, with European assets deemed as an attractive alternative.

-

Asset Manager News

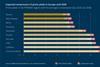

Asset Manager NewsGARBE PYRAMID MAP: Prime Yields of European Logistics Real Estate Show Stable Trend

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030.

-

White papers

White papersMacro brief: What to expect next from the European Central Bank

Greater-than-expected economic resilience in Europe has led our Capital Strategy Research (CSR) team to revise expectations around the European Central Bank (ECB) in the short term.

-

Asset Manager News

Asset Manager NewsNTR completes on an initial €65 Million Financing Deal with Rabobank and Siemens Financial Services

Funding will enable the construction phase of Irish ready-to-build solar and BESS co-location portfolio for the L&G NTR Clean Power (Europe) III Fund

-

White papers

White papersThe factors driving Eurozone investment potential to the next level

The world is changing, and investors need to have a clear view of how, and what that means for Europe.