Ravi S. Anand, Portfolio Manager and Head of Private Real Estate Credit; Zeyu “Chen” Chen, Portfolio Manager, Commercial Real Estate Debt; Sonali Wilson, Lead Investment Director – Private Credit

Commercial real estate (CRE) has long been established as a cornerstone asset within a wide range of investors’ portfolios. From individuals owning a US$250K rental home to institutions owning a US$250M high-rise apartment complex, CRE can offer diversification, consistent cash flows, a hedge on inflation, and a historically low correlation to other risk assets.

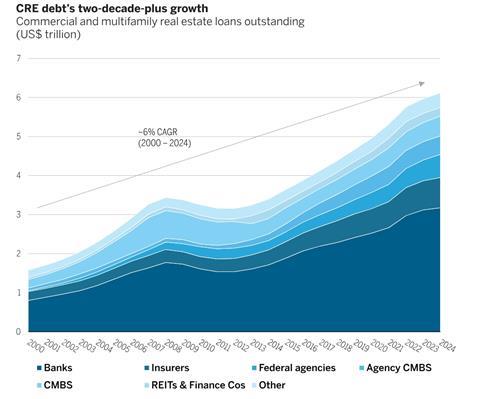

Notably, there’s a growing focus on CRE debt, in particular, as asset owners increasingly realize it provides the same fundamental advantages as CRE equity but with stronger downside mitigation potential and much lower historical volatility. With over US$6T in assets, CRE debt has grown at a 6% CAGR since the early 2000s (Figure 1).

At the same time, today’s volatility, higher-for-longer rate environment, and growing market uncertainty have caused many asset owners to re-underwrite their private-market allocations. In this piece, we share an update on the CRE debt market and why we believe it continues to be a pillar of private credit allocations with distinct tailwinds.

Figure 1: CRE debt’s two-decade-plus growth

Source: Federal Reserve. Includes mortgages backed by commercial real estate and multifamily properties, as well as ABS collateralized properties. Chart data: 1 October 1945 – 1 October 2024.

A compelling backdrop for CRE debt

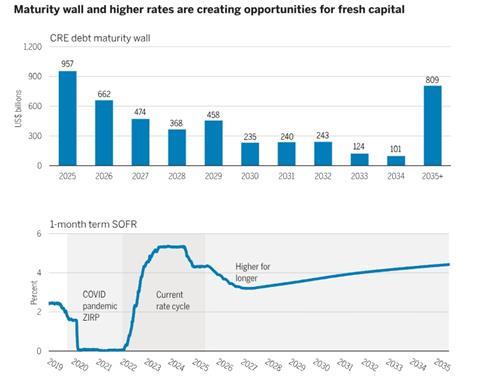

We expect CRE debt’s growth to persist with continued demand for debt from borrowers in today’s higher-for-longer rate environment. This is particularly true, in our view, due to the approximately US$2+ trillion maturity wall in the next three years driving consistent demand for debt (Figure 2). This dynamic creates a substantial opportunity for private capital to step in and take market share by playing a part in the recapitalization of assets.

Top chart: Mortgage Bankers Association, “Commercial/Multifamily Loan Maturity Volumes 2024” report. Data as of 31 December 2024.

Bottom chart: Wellington analysis of data from Bloomberg and Chatham. | PAST RESULTS DO NOT PREDICT FUTURE RETURNS. | Data is that of a third party. While data is believed to be reliable, no assurance is being provided as to its accuracy or completeness. Information provided as of the date noted.

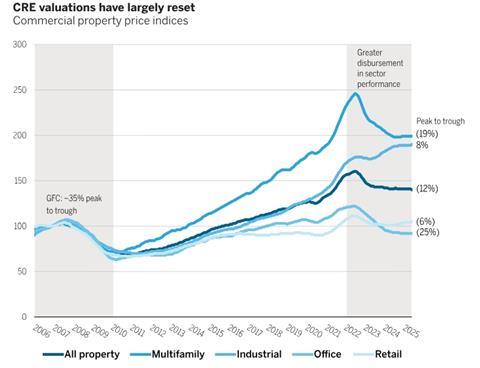

The real estate market has also experienced a reset in valuations (Figure 3). During the global financial crisis (GFC), the majority of sectors moved in tandem and average property prices dropped 35%. Today’s cycle is different with sector performance widely disbursed, leading to a less severe average valuation decline of 12%. Critically, we believe the market is in the process of bottoming (and has bottomed for some property sectors). In our view, today’s reset valuations bode well for lenders deploying capital at lower bases with stabilized values skewing to the upside.

Figure 3: CRE valuations have largely reset

Source: MSCI. Data as of 1 June 2025.

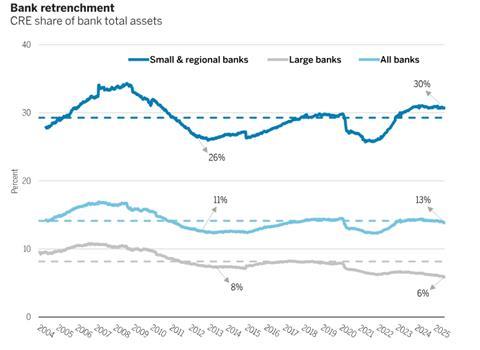

In addition, we believe the ongoing secular shift of bank retrenchment will likely continue to benefit private lenders. CRE lenders historically have spanned a wide array including banks, insurance companies, government agencies, structured product investors, REITS, and private funds all offering capital. But since the GFC, the willingness and ability for traditional lenders to extend credit has faced noneconomic, exogenous challenges. These include, but are not limited to, the regulatory environment, market liquidity, and sizing/credit underwriting constraints.

As these traditional lenders continue to reallocate and rebalance their exposure to CRE, they are both originating fewer loans and shifting to higher parts of the capital stack. This ongoing adjustment creates an enduring supply/demand imbalance (Figure 4). When coupled with generally sound fundamentals for most sectors, we believe this dynamic creates a compelling opportunity for private credit to help fill the gap.

Figure 4: Bank retrenchment

Source: Newmark, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis. Data as of 16 July 2025.

CRE debt and private credit 2.0

Commercial real estate debt is just one example of the rapid growth of private credit 2.0. Many credit markets are seeing private capital step into a more substantive role in providing credit capacity. This is, in large part, because private capital increasingly can offer greater consistency, flexibility, and reliability to borrowers in today’s uncertain environment.

Managers of private capital like CRE debt can also gain stronger structure and covenants compared to traditional lenders. In addition, we believe managers with a history of holding risk through cycles and a strong reputation with borrowers should be better positioned to drive returns and avoid adverse selection in volatile markets. Critically, traditional lenders (regional banks, insurance companies, etc.) will, in our view, remain highly relevant in these markets but are more likely to partner with private lenders — and, most significantly, with trusted partners.

Bottom line on private CRE debt

Today’s outlook for real estate is mixed, varying by market and asset class. But in a higher-for-longer interest-rate environment with bottoming valuations, we believe business plans may need to be adjusted, and delays will probably persist. As a result, borrowers likely need to reassess their capitalization and reimagine the highest and best use of their assets. We believe this should lead to a continued supply-and-demand imbalance for debt. In our view, private lenders are likely to take market share, and it will be crucial in this market for them to have deep capabilities in sourcing, structuring, underwriting, and actively managing with a bottoms-up approach and a risk-holder lens.