Content (23)

-

White papers

Global real estate perspectives: repricing and opportunity across cycles

In an era of repricing and tighter liquidity, BGO Co-Presidents, Amy Price and Toby Phelps, discuss how market dynamics across North America and Europe are shaping the next chapter of real estate investment.

-

White papers

How AI and data modeling give real estate investment professionals a new superpower

In the spring of 2020, Las Vegas was a ghost town. With the COVID-19 pandemic in full swing, casinos and restaurants were shut down, sending the city’s unemployment rate soaring to the highest in the nation.

-

White papers

Private markets and the data revolution: Challenges, solutions, and the future with AI

To conclude our 2024 Private Markets Study series, we gathered a panel of industry specialists from the financial services and technology sectors to analyze how LPs and GPs are tackling data challenges, evolving their strategies, and leveraging AI to transform private markets.

-

White papers

The cold storage sector comes with challenges but offers valuable opportunities

The future of cold storage is bright, as increasing global demand for fresh and frozen food products place this asset class in an irreplaceable position on the global supply chain. In an interview with IREI, Jonathan Epstein, managing partner at BGO, discussed the outlook for cold storage, barriers to entering its market, and suggestions on investing in this emerging sector.

-

White papers

In Plain Sight: The Core Plus real estate investment opportunity that every investor should know about

In today’s commercial real estate environment, a new paradigm is reshaping the way BGO is approaching the market. Structural shifts in capital flows, transformative demographic trends, and evolving tenant behaviors are driving waves of change that have further strengthened our resolve and the rationale for Core Plus investing. We are in a higher cost of capital world, not only with interest rates but also with insurance costs and operating environments. Further, secular shifts have changed the way the built environment is utilized globally.

-

White papers

Women in CRE: Amy Price

When a door opens, “charge through it,” says the president of BGO.

-

White papers

BGO Co-CEO John Carrafiell On Using Data to Nail Real Estate Investment

BGO Co-CEO John Carrafiell On Using Data to Nail Real Estate Investment

-

White papers

BGO raises €1.38bn for third Europe Secured Lending fund

Global real estate investment firm BGO has closed its third Europe Secured Lending fund with €1.38bn (£1.18bn) in commitments from 40 institutional investors. The fund surpassed its initial target of €1.35bn. This is BGO’s third fund for its Europe Secured Lending business and is a complement to its UK Secured Lending strategy, which raised £1.43bn for its third fund at the end of 2023.

-

White papers

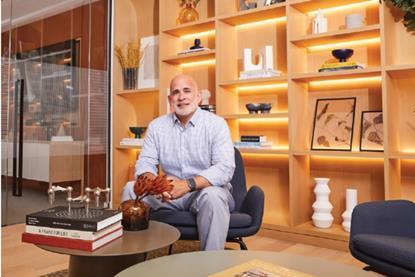

Dara to Know

Dara Friedman is on the defensive, and that’s intentional. BGO’s Core Plus manager talks about fighting back against market uncertainty.

-

White papers

BGO’s Rob Naso On the Landlord’s New Move-In-Ready Office Model

BGO’s Rob Naso On the Landlord’s New Move-In-Ready Office Model. The company’s rolling out the new Move-In-Ready Office model in New York, Boston, Chicago and other cities to attract tenants that might be uncertain about their office needs.

-

White papers

The Rising Demand for Healthy Buildings

Lest we needed a reminder, the pandemic we are all living through has made clear the ways in which buildings contribute to our well-being—from providing workplaces that are safe, having comfortable and functional spaces to shelter in place, and in serving society’s most acute health and welfare needs.