Hines is a privately owned global real estate investment, development, and property manager with $91.8bn1 in AUM. Since its inception in 1957, the firm has grown to more than 4,600 professionals in 30 countries.

The firm employs various strategies to pursue acquisition and development opportunities, and its diverse suite of investment vehicles covers a wide range of property types, geographies, and risk profiles.

Hines is distinguished in the market by its local expertise and relationships, proprietary research methodologies, holistic stewardship-based investment approach, and pioneering sustainability commitments, including achieving operational efficiency by 2040. Hines is one of the largest and most respected real estate organizations in the world.

Please visit www.hines.com for more information.

¹Includes both the global Hines organization as well as RIA AUM as of June 30, 2025.

Sector forecasts

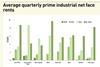

INDUSTRIAL: Industrial market fundamentals have stabilized over the last 12 months. Trailing annual demand in Developed Asia was +9% y/y, and well above long-term averages while new supply has eased. (JLL, Hines Research as of Q2 2025) Overall vacancy in Developed Asia was 10.1%, down 40bps over the last quarter. (JLL, Hines Research as of Q2 2025) Rental growth has decelerated from a peak of 13.1% y/y in Q1 2023 to 2.6% y/y as of Q3 2025. Fundamentals remain strongest in Australia with rents up 5.2% y/y as of Q3 2025. We expect forward Developed Asia rental growth to remain around this level as new supply falls due to higher construction costs. We expect substantial divergences between submarkets to persist with new supply typically concentrated in less-favored peripheral locations. 12-month trailing price growth has accelerated as cap rates have tightened in certain markets, most notably Australia and Korea. We forecast moderate price growth in 2025 with Seoul positioned for continuation in its rebound as its supply/demand imbalances normalize.

OFFICE: Office fundamentals remain differentiated across the region. Over-all, demand was very strong with regional net absorption +24% year-on-year as of Q3 2025. India accounted for around 60%, with trailing 12-month absorption +39% y/y, while Japan’s recovery has gained further momentum with demand running 70% above long-term averages. Aggregate vacancy has moved down 73 bps Q3 2024 – Q3 2025 to 14.5% as new supply has eased, particularly in Australia. Developed Asia vacancy sits at 8.5% or 3.8% excluding Australia and Hong Kong, with fundamentals very strong in Tokyo. Headline rental growth has returned to growth y/y at 3.7%, with rent growth ranging from -4.1% and -6.6% in Hong Kong and Mainland China to +10.7% in Japan. Investor appetite for office has reflected fundamentals, with volumes more robust in Seoul, Japan, and India and weak in Greater China markets. In Developed Asia, the sharpest repricing has been evident in Australia, with cap rates expanding by 201 bps to reach 7.3% as of Q3 2025 and prices down 21% from the peak. As we expected, prices bottomed out in late 2024 and have returned to growth in 2025. We continue to have strongly positive forecasts for Sydney Office. (JLL, Hines Research as of Q3 2025).

RESIDENTIAL: Healthy demand and limited new supply characterize for-rent residential markets across Developed Asia. In Japan, positive population inflows into major cities, improving wage growth and vacancy <3% has underpinned accelerating rent growth. Rents in Australia continue to grow albeit at slower pace, with negligible vacancy while residential is the one sector in Hong Kong exhibiting rental growth. On the back of these fundamental trends, investor demand for the living sector remains robust but investors are challenged by the lack of appropriate product and relatively expensive pricing. Strategies to create new product through conversions and / or development have structural tailwinds but face headwinds from relatively high construction costs. Japan remains one of the most liquid of the regional markets and activity remains healthy given the strength of fundamentals. We see heightened investor interest for increased exposure to the sector in Korea and Australia.

RETAIL: Retail fundamentals have leveled off across most Asian markets, though relatively healthy domestic consumption and intra-regional tourism remain important demand drivers. Net absorption has softened y/y, though likely more reflective of the dearth of new supply; structural pressures affecting the sector over the last decade, land constraints and high construction costs have constrained development, particularly in Australia. Australia is the market with the clearest improvement in fundamentals, with vacancies falling and rent growth accelerating. With cap rates the highest by sector across the region and a stabilization in fundamentals, 2024 saw retail become a more favorable investment sector. Through 2025 we have started to see yields harden in Australia on the back of increased investor interest. Nonetheless, our forecasts remain positive on the sector.

Investment principles & strategy

Hines’ investment philosophy is to focus on high-quality properties and maximize value creation, which translates into more consistent investment performance for investors over the long term while mitigating short-term downside risks.

Hines applies this philosophy to properties in all real estate sectors—mixed-use, residential, retail, industrial, office, and niche properties—across the risk spectrum and around the world.

Investment activity at Hines is identified at the local level and approved by the Investment Committee, which provides pattern recognition across geographies and product types, market intelligence, strategic foresight, and risk assessment. This differentiated approach – including a vertically integrated structure that promotes deep local knowledge, proven investment management capabilities, and extensive subject matter expertise – is key to delivering returns for investors. Hines believes that the integration of these critical real estate investment functions within one organization provides a competitive advantage that will directly benefit the investment.

Strategic corporate development

Hines’ corporate development strategy is to grow organically. Since its inception in 1957, Hines has grown to $91.8bn1 in AUM and more than 4,600 employees globally. Hines is a vertically integrated real estate investment manager with significant development and property management capabilities, paired with a long history of understanding how sustainability and innovation intersect the built environment.

1Includes both the global Hines organization and RIA AUM as of 30 June 2025.

COMPLIANCE STATEMENT

This marketing communication is for informational purposes only and is intended solely for the use of professional and other qualified investors and is not for general public distribution. The information contained herein was up to date at the time of production and is subject to change. This information does not constitute an offer to subscribe for securities, units or other participation rights. It is not intended to be a recommendation or investment advice. This document is not directed at or intended for any person (or entity) who is a citizen or resident of (or located or established in) any jurisdiction where its use would be contrary to applicable law or regulation or would subject the issuing companies or products to any registration or licensing requirements.

![Hines [Real Estate - Asia Pacific]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/web/m/f/x/hines_934187.png)

![Hines [Real Estate - Asia Pacific]](https://dvn7slupl96vm.cloudfront.net/Pictures/480xany/P/Pictures/web/x/h/i/bottombanner1180x400feb20201_265490.jpg)

![Hines [Real Estate - Asia Pacific]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/Pictures/web/m/f/x/hines_934187.png)