Corporate overview

M&G Investments is one of the world’s largest real estate investment managers1, with over $50 billion2 of real estate debt and equity investments under management globally, across 13 offices.

Our real estate platform is built on scale, tried and tested strategies and robust research, providing global exposure through local experts.

Investing on behalf of Prudential Insurance for generations, we have the strength of capital to back our investment convictions though scalable strategies and meaningful co-investments.

With the breadth of capabilities to pursue relative value through market cycles and across the capital stack, we are seek to add value through a commitment to cycle resilience.

Decades of experience in buying, selling and managing properties has shaped our investment approach, which focuses on identifying fundamentally well located assets that are underpinned by favourable structural and demographic trends. Access to new opportunities and the ability to offer a range of innovative solutions spanning the full risk spectrum, is supported by our scale, experience, depth of knowledge and strong industry relationships in the markets where we operate.

Across our global portfolio, we take an intentional approach to sustainability, with 90% of assets submitted in the GRESB 2024 Real Estate Assessment awarded a 4 Star rating or above3.

1 IPE Top 150 Real Estate Investment Managers 2024’.

2 M&G as at Q2 2025.

3 GRESB 2024 Real Estate Assessment results. GRESB ratings should not be taken as a recommendation. Find out more about GRESB rating methodology here : https://www.gresb.com/wp-content/uploads/ resources-gresb-real-estate-methodology.pdf

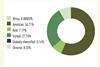

Sector forecasts

LOGISTICS: Occupier markets in the logistics sector have now clearly recalibrated from the era of exceptional growth recorded in the pandemic-fuelled boom years. Demand in 2024 has consolidated to more typical levels, resulting in a slight uptick in vacancy rates. With occupiers are now able to display increased selectivity, factors such as location within core distribution hubs and asset specification – particularly in relation to ESG credentials – are poised to become more significant determinants of outperformance. That said, supply remains relatively tight by historical standards, supported by a significantly reduced development pipeline. Moreover, the sector continues to benefit from structural tailwinds including e-commerce growth, occupier supply chain optimisation and forecast growth in specialised manufacturing. Rental growth prospects remain robust as a consequence, with strong investor demand in the sector expected to persist.

OFFICE: European office markets are expected to benefit from improved leasing momentum moving forward, although the occupier preference for well located, high-quality and sustainable space will drive continued bifurcation in the market. Despite weak sentiment towards the sector, supply of prime space remains relatively tight, particularly in major European CBDs. This segment of the market benefits from more resilient rental growth expectations which in turn is likely to underpin a recovery in investor demand. In contrast, weaker assets face mounting challenges from both an occupational perspective and from obsolescence risk. The proportionally high cost of associated capex requirements for retrofitting non- ESG compliant office buildings will remain a major factor dampening investor demand for this type of asset. At present, secondary offices represent one of the few segments of the European real estate market where there is significant remaining downside risk from a yield perspective.

RESIDENTIAL: Across Europe, the living sectors continue to show occupational strength, fuelling strong investor interest. While rental growth is set to moderate from the heightened levels recorded during the pandemic, this is primarily a function of affordability concerns. With markets characterised by structural undersupply in the face of robust occupational demand, these markets are set to face ongoing upward rental pressure. Tenant demand in the private rental sector remains supported by stretched house price affordability and is set to outpace growth in housing stock in markets across Europe. Similar pressures exist within other segments of the living sector, notably purpose-built student accommodation (PBSA), which is witnessing growth in unmet demand, driven by increasing international student enrolment. PBSA presents a significant growth opportunity for investors, particularly in southern European markets where it remains a relatively nascent institutional asset class.

RETAIL: Prospects in the retail sector have improved over 2024, as retail sales are now showing tentative signs of growth, supported by rising real wages and improving consumer sentiment. Occupier markets are showing signs of stabilisation and recovery following the dramatic structural adjustment witnessed in recent years. Footfall for many types of asset and markets is recovering beyond pre-pandemic levels and vacancy rates have been falling for a number of quarters, stimulating some modest rental growth. That said, the sector is subject to a high degree of variance across different asset types. Pockets of best performance are likely to found in prime high street locations in attractive tourist cities and dominant retail warehouse parks which have a diverse tenant base and omni-channel consolidation opportunities. Shopping centres continue to struggle with higher vacancy rates in all but the highest quality assets.

Investment principles & strategy

Our investment philosophy and approach is built around the needs of longterm, income-focused capital and is shaped by decades of experience managing the assets of insurance companies and pension funds, which make up over 90% of our AUM. Investment decisions are informed by proprietary forecasts and market insight from an experienced global research team.

We believe that:

- Income is the primary driver of long-term returns. We target and proactively manage assets which can generate sustainable, growing income streams.

- A balanced portfolio diversified by geography and asset type enhances risk adjusted returns over the long term.

- Real estate markets are inefficient. Using proprietary research and financial models, we identify and exploit mispricing at asset class, real estate sector and individual asset levels.

We aim to provide commercial real estate mortgages to borrowers secured against a range of different investments, including income producing, transitional and development assets.

Moreover, we are strongly focused on self-originating debt that allows us to achieve attractive risk-adjusted returns through:

- Origination – direct origination of loans to maximise negotiating power.

- One-stop shop – reduce execution risk. Provide senior and junior debt in a single whole loan solution.

- Hold-to-maturity – a buy-and-hold investor.

- Funding large transactions – average ticket of £100m+.

Strategic corporate development

M&G Real Estate has built its reputation on market leading, core, open-ended, diversified funds in the UK, Europe and Asia. We have strong local teams across each region which originate and manage direct investments for our clients. In the UK we have multiple well-established funds focusing on both long-income real estate investments as well as residential property in all its forms. In the last 10 years we have also extended these skills to Continental Europe and we are looking to establish a similar residential franchise in Asia Pacific.

Similarly, we are also looking to expand our well-established European real estate debt franchise (15 dedicated real estate debt specialists) to other regions.

Our growth to date has been achieved by the strong alignment of significant internal client capital in all our investment vehicles. We advise, and execute investments on behalf of our clients, based on the conviction of our local investment teams and well-resourced real estate research teams in those areas of the market where we have a competitive advantage and where there is a market opportunity to build a new franchise. We then invite third-party institutional investors to join us to scale up our ambitions, either as joint venture partners, co-investors or cornerstone investors in our funds.

COMPLIANCE STATEMENT

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents. M&G does not offer investment advice or make recommendations regarding investments. Opinions are subject to change without notice. M&G plc, a company incorporated in England and Wales, is the direct parent company of The Prudential Assurance Company. The Prudential Assurance Company is not affiliated in any manner with Prudential Financial, Inc, a company whose principal place of business is in the United States of America or Prudential plc, an international group incorporated in the United Kingdom.