Content (26)

-

Video

Webinar replay: Healthcare real estate surge

Watch the webinar replay of Nuveen Real Estate’s Bill Abramowitz, Portfolio Manager, Healthcare and Alternatives Strategy and NexCore’s CIO Michael Ray, as they discuss how the surge of Americans entering retirement age is driving the demand for healthcare oriented real estate, including senior living and medical outpatient facilities.

-

White papers

Growing U.S. healthcare demand creates real estate opportunity

Why medical outpatient buildings deserve your attention now

-

Asset Manager News

Nuveen Real Estate Raises $320 Million for U.S. Cities Retail Fund

Capital to be deployed in grocery-anchored, necessity-based retail across top U.S. neighborhoods

-

Asset Manager News

U.S. apartment investment opportunities expected to remain robust amidst sector recovery

The U.S. apartment sector is well-positioned to capitalize on shifting sector dynamics, creating potentially long-term opportunities within the market. Below, we examine what factors are driving these changing conditions, and where investors may find value.

-

Webinar

Webinar replay: The concrete fundamentals of light industrial

Register to watch the webinar replay of Nuveen Real Estate’s Global Head of Industrial, Gray Bouchillon, and Managing Director, Real Estate Specialist, Sayuri Khandavilli for an in-depth discussion on the evolving dynamics of industrial real estate and the opportunities on the horizon. This session delves into key factors shaping the sector including the rapid growth of e-commerce, the impact of dwindling light industrial supply, the increasing significance of re-shoring and near shoring initiatives and how to effectively leverage current market distress.

-

Asset Manager News

CalPERS expands commitment to Nuveen real estate with an additional $400 million allocation

With $500 Million Total Allocation from CalPERS, Nuveen Underscores Commitment to Preserve Affordable Housing and Build Resilient Communities

-

White papers

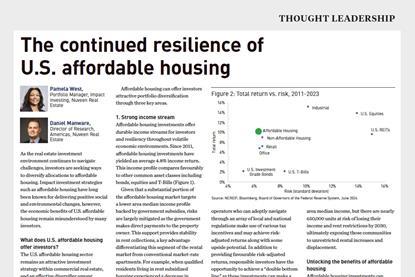

The continued resilience of U.S. affordable housing

As the real estate investment environment continues to navigate challenges, investors are seeking ways to diversify allocations to affordable housing. Impact investment strategies such as affordable housing have long been known for delivering positive social and environmental changes, however, the economic benefits of U.S. affordable housing remain misunderstood by many investors.

-

White papers

Medical outpatient buildings are well-positioned to outperform

Private commercial real estate continues to mature and evolve. In recent years, investors increased exposure to alternative sub-sectors within the asset class that offer unique demand drivers and the potential to outperform core real estate sectors. Healthcare real estate, which includes a diverse set of sub-types including medical outpatient buildings (MOBs) has quickly gained investor interest and for good reason.

-

White papers

2024 U.S. Affordable Housing Impact Report

At Nuveen Real Estate, we recognise that the shortage of affordable housing options is a prevalent issue and significant market opportunity. We are committed to investing to preserve affordability, improve housing quality and sustainability, and enhance resident well-being in assets across the globe with dedicated affordable housing impact investments in the U.S.

-

Webinar

Webinar replay : The evolution of convenience culture and property markets

Register to watch the webinar replay of Nuveen Real Estate’s Head of U.S. Retail and Mixed-Use, Katie Grissom, on the discussion of the retail comeback, how consumers are shaping the future of retail and the resilience of property fundamentals with moderator Wendy Pryce, Lead U.S. Real Estate Specialist.

-

White papers

Impact investing: The continued resilience of U.S. affordable housing investments

As the investment environment in real estate continues to navigate challenges, investors are seeking ways to diversify allocations to affordable housing. Impact investment strategies such as affordable housing have long been known for delivering positive social and environmental changes, however, the economic benefits of U.S. affordable housing remain misunderstood by many investors.

-

Asset Manager News

Nuveen Secures CalPERS Funding to Preserve Affordable Housing and Build Resilient Communities

Allocating $100 Million to the Nuveen Real Estate U.S. Affordable Housing Strategy