Equities – Page 20

-

White papers

White papersEmerging-Market Stocks: Great Businesses Hide in a Murky Market Landscape

Sour sentiment toward emerging-market stocks is obscuring uncommon opportunities for equity investors.

-

White papers

White papersTrade Wars and Tariffs Test Equity Investing Research

How can global equity investors incorporate the impact of tariffs into fundamental analysis of companies?

-

White papers

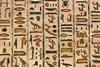

White papersA New Frontier for Equity Investors: The Middle East Transformation

Investors in emerging-market equities haven’t typically paid much attention to the Middle East. It’s time to take a closer look.

-

White papers

White papersCalculated Risk Management: Strategy, Tools and Culture for Equity Portfolios

Investors need a better grasp of risk-management tools to gauge a portfolio’s strategic resilience in a rapidly changing world.

-

White papers

White papersSpotting Hidden Extension Risk in Corporate Hybrids

Failure to call a hybrid at the first opportunity is rare but, if realised, can be negative for investors—can we identify the telltale signs of heightened risk?

-

White papers

White papersEuropean Industrials: A Hotbed of Growth for Equity Investors

Today’s industrial business models offer surprising sources of consistent earnings growth.

-

White papers

White papersChina: The Comeback Kid?

Whisper it quietly but, after years of negative sentiment, equities in China appear to finally be holding their ground. Our Asia ex-Japan Equity team ask: what could sustain the recovery from here?

-

White papers

White papersUS consumer shows confidence

“Concerns over US economic growth persist, and this highlights the importance of a global approach to investing in the developed and emerging markets.”

-

White papers

White papersValue Stocks: Cracking the Quality Code

Today’s value stocks offer a magnificent mix of quality, forward-looking profitable firms.

-

White papers

White papersEquity rally shifts to Emerging Markets

“Emerging markets offer opportunities in regions such as Asia, led by strong economic growth, domestic demand and favourable geopolitics.”

-

White papers

White papersThree investment ideas from earnings season

Quarterly earnings for most companies in the S&P 500 Index have exceeded expectations. Businesses continue to cut costs, pass on price increases to consumers and find new areas of growth.

-

White papers

White papersPositives for Europe, but the Middle East could be a headache

Inflation is a stubborn problem in the US due to labour shortages, but this is much less of a factor in Europe where activity is dull but likely to recover as the consumer is well supported.

-

White papers

White papersDo We Now Need to Worry About Stagflation?

We believe high nominal growth, peak rates and broadening earnings performance continue to underpin equity market performance.

-

White papers

White papersPEI Secondaries Roundtable: Private Markets’ Most Undercapitalized Asset Class

In a roundtable conducted by PEI, Ben Perl and other market leaders discuss the growth potential and opportunity set within the secondaries space, while also commenting on the issue of limited liquid capital available.

-

White papers

White papersJapan’s corporate transformation fuels renewed optimism

After a 34-year wait Japan’s stock market has reached a new record high, driven by optimism about corporate governance changes and attractive valuations. Following a stellar rally over the past year, Carl Vine, Co-Head of Asia Pacific Equities, believes there are further chapters to come in the Japanese equity story and the ongoing transformation of corporate culture offers potential opportunities for patient, engaged investors.

-

White papers

White papersEmerging markets are gaining interest

“In the search for equity opportunities, Emerging Markets may offer appealing valuations and exposure to long-term growth opportunities.”

-

White papers

White papersClimate investing is an opportunity for Emerging Markets

Climate pathways are integral to economic and market expectations, and investors must increasingly focus their attention on the impact of the energy and climate transitions, particularly in Emerging Markets (EM). Last year’s record-breaking temperatures were a stark reminder that the global economic landscape is undergoing profound shifts; 2023 was the hottest year on record, with average temperatures exceeding 1.5°C of warming above pre-industrial levels.

-

White papers

White papersYour Questions Answered: Global Emerging Markets

In the latest in our ‘Your Questions Answered’ series, Chris Clube, Co-Portfolio Manager on the GEMs strategy, discusses the team’s definition of a ‘quality’ company, their view on investing in Chinese equities and whether the India growth story is overhyped.

-

White papers

White papersKorea discount: a dream deferred?

South Korean authorities are looking at a number of measures to address the ‘Korea discount’. Most won’t work, says Jonathan Pines, Lead Portfolio Manager, Asia ex-Japan Equity.

-

White papers

White papersCausality Approach Applied to Clean-Tech Equities

The clean-tech industry has experienced remarkable growth, bringing forth groundbreaking technologies and sustainable solutions. This research article delves into the examination of factors that shape the evaluation of net-zero assets in various sectors and themes.