Content (11)

-

White papers

Combining sustainability and outperformance with credit factor investing

What is the ex-ante impact of different sustainable investment approaches on the alpha of a credit portfolio? And what can investors do who want both outperformance and sustainable credit investments? Credit factor investing provides a solution to both questions.

-

White papers

Emerging market equities – navigating a bumpy but attractive route

In 1990, developed markets accounted for just over 60% of global GDP and emerging markets for just under 40%.

-

White papers

Making Sense Of ESG Data– How To Quantify SDG Contribution

Sustainability is one of the world’s most prevalent topics, and within asset management investors are accordingly shifting their portfolios towards environmental, social and corporate governance (ESG) investing. As a result of this increased demand for ESG investing, various frameworks have emerged such as ESG rating, ESG metrics and Sustainable Development Goal (SDG) impact.

-

White papers

Inflation Expectations And Interest Rates In The US

Recently, concerns about rising inflation rates have grown. Yield curves have steepened and interest rate levels have increased.

-

White papers

Increasing Yield with US Corporate Bonds

For 2021, with interest rates very low and spreads tight, investors are wondering where to turn in order to generate returns in the liquid fixed income universe. We will show that US credit investments offer attractive returns even after currency hedging. Due to a steep US yield curve, the expected return is higher than the current yield.

-

White papers

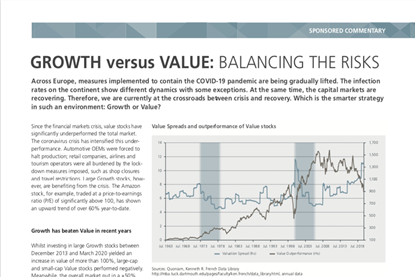

Growth versus Value: Balancing the Risks

Across Europe, measures implemented to contain the Covid-19 pandemic are being gradually lifted. The infection rates on the continent show different dynamics with some exceptions. At the same time, the capital markets are recovering. Therefore, we are currently at the crossroads between crisis and recovery.

-

White papers

Realistic Assumptions For ESG Integration

Environmental, social and governance aspects are becoming increasingly important. More than 2,000 investors – with almost USD 90 trillion in assets under management – have signed the UN Principles for Responsible Investment (UN PRI). At the same time, this raises a question: what impact do ESG factors have on a portfolio?

-

White papers

Active multi-factor interest rate management

Quantitative alpha strategies in interest rate markets have repeatedly been questioned over recent years. Regular interventions by central banks – often running contrary to fundamental trends – were a challenge for the forecasting quality of numerous approaches. Yet it is possible to generate robust outperformance, even in difficult market conditions, by applying a diversified multi-factor rates overlay.

-

White papers

Innovative factors provide leading edge – on the potential of alternative data

An active, factor-based strategy focuses on tapping into new sources of data, on identifying relevant information and how to intelligently combine such information. Within this context alternative data – texts, images, or audio files – is becoming more important for the investment process, and regarding additional analytical value. At the same time, comprehensive and swift analysis requires state-of-the-art technology and plenty of experience.

-

White papers

Uncovering the hidden beta in risk premia strategies

The long period of low interest rates made risk premia strategies popular, especially because of their promise of uncorrelated returns. February 2018 was a first stress test as equity markets lost up to 10% in a few days. The majority of strategies showed a strong link to equities and generated significant negative returns. This was a reminder that picking the right risk premia strategy is crucial.

-

White papers

Factoring in the best approach

There continues to be a lot written and said about factor investing and, like any popular idea, there can be confusing and conflicting messages.