Content (9)

-

White papers

Modern Logistics In Europe: A Timely Opportunity For Institutional Capital

As the new European real estate cycle takes shape, we continue to see logistics as one of the more attractive investment propositions, underpinned by three pillars:

-

White papers

The Appeal Of European Net Lease To Non-European Investors

The global uncertainty created by U.S. tariff policy has unsettled financial markets and has cast a shadow on economic growth prospects. While the situation remains fluid with many moving parts, we believe that a corner of stability may be found in European commercial real estate, which has significantly repriced since market peaks in 2022, and where market fundamentals remain solid and macro–drivers broadly supportive. Defensive, income-oriented strategies – such as European Net Lease – can be especially interesting for non–European investors seeking stability, yield, and geographic diversification. This report sets out the rationale for that conviction.

-

White papers

Sustainability In European Logistics Real Estate

Sustainability has become an increasingly significant consideration in European real estate investing and asset management. This shift results from investors’ sustainability targets and growing pressures from occupiers, set against a backdrop of tightening European regulations aimed at decarbonising the built environment. These factors are accelerating key trends across all property types, including logistics.

-

White papers

To maximise the new cycle, investors should target modern logistics

2024 was a transitional year for European logistics, with capital markets showing early signs of recovery, while the occupational market remained relatively sluggish. With demand conditions stabilizing, we believe 2025 is an inflection year offering a potentially compelling entry point into a new cycle.

-

White papers

European Sale-Leaseback: A Timely, Strategic Opportunity in Europe

This paper, the third in our series, explores why European Sale and Leaseback (SLB) investments are especially compelling at this point in the economic cycle. With appealing day-one income yields, a strong deal pipeline, and a favourable macroeconomic environment, we believe European SLBs offer an attractive opportunity for investors.

-

White papers

European Logistics: Why Now

Why European Logistics? During the previous property cycle, the European logistics sector emerged as a standout performer, driven by robust fundamentals and enduring demand trends.

-

White papers

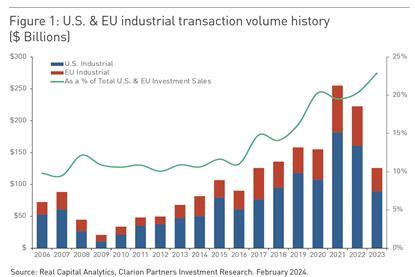

The case for U.S. & EU industrial real estate

The industrial sector has become a global favorite amongst institutional investors as large structural shifts already underway accelerated during the pandemic.

-

White papers

Impact of Rising Inflation on European Logistics Real Estate: Q3 2022

RECORD HIGH INFLATION IN THE EUROZONE: Europe, much like other parts of the world, is grappling with inflation levels not seen since the oil shocks of the 70s.

-

White papers

The Impact Of Rising Inflation On European Logistics Real Estate

Europe, much like other parts of the world, is grappling with inflation levels not seen since the oil shocks in the 70s. In August 2022, inflation in the Eurozone reached 9.1%, up from 8.9% in July 2022 and 3.0% in August 2021.1 Core inflation, a closely watched indicator for price stability, edged higher to 4.3% in August 2022, up from 4.0% in July 2022.