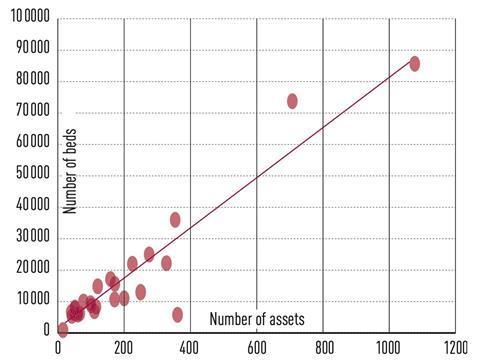

The European healthcare sector remains increasingly popular: being more defensive thanks to its long-term demographic drivers, the healthcare sector has always been a meaningful and defensive diversifier in a multi-asset portfolio. Despite a combination of headwinds related to rising interest rates and some operator’s issues, capital value dynamics have diverged across countries and subsectors of health and care. According to MSCI data, portfolios usually comprising large assets like nursing homes had to deal with a high concentration risk: these were often managed by listed operators, more vulnerable to volatility as triggered in 2021. Conversely, highly diversified portfolios regarding of countries, health and care sectors, as well as non-listed operators, have demonstrated stronger resilience in terms of capital value dynamics and net operating income growth.

Operators in Europe

In 2024, the healthcare sector accounted for 2.2% of total investment volumes (€189bn, +4% compared to 2023) in Europe in line with its long-term average. In 2024, investors with in-depth knowledge of the entire value chain in the healthcare sector maintained an active strategy in order to benefit from the opportunities generated by highly leveraged sellers or funds facing redemptions. The strong track record of investors, capable of ensuring adequate supply will continue to deliver sustainable income streams over time as long as structural changes in demographics, technology and climate transition are part of the overall performance equation.

Read the full ‘Sponsored Commentary’ now at the link below

Supporting documents

Click link to download and view these filesManaging health and care for sustainable performance

PDF, Size 0.12 mb