The European sale-leaseback (“SLB”) market is a large,yet relatively untapped market, that has the potential to offer the kind of stable, inflation-linked returns that may appeal to institutional investors in today’s uncertain environment.

Moreover, Clarion Partners believes that the ongoing dislocation in the European corporate credit market could drive an increase in SLBs as corporates look at alternative forms of financing; for the following reasons:

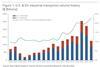

- Historically tight lending standards: The cost of borrowing for non-financial corporations in the Euro area is at a 15- year high and increasingly risk-averse European banks have considerably tightened their lending standards over the last 9-12 months. Figure 1 implies a correlation between lending standards and the actual growth in corporate loans and points to a further slowdown in the flow of credit to Euro area firms going forward.

You can now read the full thought leadership at the link below