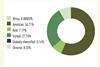

GLP Capital Partners is a leading alternative asset manager with approximately $79 billion AUM across 46 real asset and private equity strategies spanning logistics real estate, digital infrastructure and renewable energy. We invest in high-growth high-resilience new economy sectors where our differentiated market insights, operating scale and deep sector expertise provide a strong competitive advantage.

We are one of the largest investment managers for logistics assets in Asia and strategically invest across the entire risk spectrum, encompassing development, value-add and income generating opportunities. Leveraging our heritage in logistics, we have diversified into adjacent strategies including digital infrastructure and renewable energy and private equity.

With a deep understanding of global public and private capital markets and a track record of growth at scale, our global and diverse investor base continues to grow in tandem with our product offerings, demonstrating confidence in our ability to invest in and manage highquality assets across multiple asset classes.

Investment principles & strategy

We invest thematically in high-potential, resilient sectors of the new economy including logistics, digital infrastructure, renewable energy and adjacent technologies through both real asset and private equity strategies. Within our real asset strategies, we invest across the risk spectrum from development, value-add to income opportunities. For our private equity strategies, we focus on growth equity and venture capital opportunities.

Logistics –

As a core pillar of the global economy, we believe in the longterm growth potential of the logistics supply chain sector, underpinned by sustained growth in e-commerce. Our vertically integrated platform provides differentiated access to investment opportunities and operational perspectives which sharpen our investment decisions. Our in-house teams provide a full spectrum of value-added services across the logistics value chain - from development, construction and leasing to property and supply chain management. We focus on enhancing the value of our assets by enhancing operational efficiency through technological investments and innovation. As a comprehensive logistics solutions provider, we are the partner of choice for customers and investors alike.

Digital Infrastructure -

The growth of the digital economy and the rise of artificial intelligence and cloud computing are creating unprecedented demand for data centers, driven by trends such as increased enterprise adoption, data consumption and processing requirements. GLP is a fast-growing provider of digital infrastructure solutions, with a full-service data center platform in China with 1,400 MW of IT power in operation and under construction, and a 1 GW portfolio of powered data center sites across Japan, Europe and Brazil. Our strong in-house land sourcing and development expertise provides us an edge in securing strategically located powered sites suitable for data center development. Our flexible designs accommodate both AI-oriented and traditional cloud workloads, meeting the needs of both hyperscale and enterprise customers.

Energy Transition – Investors and customers are prioritizing clean sources of energy to decarbonize their supply chain. Through real asset and private equity investments, we offer a spectrum of renewable energy solutions with over 900MW of capacity under management across distributed solar, ground mounted solar, wind and battery storage solutions. Our teams provide end-to-end capabilities across the energy transition value chain, from land sourcing to project development as well as the operation and maintenance of renewable energy infrastructure assets. As part of our ecosystem offerings, we provide customers in logistics and data centers access to clean energy solutions, improving the energy efficiency and sustainability of projects in operation.

Our connectivity and local market knowledge provide us considerable insight into our focused asset classes, enabling us to make better investment decisions to build scaled platforms using our combined investment expertise and operational resources. We leverage our unique market position and industry insights as a leading logistics real estate investor to source and execute proprietary investments, allowing us to capitalize on ecosystems which serve to directly inform and enhance fund and asset-level performance.

Our unique investor-operator model allows it to recognize new economy sectors and trends early in their growth cycle. By developing expertise and credibility in growing sectors early, we believe we are able to identify high-quality investment and business opportunities. We have achieved a long track record of success with this approach across multiple strategies, sectors and geographies.