Latest Manager Research – Page 237

-

White papers

White papersCapital with purpose – impact investing in listed equities

Faced with complex global issues like climate change the definition of impact investing needs to expand. Our Global ESG Equities Team argue the case for making a positive difference through investment in public equities.

-

White papers

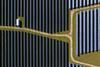

White papersThe ups and downs of elevator maintenance

Elevator maintenance can be costly and disruptive. Predictive maintenance using artificial intelligence can provide a less expensive, more responsive lift maintenance service. The approach can be applied across many asset services.

-

White papers

White papersReal Asset Insight May/June, Sustainable transition

Up to now, sustainability has hardly been an issue when acquiring or leasing a logistics property. That is now changing – which poses a number of challenges for the real estate sector.

-

White papers

White papersReal Deal Interview: Matt Scholl

“The sector is an ideal and timely diversifier to our sizable US Portfolio” - Matthew Scholl, Executive Director and Head of Investment Management Americas at Union Investment, regarding the attractiveness of the US Multifamily market.

-

White papers

White papersWhere Will Job Markets Be Tightest?

Waiting for the U.S. Labor Force Participation Rate to rebound? Demographic trends and the graying population will likely make a full return difficult to achieve.

-

White papers

White papersThe Bull Case for Next Year: It Won’t be Worse Than This Year

It’s not a pretty outlook, but it’s important to keep thinking at least one or two moves ahead.

-

White papers

White papersECB meeting: bold rate hike; watch out for more to come

What is your take on the September ECB meeting and what could the next steps be?

-

White papers

White papersReassessing the view on Europe: hot questions for investors

Is stagflation a highly likely scenario, or will the European economy enter a recession this year? How will governments respond?

-

White papers

White papersThe challenges that lie ahead - can investing in infrastructure help?

Particularly during the height of the pandemic and ensuing lockdowns, infrastructure debt proved to be resilient as an asset class. Despite lockdowns shutting down businesses and many aspects of society, specific sectors such as renewables, telecommunications and utilities continued to perform through the provision of essential services.

-

White papers

White papersInsights into private markets (IPM)

Insights into Private Markets (IPM) is our next generation Real Estate Outlook (REO). IPM uncovers key insights across real estate, infrastructure, food & agriculture, private equity and private credit.

-

White papers

White papersMacroeconomic Picture - September 2022

United States: The H1 contraction will be followed by a protracted period of sub-par growth, but the ongoing deceleration is so far not yet due to Fed tightening; cracks are appearing in an apparently strong labour market, and we expect the lack of productivity to cause a labour market correction.

-

White papers

White papersMarket Scenarios and Risks - September 2022

We have reviewed the content and probabilities of our scenarios. First of all, we have included in our central scenario some of the risks that are materialising (e.g. stagflation in Europe) and that were previously included in our downside scenario.

-

White papers

White papersLatAm elections cycles wrapping up: politics and policy transitions in full swing of uncertainty

LatAm’s dramatic elections calendar that landed three leftist presidents in the Andean region might be two-thirds over, but the political and policy uncertainty created by these election results is far from it. Chile and Colombia are expanding the size and role of the state, while intense political and macro conditions have forced yet another and a big-time government reshuffle in Peru and Argentina, respectively.

-

White papers

White papersTaiwan: depicting the unthinkable

Russia’s recent invasion of Ukraine has focused investors’ minds on the Taiwan issue and the People’s Republic of China’s potential approach to it. We believe that the risk of war remains low.

-

White papers

White papersQ2 earnings season – strong results helped support the summer rally

The Q2 earnings season was again stronger than expected and contributed to the equity market rally up to mid-August. However, the results are of ‘low quality’ and are not a reason to turn bullish on equities. Ultimately, margins coming down from very high levels should drive the earnings downturn in our view.

-

White papers

White papersRational inattention at the core of central bank strategy

The origins of inflation are not always well understood. While some economists had warned of impending inflation as early as last year, few had anticipated the dramatic shift in spending from services to goods and the effects of such a shift. The fact that inflation expectations remain subdued is likely due to rational inattention. In the absence of monetary tightening, we believe that inflation expectations would inevitably get de-anchored.

-

White papers

White papersThe Climate Has Changed for Infrastructure

Following a year of starkly revealed vulnerabilities in water, energy and supply-chain assets, some game-changing legislation suggests that governments are finally getting serious about infrastructure investment.

-

White papers

White papersHow can investors aid pandemic resilience?

Covid-19 taught us important lessons on pandemic preparedness. How can we plan for the future, and how can investors help bolster resilience against future pathogens? Alexander Bernhardt and Delphine Riou explore.

-

White papers

White papersMunicipal bond sectors: resilient in times of uncertainty

Many investors are concerned about the potential for a prolonged economic downturn. If that were to happen, municipal credit should show resilience, due to unprecedented federal pandemic stimulus support, strong reserves and revenue collections, and the ability to adjust budgets.

-

White papers

White papersPortfolio Diversification Is Key To Weathering the Storm

In this Q&A, Ian Fowler discusses the benefits diversification and warns against an over-reliance on upper mid-market deals.