Some of the predicted impacts of climate change are now inevitable. 2020 was the hottest year globally, and the number and severity of extreme events has quadrupled since the 1980s.

To date, however, efforts have focused on mitigation and emissions reduction. Despite this, the latest predictions suggest average global temperatures could increase by 2.8°C by the end of the century without rapid, large-scale change.

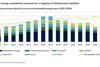

This poses a serious challenge for investors and asset owners. The risks of losses and damages from climate change compound with every increment of global warming, and the cost to global cities from sea level rise and associated flooding alone could reach $1 trillion by 2050.

The World Economic Forum suggests that the coming decades will be defined by “ex-cities and climate migrants”. Estimates suggest there have already been 31 million environmental migrants globally.

Climate change - the “threat multiplier”

The impacts of climate change are already being realized for the real estate sector, and the frequency and severity of these impacts is expected to increase. Climate change can act as a threat multiplier when combined with the unique characteristics of cities. The “urban heat island” effect can create pockets of extreme heat stress. Dense populations, in tall, energy-hungry, glazed buildings, can intensify heat gains. Increased migration – exacerbated by climate change – adds pressure to ecosystems, and increases reliance on already stressed infrastructure.

Read the full ‘Thought Leadership’ article at the link below

Supporting documents

Click link to download and view these filesClimate change and cities: Adapting real estate investment decisions

PDF, Size 0.21 mb